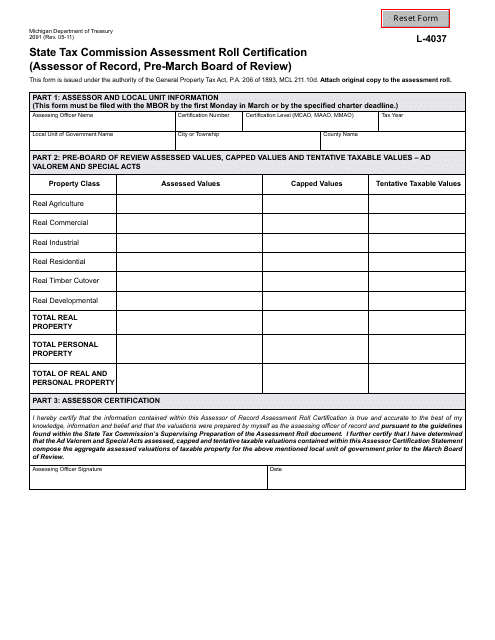

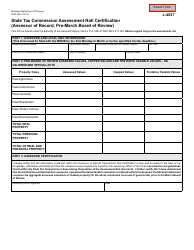

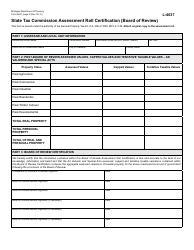

