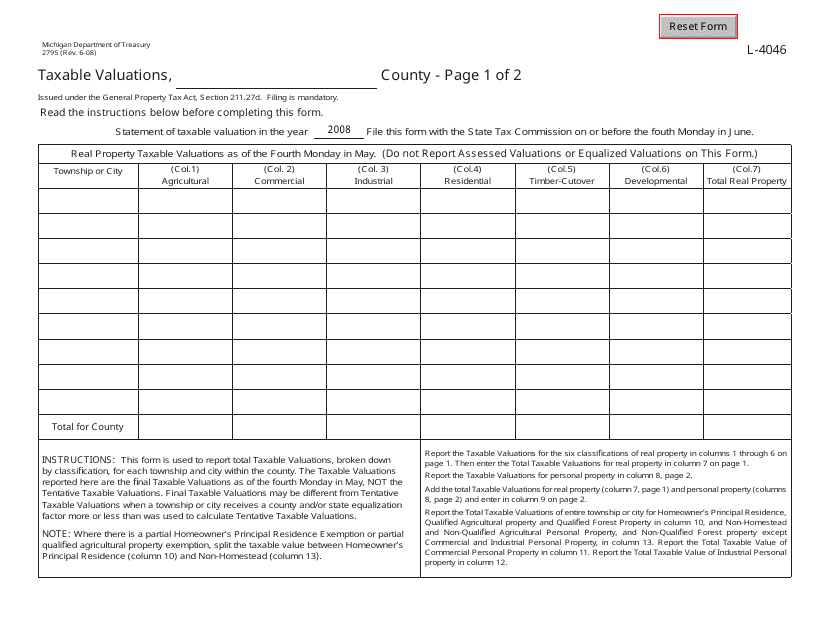

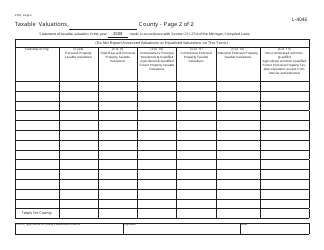

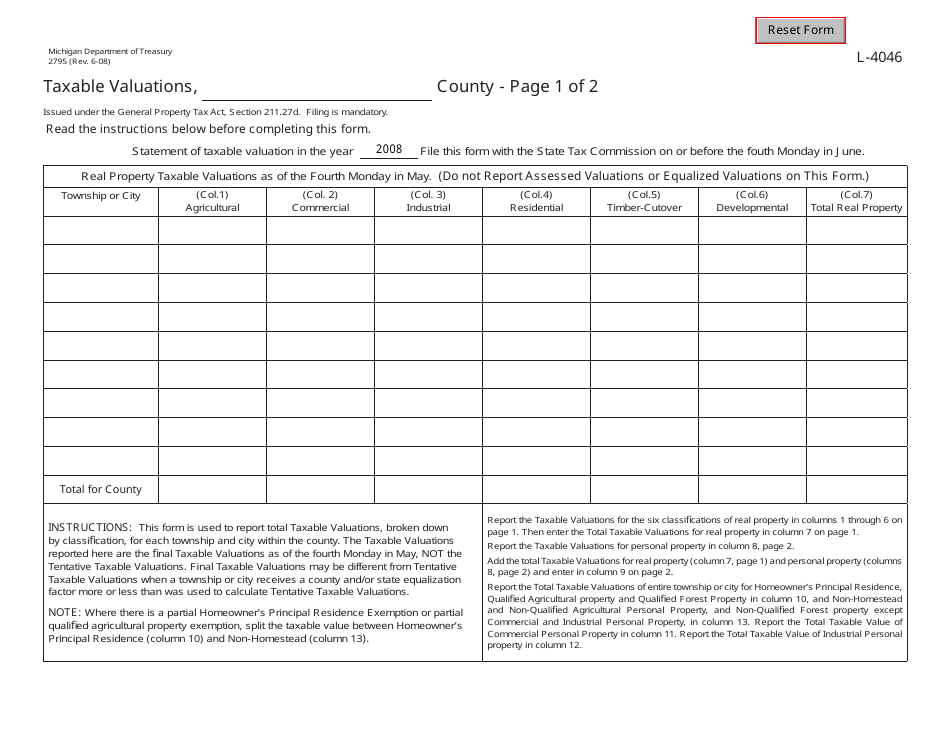

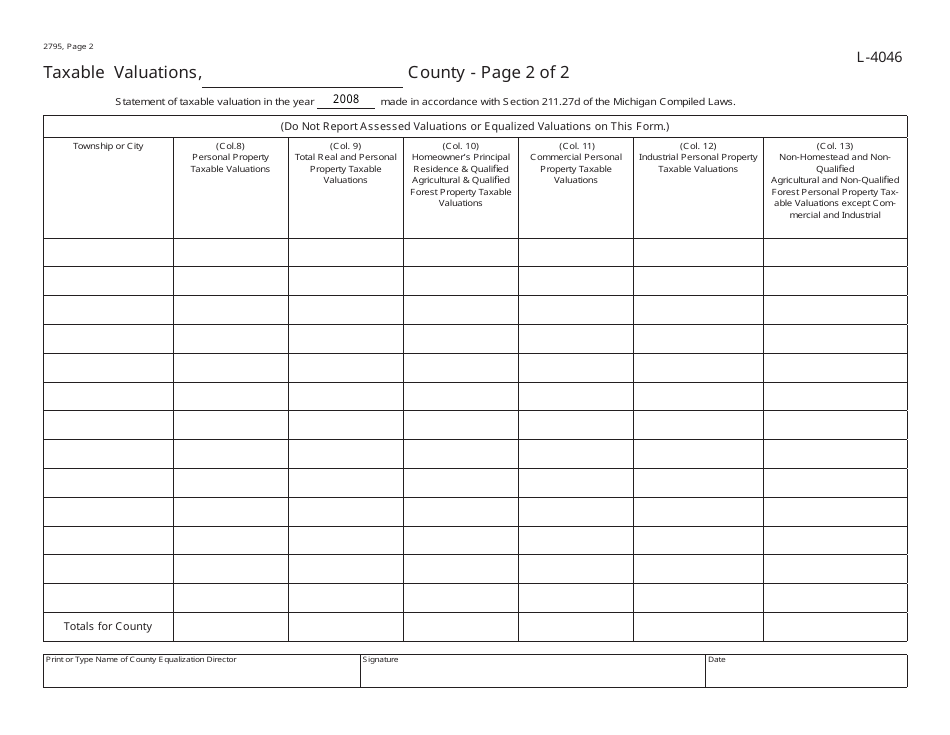

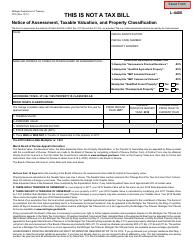

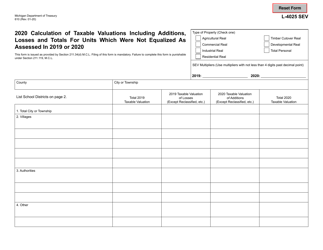

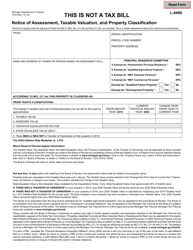

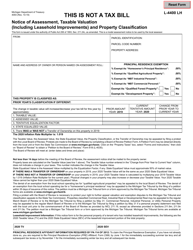

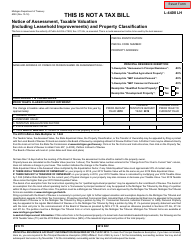

Form 2795 (L-4046) Taxable Valuations - Michigan

What Is Form 2795 (L-4046)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2795 (L-4046)?

A: Form 2795 (L-4046) is a document used to report taxable valuations in the state of Michigan.

Q: Who needs to file Form 2795 (L-4046)?

A: Property owners in Michigan who have taxable valuations need to file Form 2795 (L-4046).

Q: What are taxable valuations?

A: Taxable valuations refer to the assessed value of a property that is subject to taxation.

Q: What information is required on Form 2795 (L-4046)?

A: Form 2795 (L-4046) requires information such as the property's parcel number, address, owner's name, and taxable value.

Q: When is the deadline to file Form 2795 (L-4046)?

A: The deadline to file Form 2795 (L-4046) in Michigan is typically on or before March 1st of each year.

Q: Are there any penalties for not filing Form 2795 (L-4046)?

A: Yes, failure to file Form 2795 (L-4046) or filing it late may result in penalties or interest charges.

Form Details:

- Released on June 1, 2008;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2795 (L-4046) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.