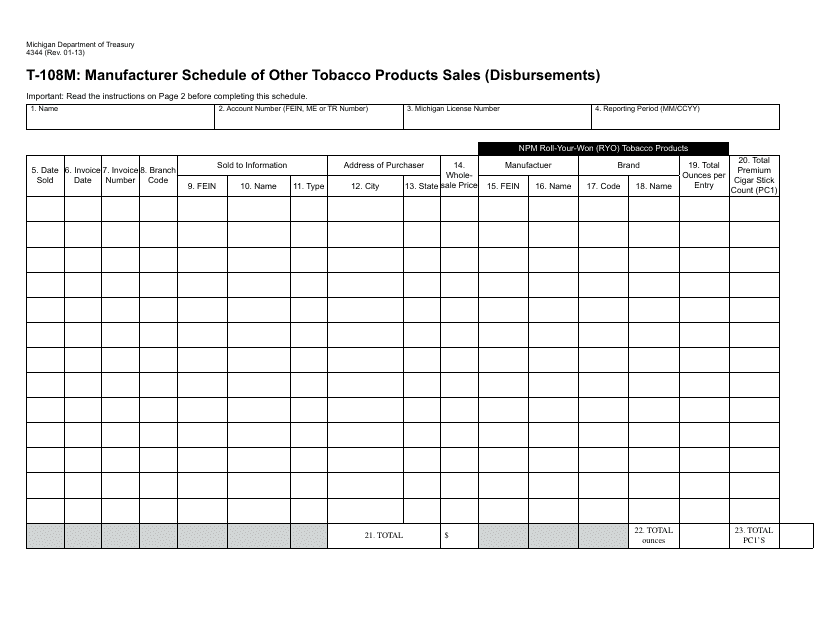

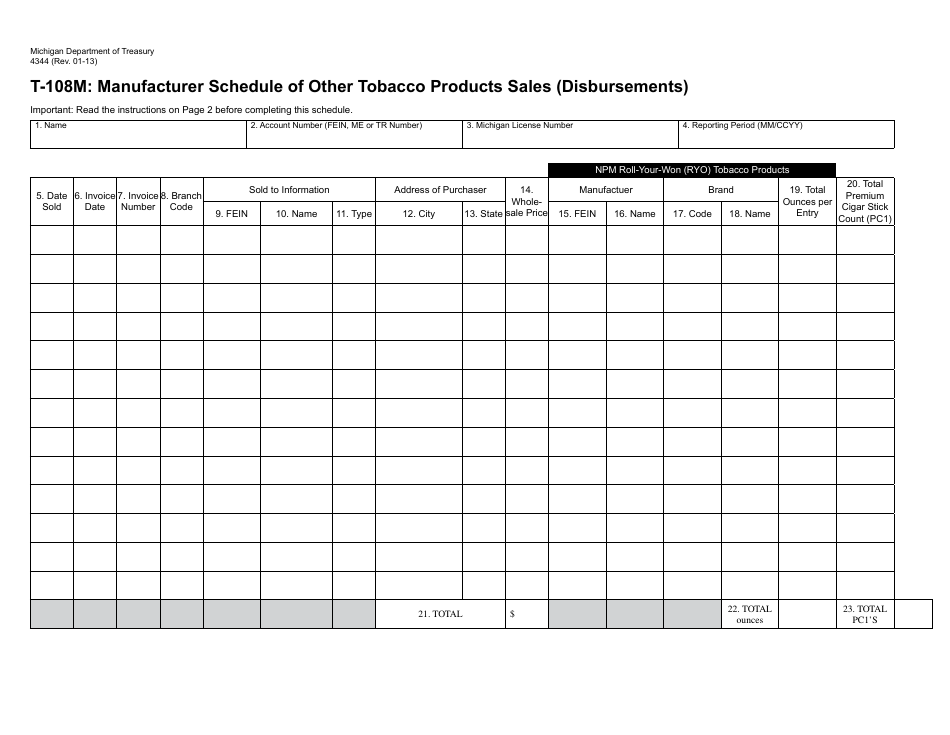

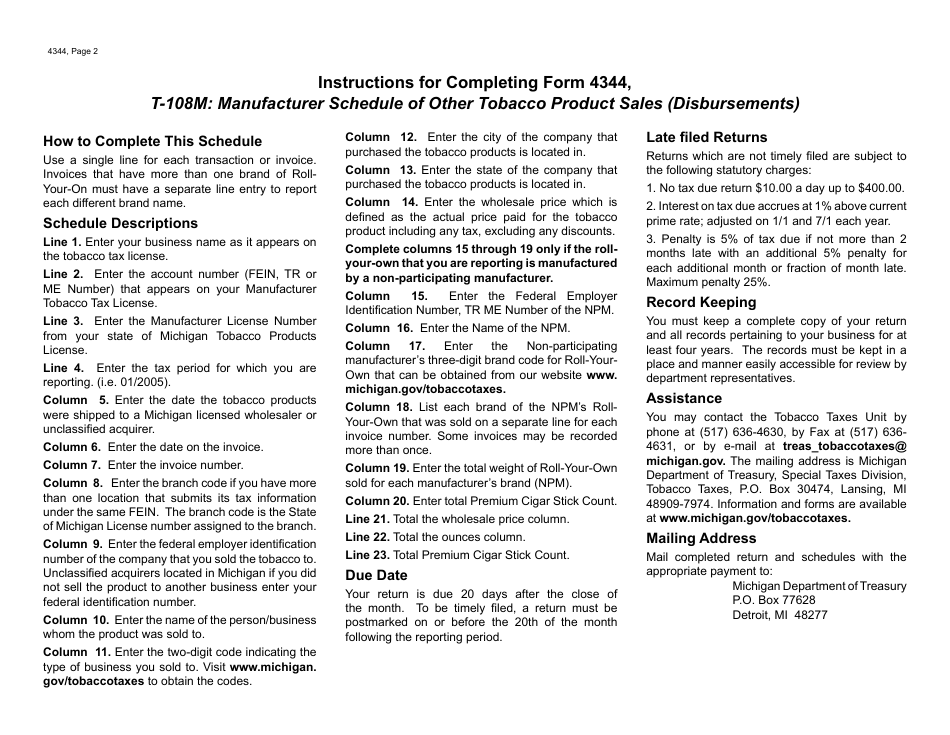

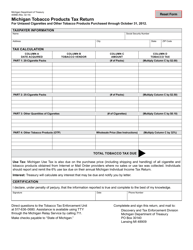

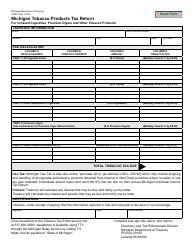

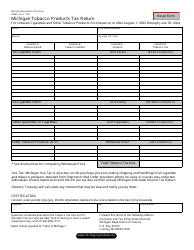

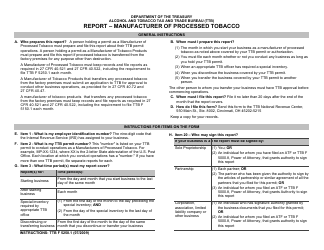

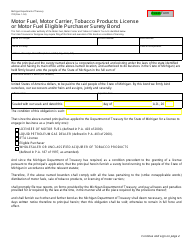

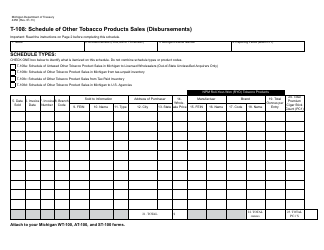

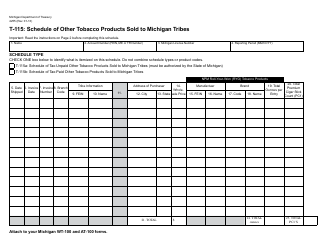

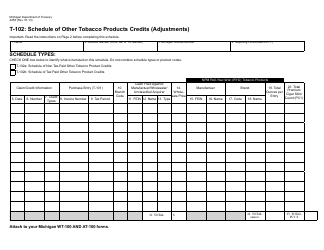

Form 4344 Schedule T-108M Manufacturer Schedule of Other Tobacco Products Sales (Disbursements) - Michigan

What Is Form 4344 Schedule T-108M?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4344 Schedule T-108M?

A: Form 4344 Schedule T-108M is a Manufacturer Schedule of Other Tobacco Products Sales (Disbursements) specific to Michigan.

Q: Who needs to file Form 4344 Schedule T-108M?

A: Manufacturers of Other Tobacco Products in Michigan need to file Form 4344 Schedule T-108M.

Q: What is the purpose of Form 4344 Schedule T-108M?

A: The purpose of Form 4344 Schedule T-108M is to report the sales or disbursements of other tobacco products in Michigan.

Q: Is Form 4344 Schedule T-108M specific to Michigan?

A: Yes, Form 4344 Schedule T-108M is specific to Michigan and is used to report tobacco product sales or disbursements in the state.

Q: When is Form 4344 Schedule T-108M due?

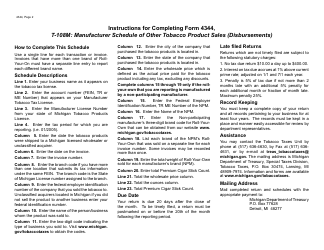

A: Form 4344 Schedule T-108M is typically due on a monthly basis, by the 20th day of the following month.

Q: Is Form 4344 Schedule T-108M mandatory?

A: Yes, manufacturers of other tobacco products in Michigan are required to file Form 4344 Schedule T-108M.

Q: What information do I need to complete Form 4344 Schedule T-108M?

A: To complete Form 4344 Schedule T-108M, you will need information regarding your sales or disbursements of other tobacco products in Michigan.

Q: Are there any penalties for not filing Form 4344 Schedule T-108M?

A: Yes, failure to file Form 4344 Schedule T-108M or late filing can result in penalties and interest charges.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 4344 Schedule T-108M by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.