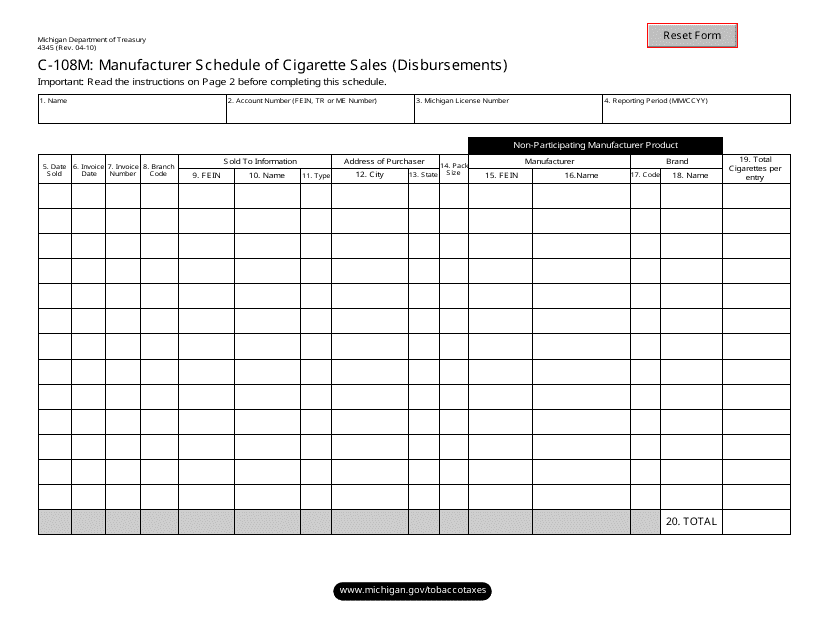

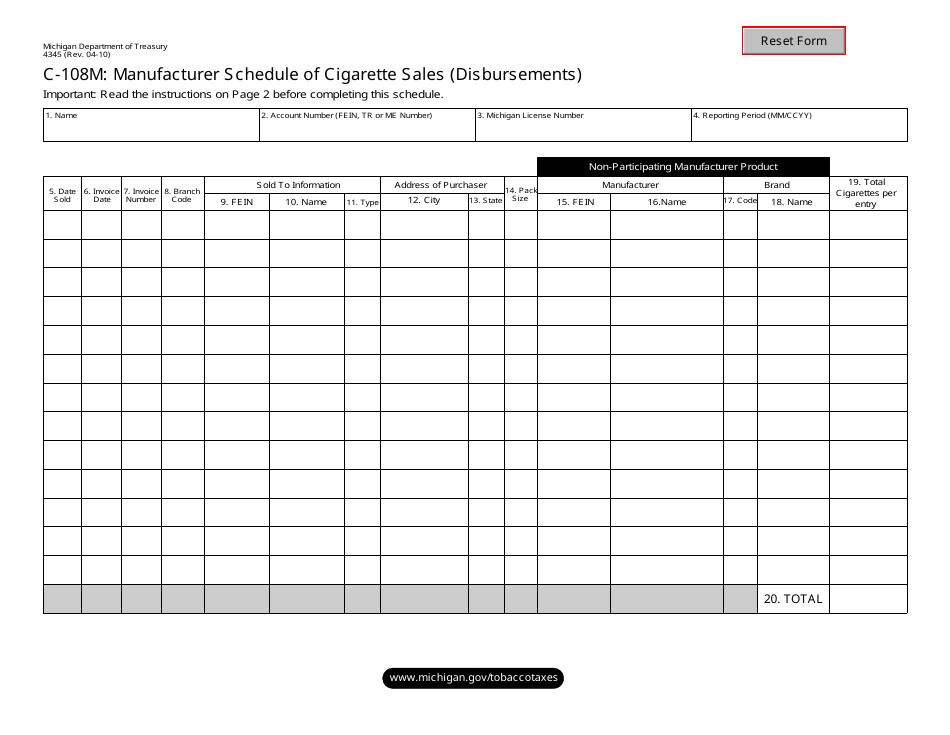

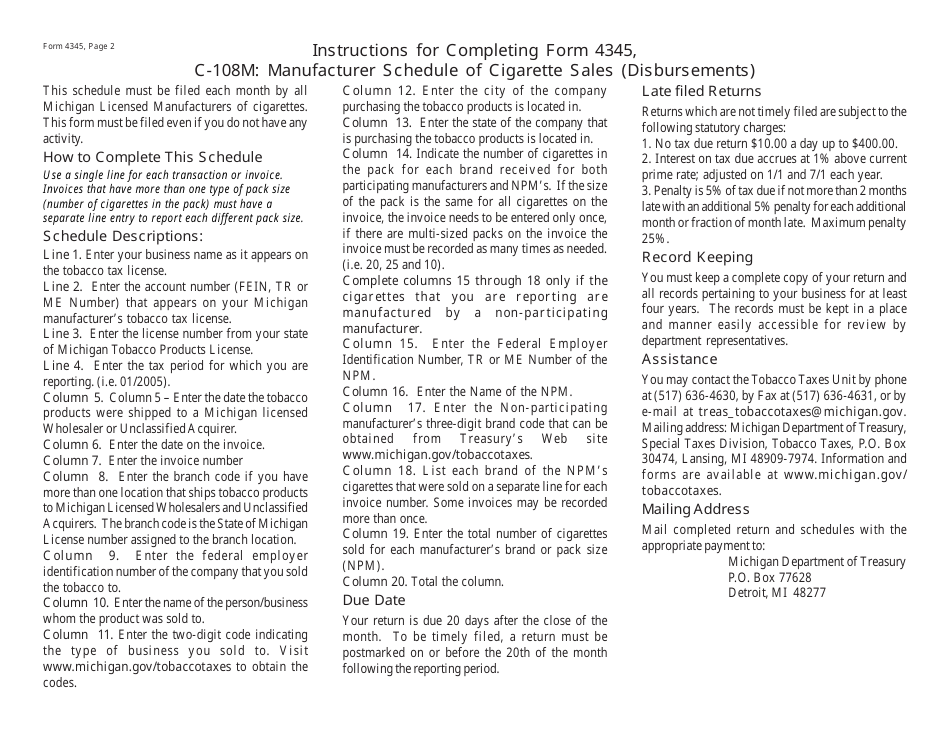

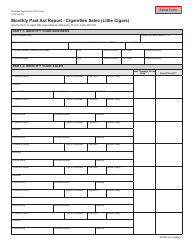

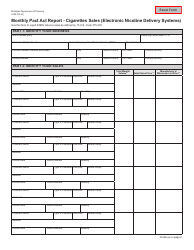

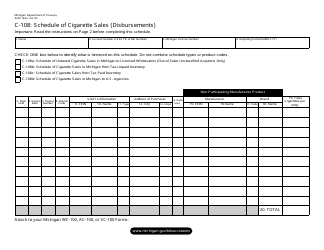

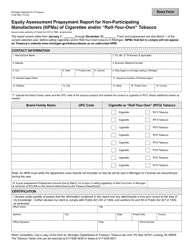

Form 4345 Schedule C-108M Manufacturer Schedule of Cigarette Sales (Disbursements) - Michigan

What Is Form 4345 Schedule C-108M?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4345 Schedule C-108M?

A: Form 4345 Schedule C-108M is the Manufacturer Schedule of Cigarette Sales (Disbursements) for the state of Michigan.

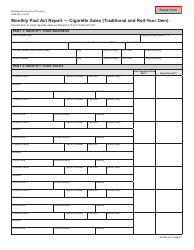

Q: What is the purpose of Form 4345 Schedule C-108M?

A: The purpose of Form 4345 Schedule C-108M is to report cigarette sales disbursements by manufacturers in Michigan.

Q: Who needs to file Form 4345 Schedule C-108M?

A: Manufacturers of cigarettes in Michigan need to file Form 4345 Schedule C-108M.

Q: What information is required on Form 4345 Schedule C-108M?

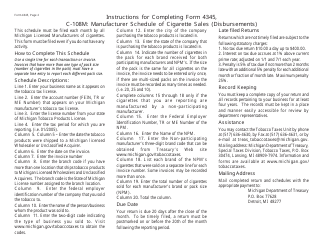

A: Form 4345 Schedule C-108M requires information about cigarette sales and disbursements, including quantities sold and taxes paid.

Q: When is Form 4345 Schedule C-108M due?

A: Form 4345 Schedule C-108M is due on a monthly basis and must be filed by the 20th day of the following month.

Q: Are there any penalties for late or incorrect filing of Form 4345 Schedule C-108M?

A: Yes, there are penalties for late or incorrect filing of Form 4345 Schedule C-108M, including monetary fines and potential legal consequences.

Q: Is Form 4345 Schedule C-108M specific to Michigan?

A: Yes, Form 4345 Schedule C-108M is specific to cigarette sales disbursements in the state of Michigan.

Form Details:

- Released on April 1, 2010;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4345 Schedule C-108M by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.