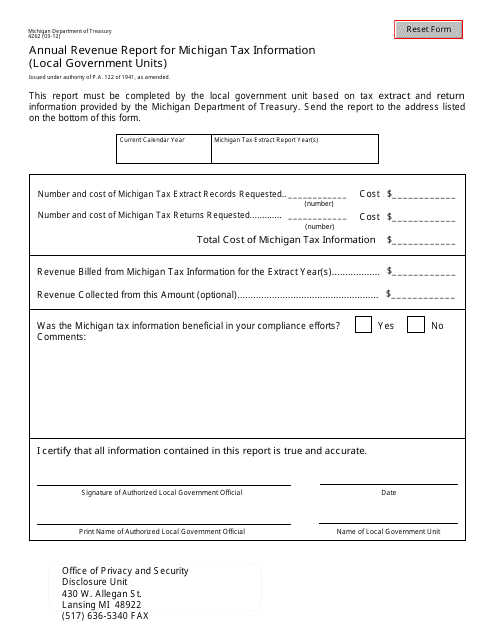

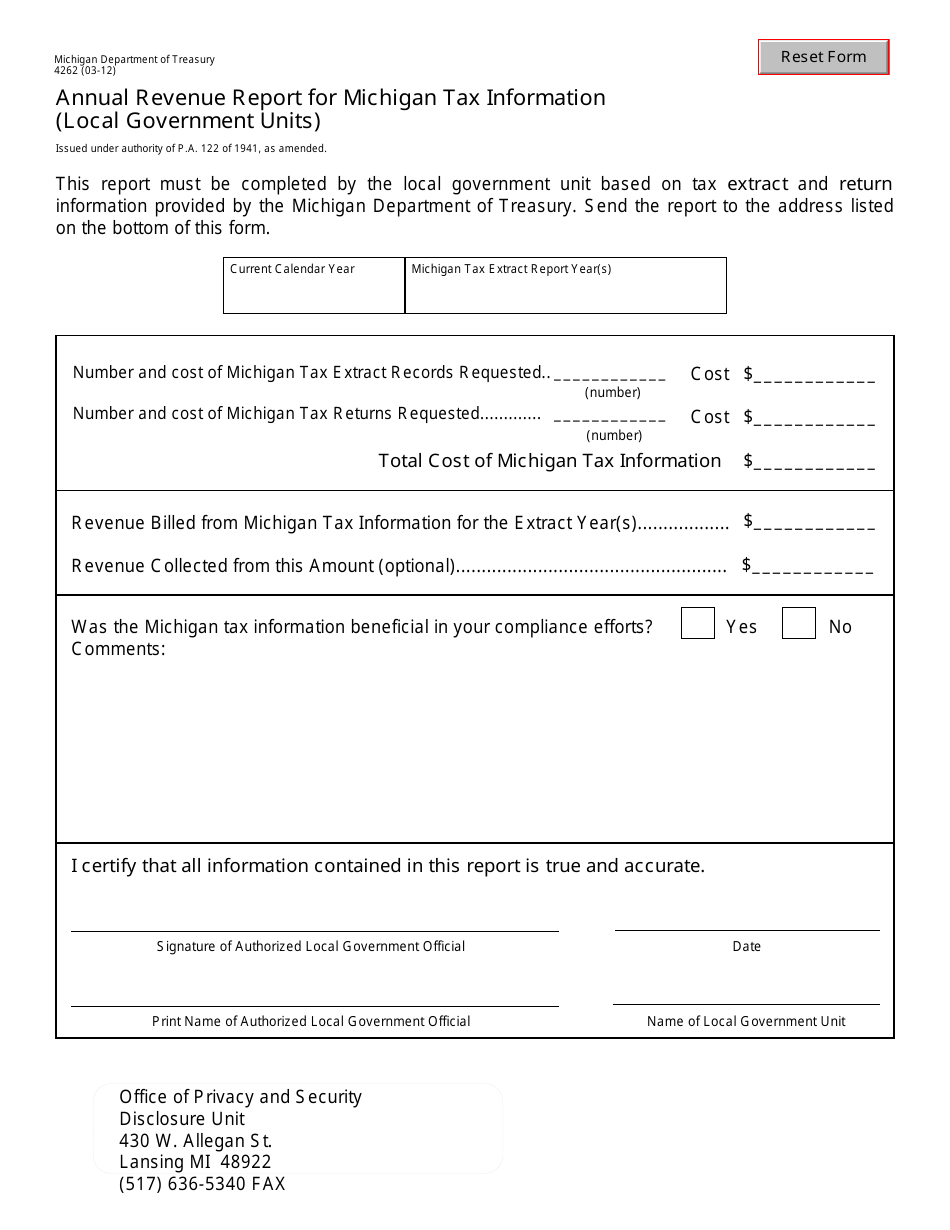

Form 4262 Annual Revenue Report for Michigan Tax Information (Local Government Units) - Michigan

What Is Form 4262?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4262?

A: Form 4262 is the Annual Revenue Report for Michigan Tax Information for Local Government Units.

Q: Who needs to file Form 4262?

A: Local government units in Michigan need to file Form 4262.

Q: What is the purpose of Form 4262?

A: The purpose of Form 4262 is to report annual revenue information for tax purposes.

Q: When is Form 4262 due?

A: Form 4262 is typically due by February 28th of each year.

Q: Are there any penalties for not filing Form 4262?

A: Yes, there may be penalties for not filing or filing late. It is important to comply with the deadlines.

Q: What information is required on Form 4262?

A: Form 4262 requires various revenue information, such as property tax revenue, state revenue sharing, and other sources of revenue.

Q: Is Form 4262 specific to Michigan?

A: Yes, Form 4262 is specific to local government units in Michigan.

Q: Who can I contact for more information about Form 4262?

A: For more information about Form 4262, you can contact the Michigan Department of Treasury or refer to the instructions provided with the form.

Form Details:

- Released on March 1, 2012;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4262 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.