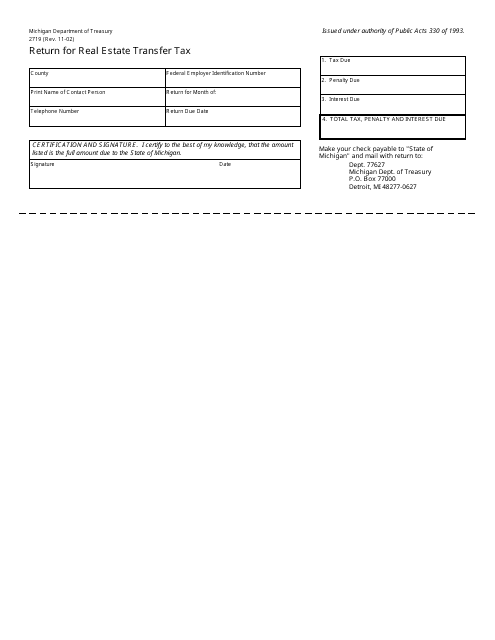

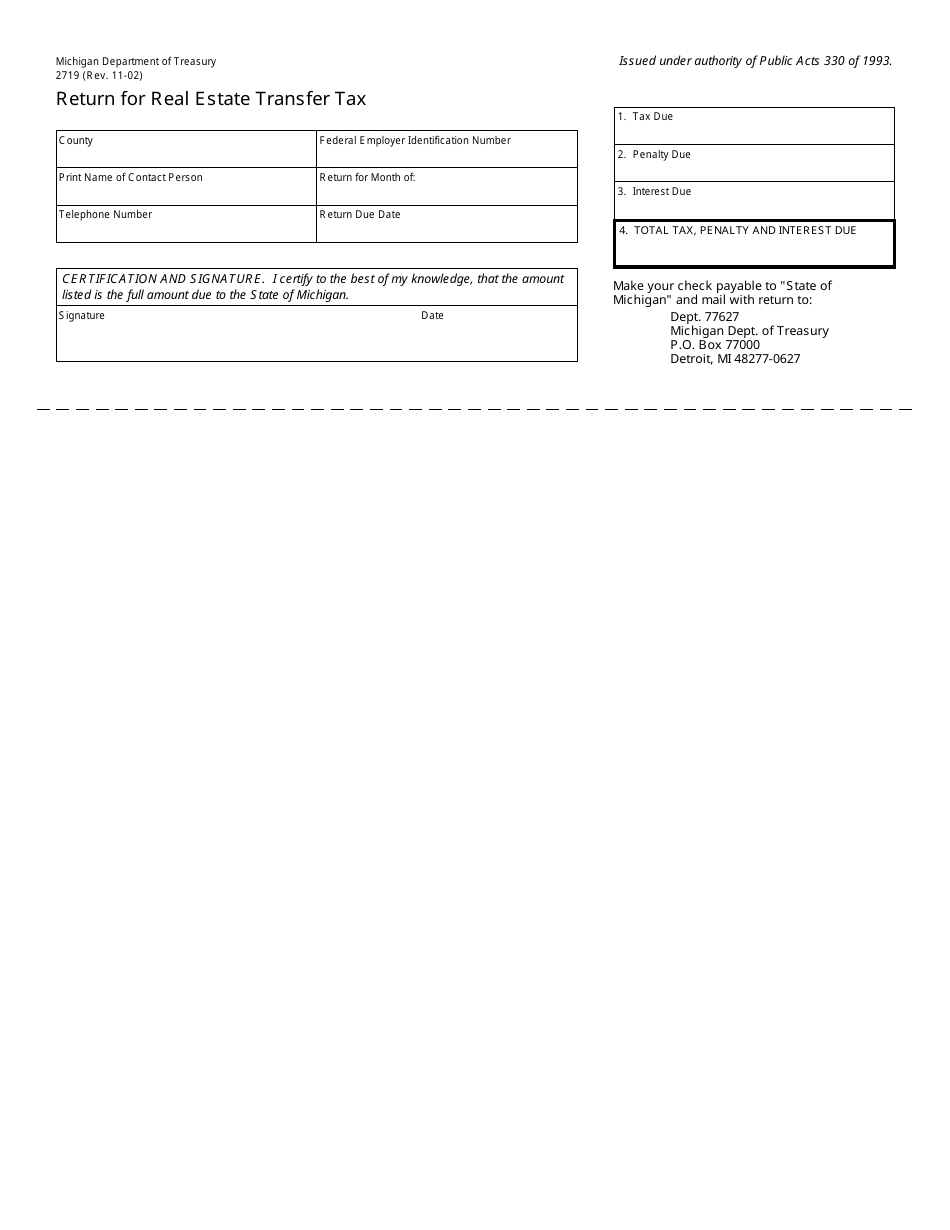

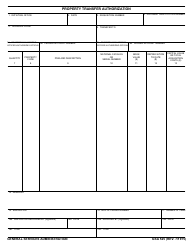

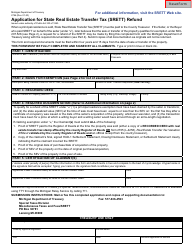

Form 2719 Return for Real Estate Transfer Tax - Michigan

What Is Form 2719?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2719?

A: Form 2719 is the Return for Real Estate Transfer Tax in Michigan.

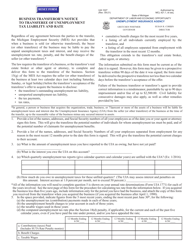

Q: Who needs to file Form 2719?

A: Anyone who is involved in a real estate transfer in Michigan needs to file Form 2719.

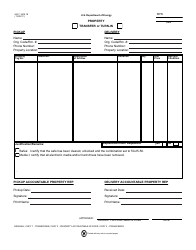

Q: What is the purpose of Form 2719?

A: Form 2719 is used to report and pay the real estate transfer tax in Michigan.

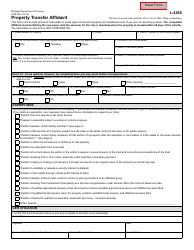

Q: What information is required on Form 2719?

A: Form 2719 requires information about the property being transferred, the parties involved, and the amount of consideration.

Q: When is Form 2719 due?

A: Form 2719 is due within 45 days after the transfer of property.

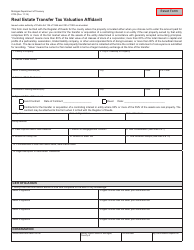

Q: Are there any exemptions from the real estate transfer tax in Michigan?

A: Yes, there are certain exemptions available. You should consult the instructions for Form 2719 or contact the Michigan Department of Treasury for more information.

Q: What happens if I don't file Form 2719?

A: Failure to file Form 2719 or pay the real estate transfer tax can result in penalties and interest.

Q: Can I e-file Form 2719?

A: No, currently electronic filing is not available for Form 2719. It must be filed by mail or in person.

Q: Can I get a refund of the real estate transfer tax paid?

A: Refunds are generally not available for the real estate transfer tax paid in Michigan.

Form Details:

- Released on November 1, 2002;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 2719 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.