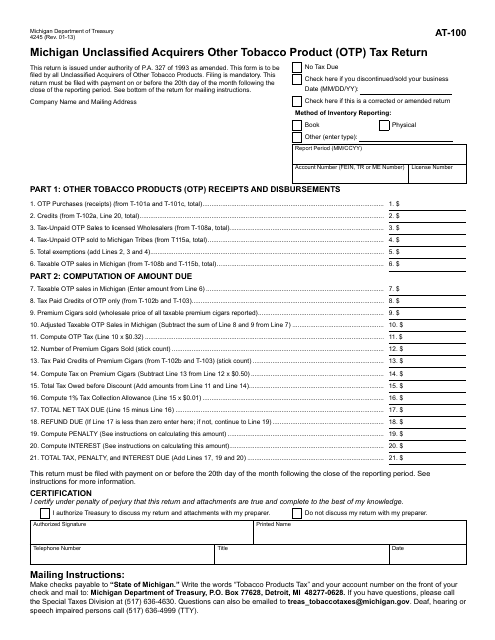

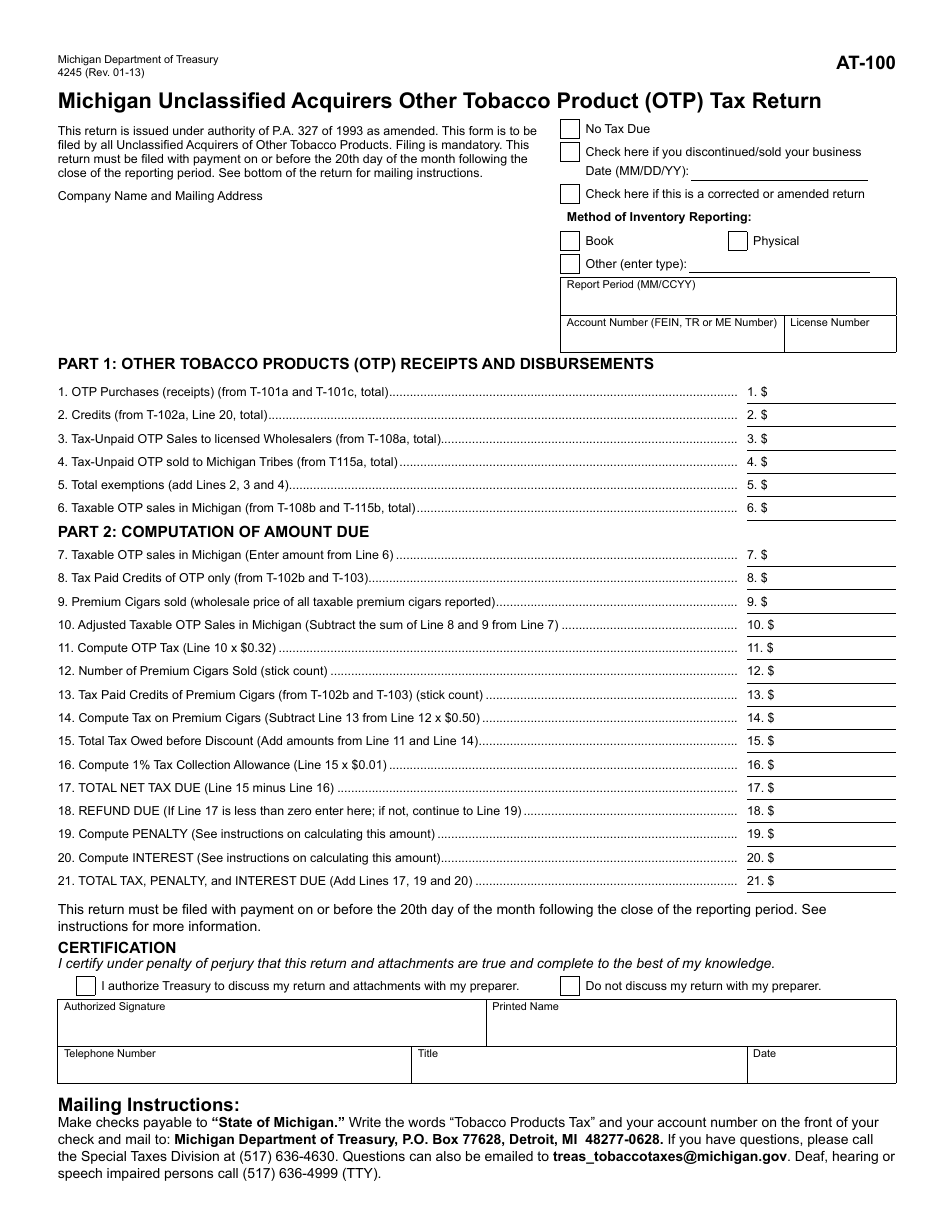

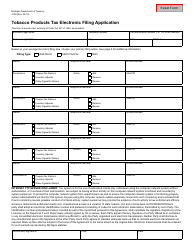

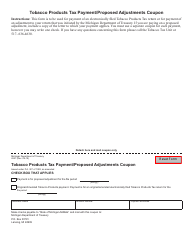

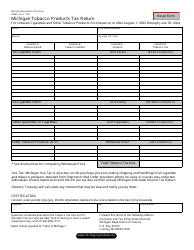

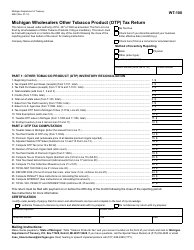

Form 4245 (AT-100) Michigan Unclassified Acquirers Other Tobacco Product (Otp) Tax Return - Michigan

What Is Form 4245 (AT-100)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

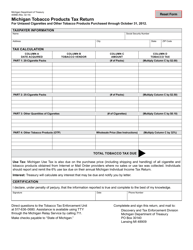

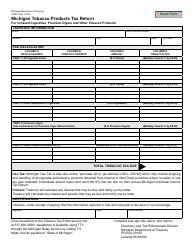

Q: What is Form 4245 (AT-100) Michigan?

