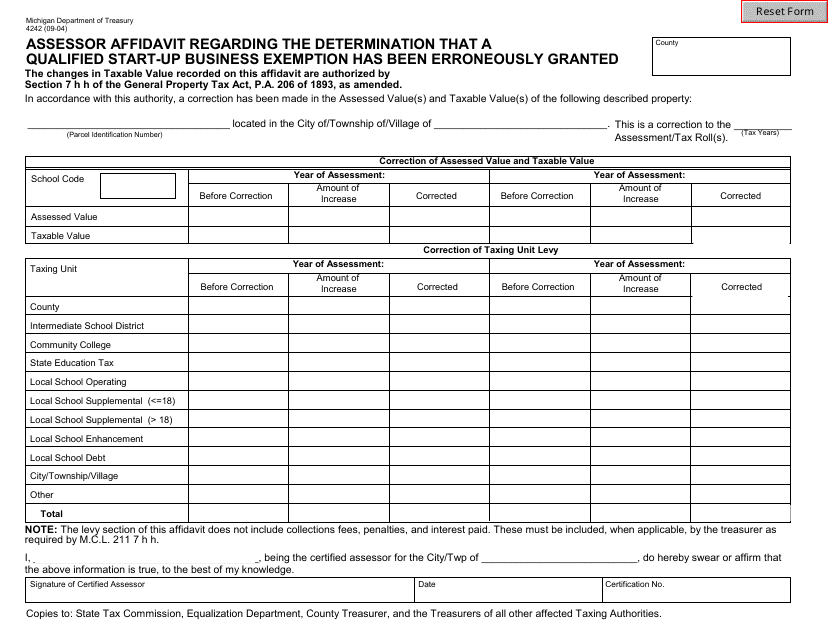

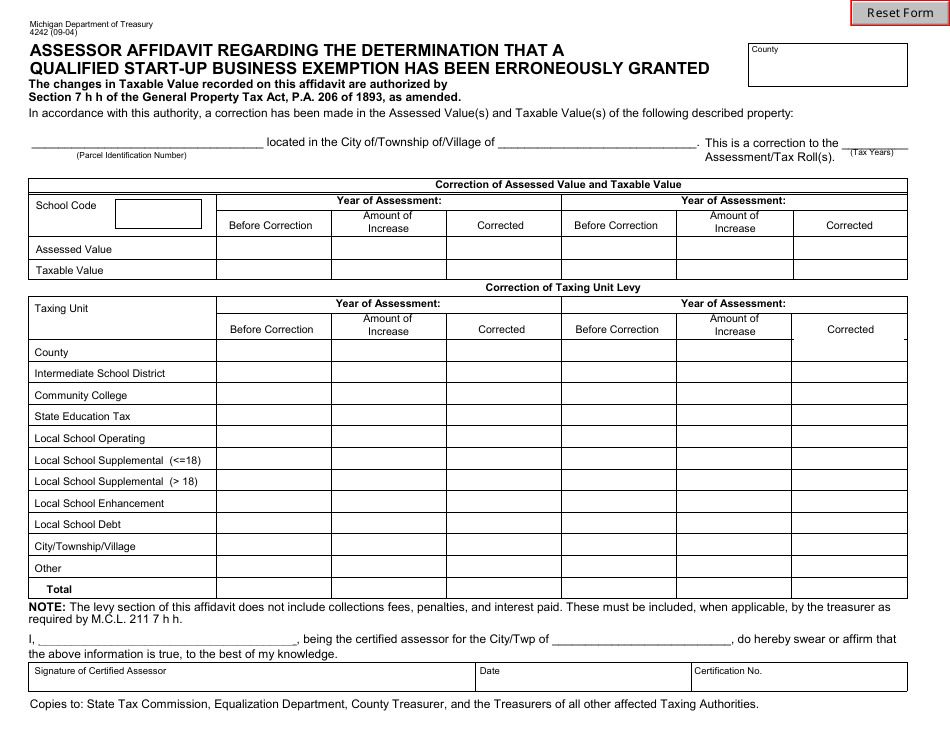

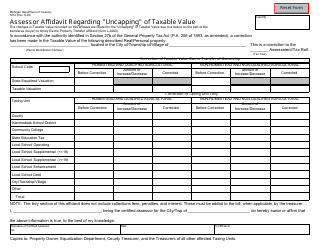

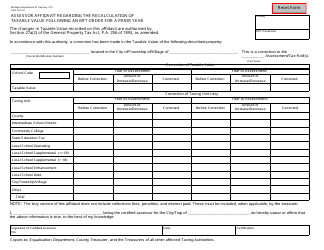

Form 4242 Assessor Affidavit Regarding the Determination That a Qualified Start-Up Business Exemption Has Been Erroneously Granted - Michigan

What Is Form 4242?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4242?

A: Form 4242 is an Assessor Affidavit regarding the determination that a qualified start-up business exemption has been erroneously granted in Michigan.

Q: What is the purpose of Form 4242?

A: The purpose of Form 4242 is to rectify the granting of a qualified start-up business exemption that was made in error by the assessor.

Q: What does the form require?

A: The form requires the assessor to provide information about the erroneous exemption and explain the reasons for the mistake.

Q: Who needs to fill out Form 4242?

A: The assessor who made the erroneous exemption needs to fill out Form 4242.

Q: Are there any filing fees for Form 4242?

A: There are no filing fees for Form 4242.

Q: What happens after submitting Form 4242?

A: After submitting Form 4242, the assessor's claim will be reviewed and a determination will be made regarding the correction of the exemption.

Q: Can Form 4242 be used for businesses outside of Michigan?

A: No, Form 4242 is specific to businesses in the state of Michigan.

Q: Can individuals fill out Form 4242?

A: No, Form 4242 is only applicable to assessors and not individuals.

Q: Is Form 4242 confidential?

A: The information provided on Form 4242 may be subject to public disclosure under Michigan's Freedom of Information Act.

Form Details:

- Released on September 1, 2004;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4242 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.