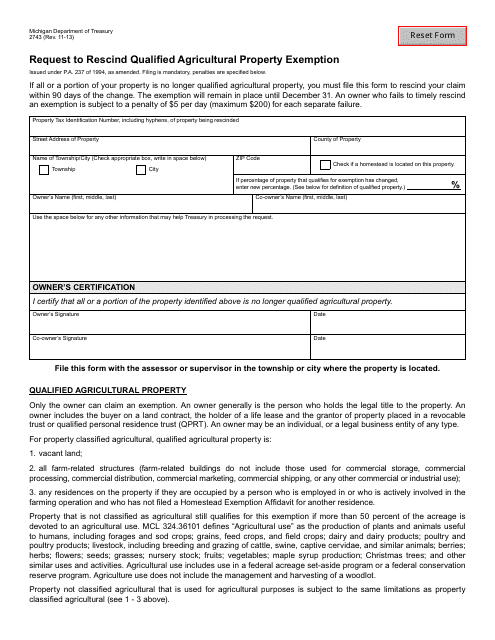

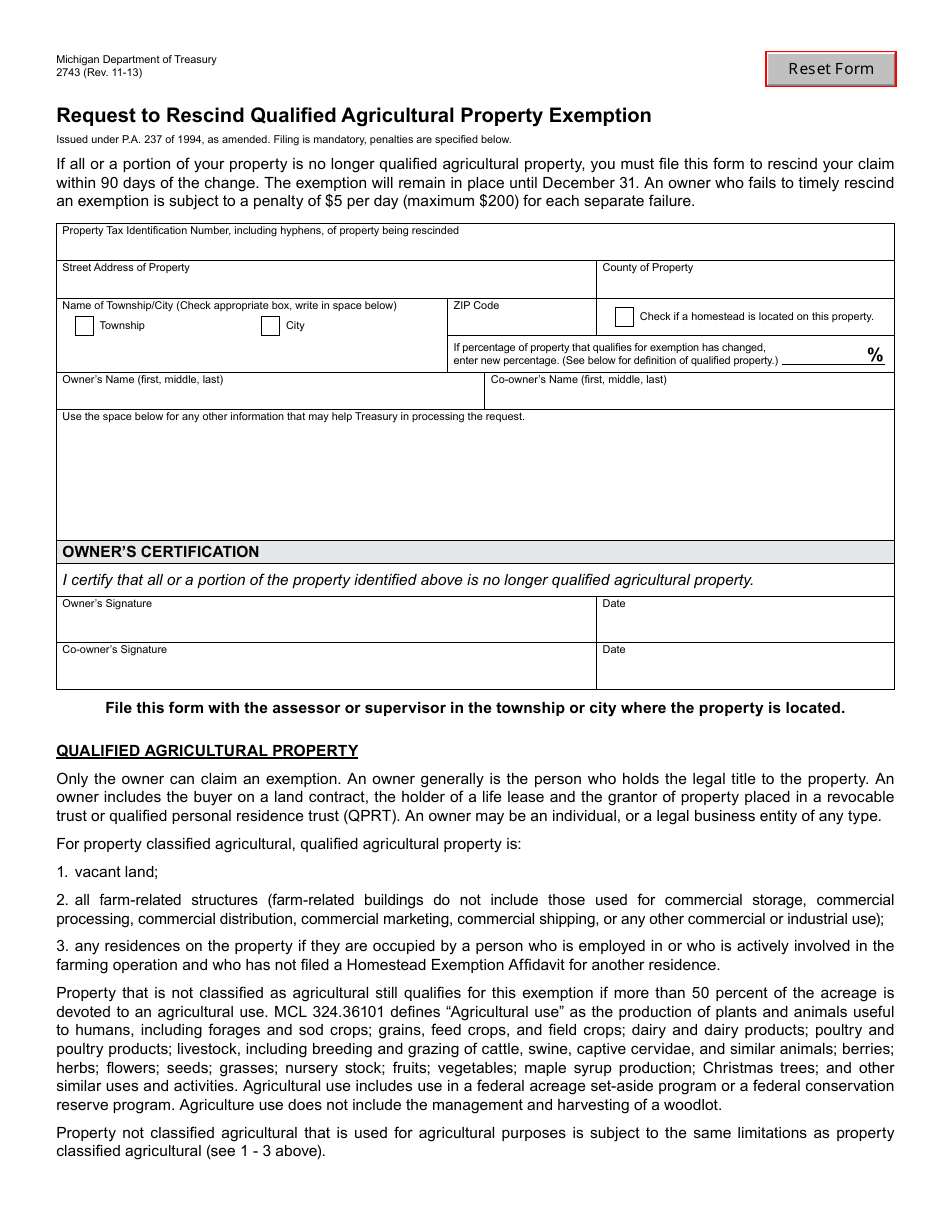

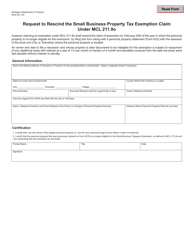

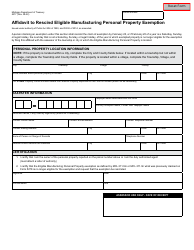

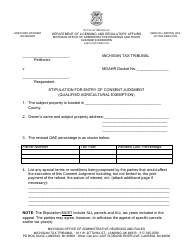

Form 2743 Request to Rescind Qualified Agricultural Property Exemption - Michigan

What Is Form 2743?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2743?

A: Form 2743 is a request to rescind a qualified agricultural property exemption in the state of Michigan.

Q: What is a qualified agricultural property exemption?

A: A qualified agricultural property exemption is a tax exemption given to property that is used for agricultural purposes in Michigan.

Q: Who needs to file Form 2743?

A: Anyone who wants to rescind their qualified agricultural property exemption in Michigan needs to file Form 2743.

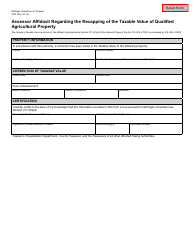

Q: What information is required on Form 2743?

A: Form 2743 requires information such as the property owner's name, address, and property identification number, as well as the reason for requesting the rescission.

Q: Are there any deadlines for filing Form 2743?

A: Yes, Form 2743 must be filed with the local assessor's office by May 1st of the year following the year in which the property was granted the agricultural property exemption.

Q: What happens after I file Form 2743?

A: After you file Form 2743, the local assessor's office will review your request and make a determination regarding the rescission of the agricultural property exemption.

Form Details:

- Released on November 1, 2013;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2743 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.