A: Form 4245 (AT-100) Michigan is a tax return form specifically for reporting Other Tobacco Product (OTP) tax in the state of Michigan.

Q: Who needs to file Form 4245 (AT-100) Michigan?

A: Any unclassified acquirers of Other Tobacco Products (OTP) in Michigan need to file Form 4245 (AT-100).

Q: What is Other Tobacco Product (OTP) tax?

A: Other Tobacco Product (OTP) tax is a specific tax imposed on tobacco products other than cigarettes, such as cigars, smokeless tobacco, and pipe tobacco.

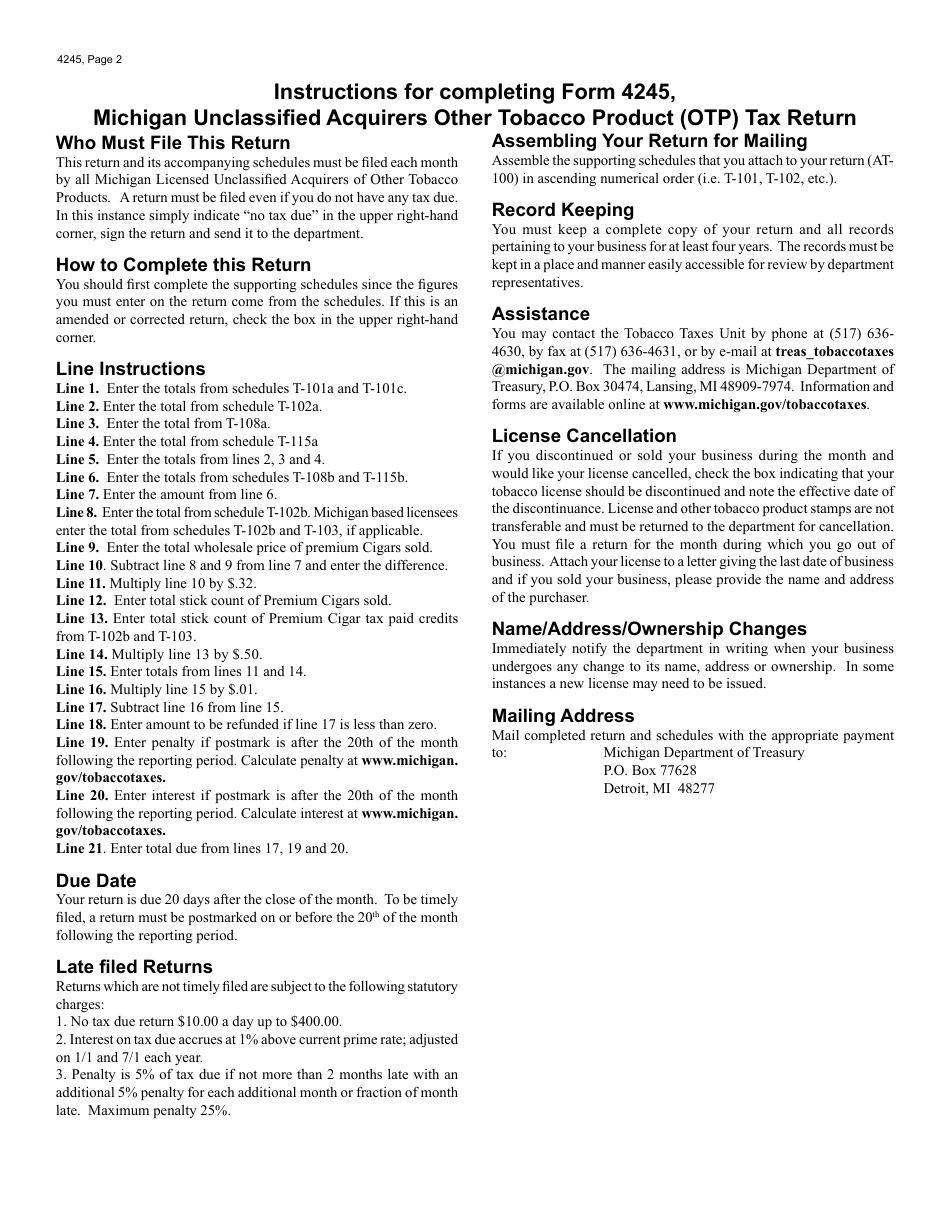

Q: When is the deadline for filing Form 4245 (AT-100) Michigan?

A: The deadline for filing Form 4245 (AT-100) Michigan is typically the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there may be penalties for late filing or non-compliance with the Other Tobacco Product (OTP) tax requirements in Michigan. It is important to file the form on time to avoid any penalties.

Q: What should I do if I have questions or need assistance with Form 4245 (AT-100) Michigan?

A: If you have questions or need assistance with Form 4245 (AT-100) Michigan, you should contact the Michigan Department of Treasury for guidance and support.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 4245 (AT-100) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.