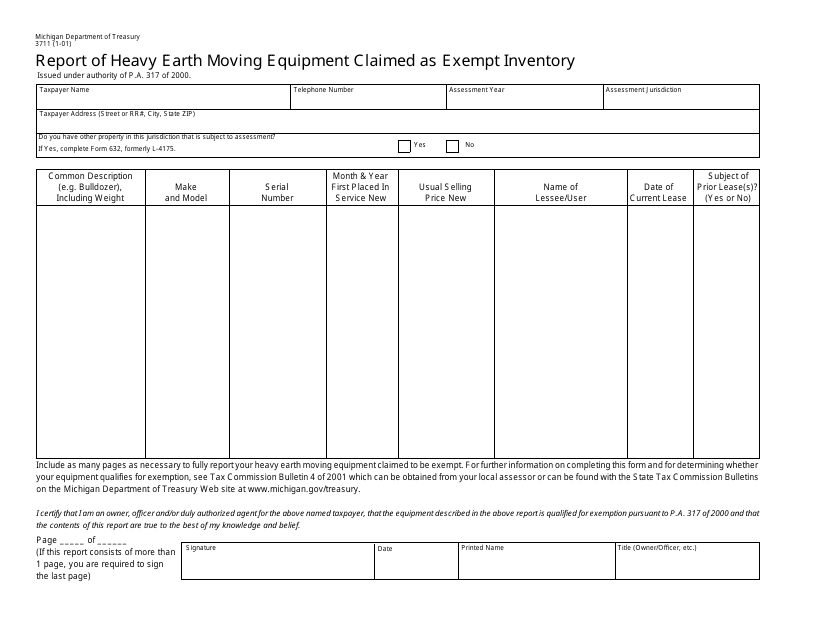

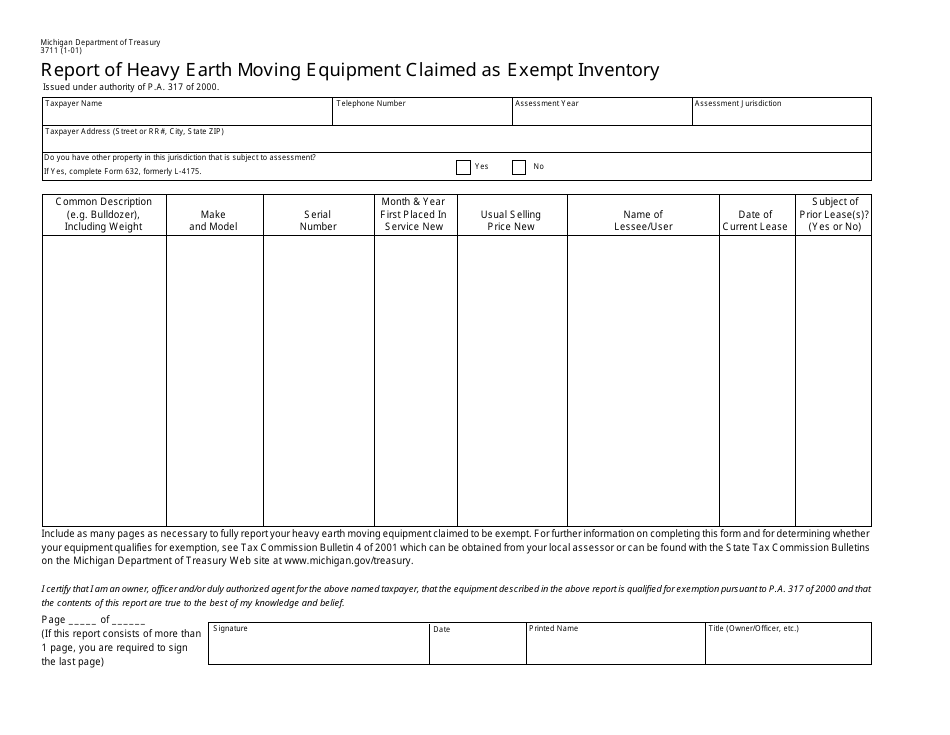

Form 3711 Report of Heavy Earth Moving Equipment Claimed as Exempt Inventory - Michigan

What Is Form 3711?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3711?

A: Form 3711 is a report used in Michigan to claim heavy earth moving equipment as exempt inventory.

Q: What is heavy earth moving equipment?

A: Heavy earth moving equipment refers to machinery used for excavation, construction, and other earth-moving tasks.

Q: What does it mean to claim equipment as exempt inventory?

A: Claiming equipment as exempt inventory means that the equipment is not subject to property tax.

Q: Who needs to file Form 3711?

A: Any person or business in Michigan with heavy earth moving equipment that qualifies for the exemption.

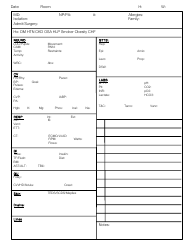

Q: What information is required on Form 3711?

A: The form requires information about the equipment, its value, and the company's ownership.

Q: When is Form 3711 due?

A: Form 3711 is due by February 20th of each year.

Q: Are there any fees associated with filing Form 3711?

A: No, there are no fees for filing Form 3711.

Q: What happens if I don't file Form 3711?

A: Failure to file the form may result in the equipment being subject to property taxes.

Form Details:

- Released on January 1, 2001;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 3711 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.