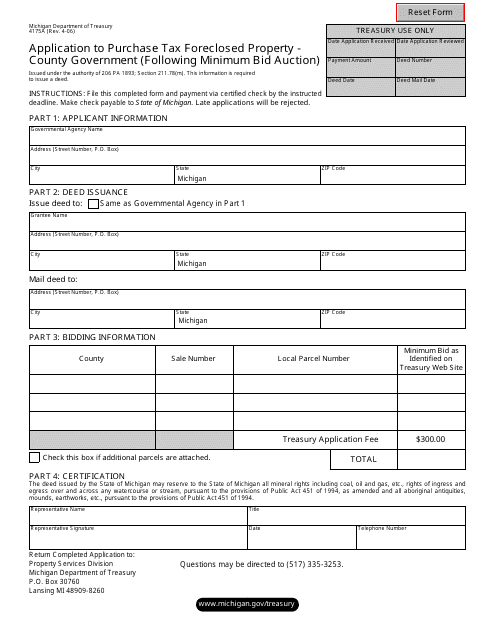

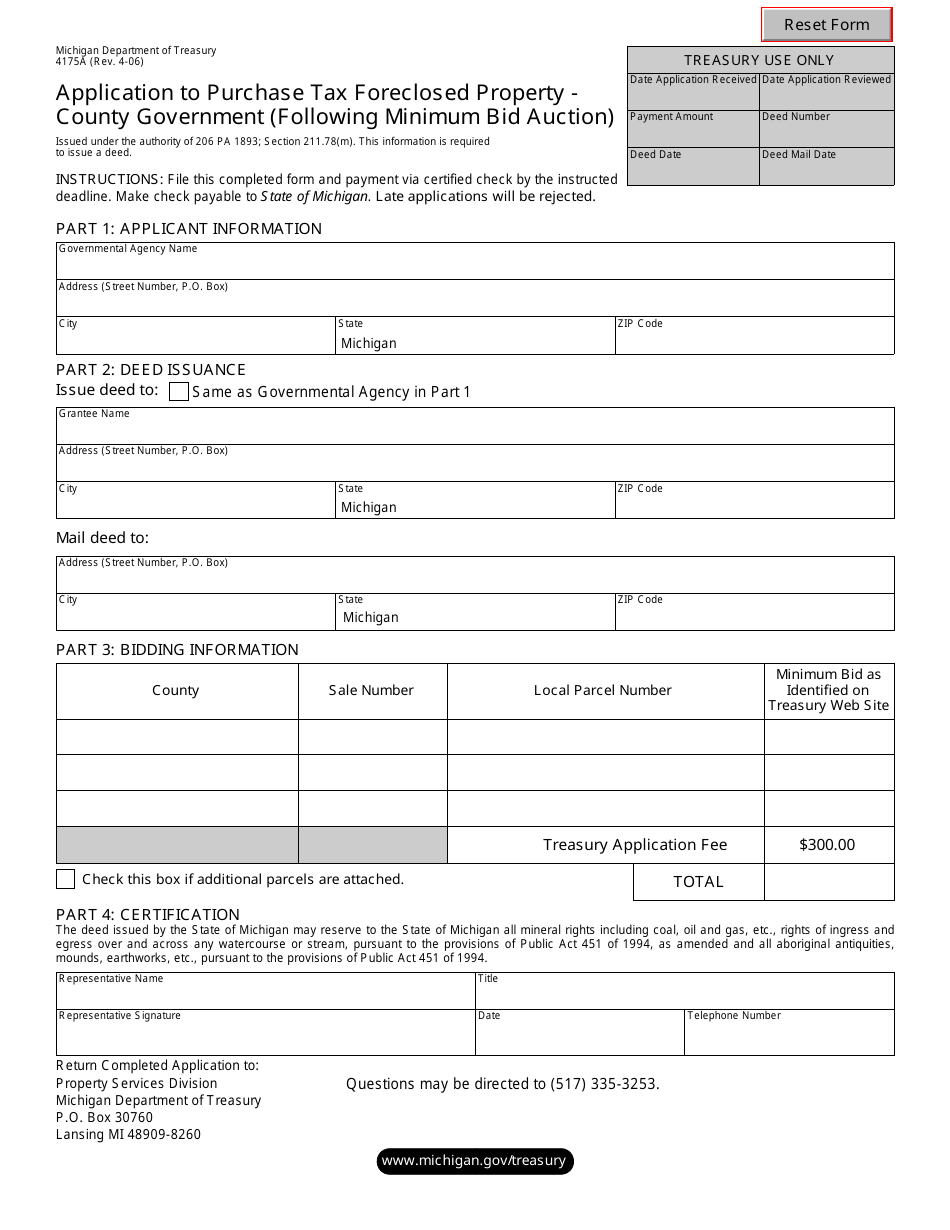

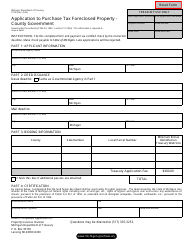

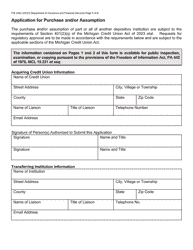

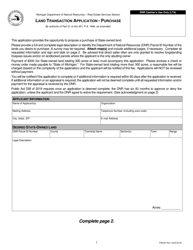

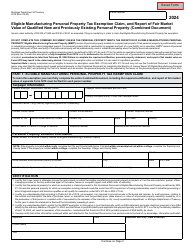

Form 4175A Application to Purchase Tax Foreclosed Property - County Government (Following Minimum Bid Auction) - Michigan

What Is Form 4175A?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4175A?

A: Form 4175A is an application form used to purchase tax foreclosed property after a minimum bid auction conducted by the county government in Michigan.

Q: What is tax foreclosed property?

A: Tax foreclosed property refers to properties that have been taken over by the government due to non-payment of property taxes.

Q: What is a minimum bid auction?

A: A minimum bid auction is an auction conducted by the county government where properties are sold at a minimum bid price, which is often equal to the amount of unpaid taxes.

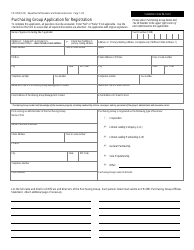

Q: Who can use Form 4175A?

A: Anyone interested in purchasing tax foreclosed property after a minimum bid auction in Michigan can use Form 4175A.

Q: What information is required on Form 4175A?

A: Form 4175A requires information such as the property address, buyer's name and contact details, and the bid amount.

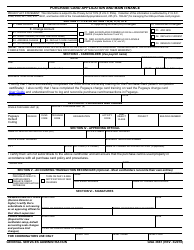

Q: Is there a deadline to submit Form 4175A?

A: Yes, there is usually a deadline specified by the county government to submit Form 4175A after the minimum bid auction.

Q: What happens after submitting Form 4175A?

A: After submitting Form 4175A, the county government will review the application and determine if the buyer meets all the requirements.

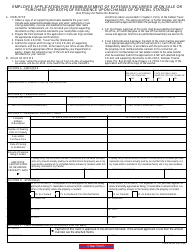

Q: Can I finance the purchase of tax foreclosed property?

A: Financing options for the purchase of tax foreclosed property may vary. It is recommended to contact a lender or financial institution for more information.

Q: What should I do if my application is approved?

A: If your application is approved, you will need to complete the purchase by paying the bid amount and any additional fees.

Q: What if my application is not approved?

A: If your application is not approved, you may have the option to participate in future auctions or explore other opportunities to purchase property.

Form Details:

- Released on April 1, 2006;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4175A by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.