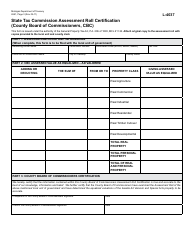

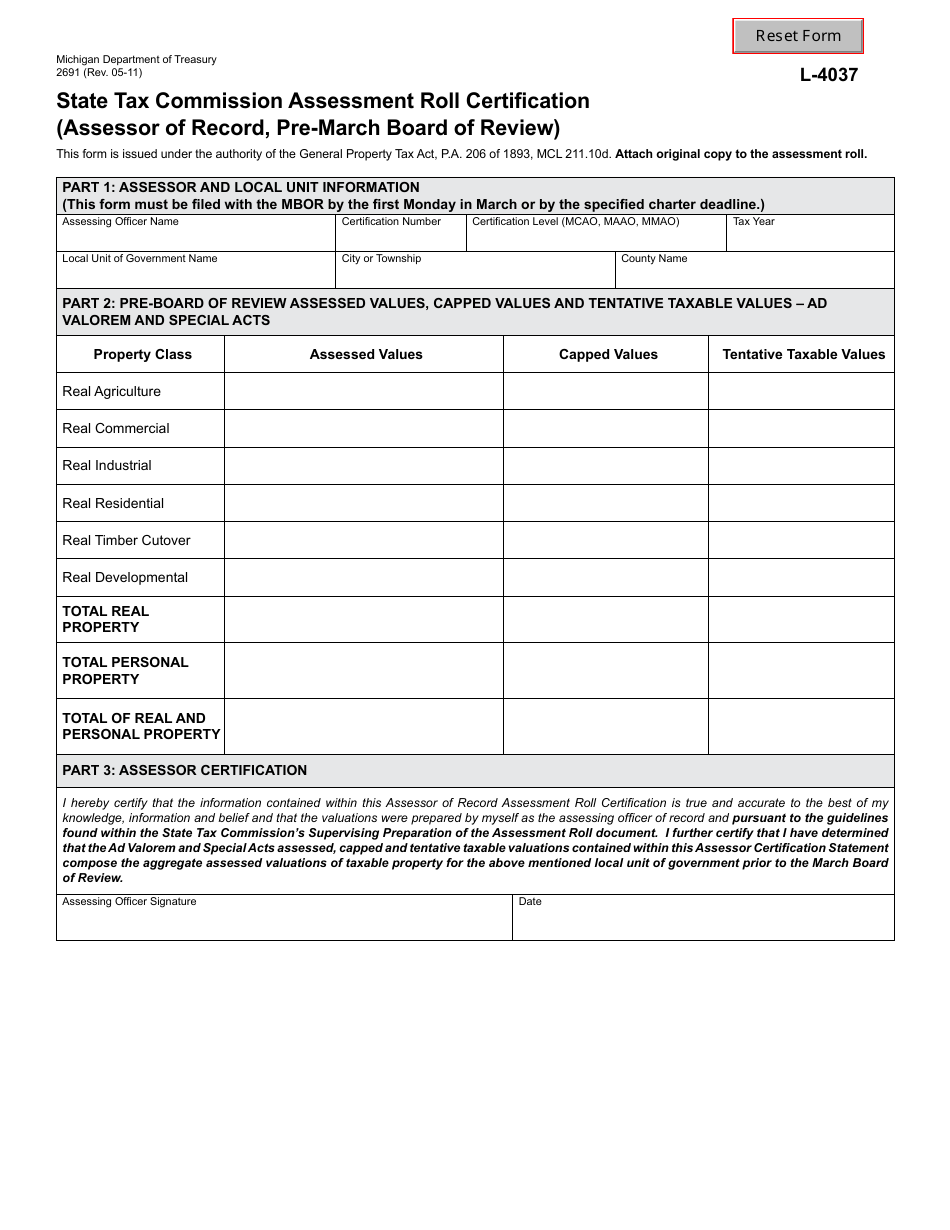

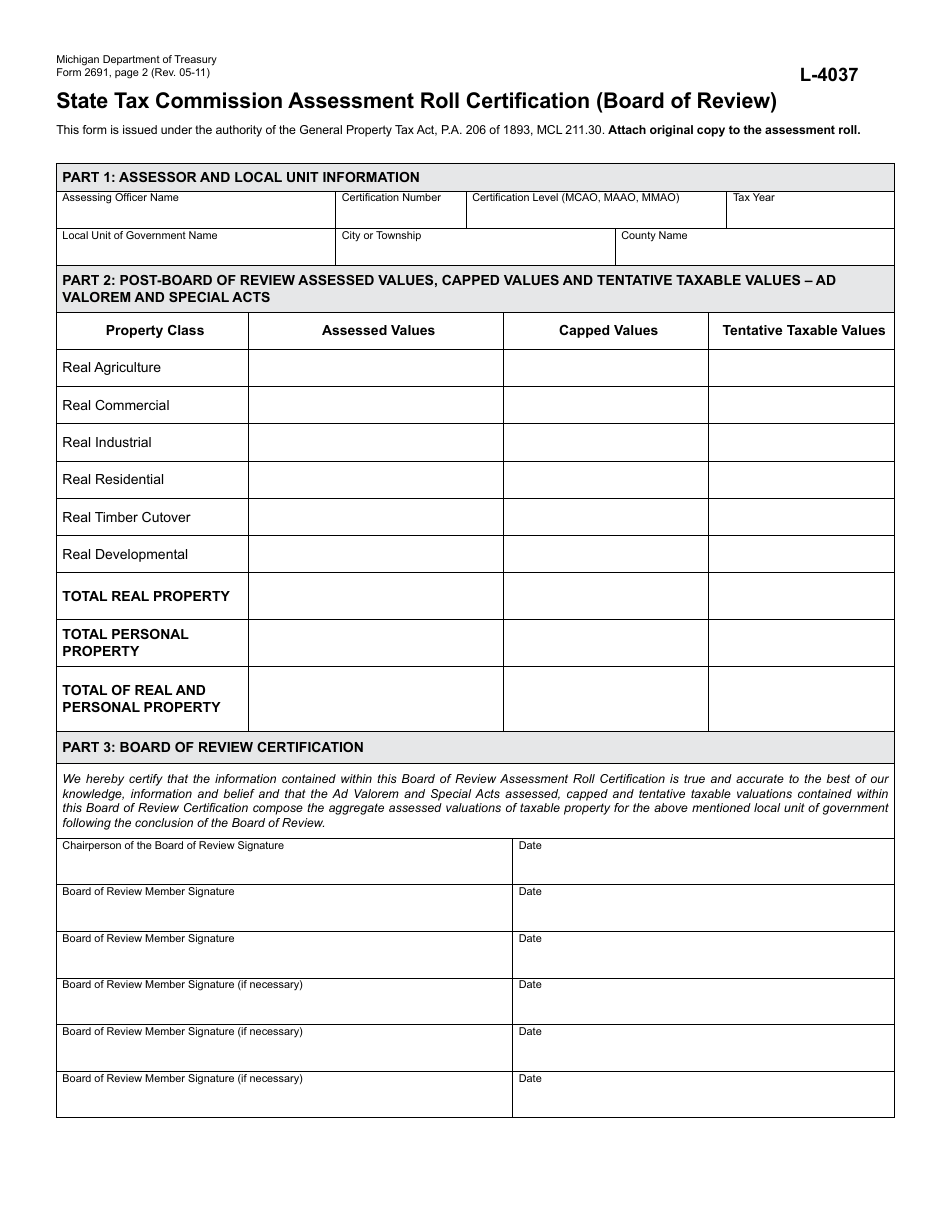

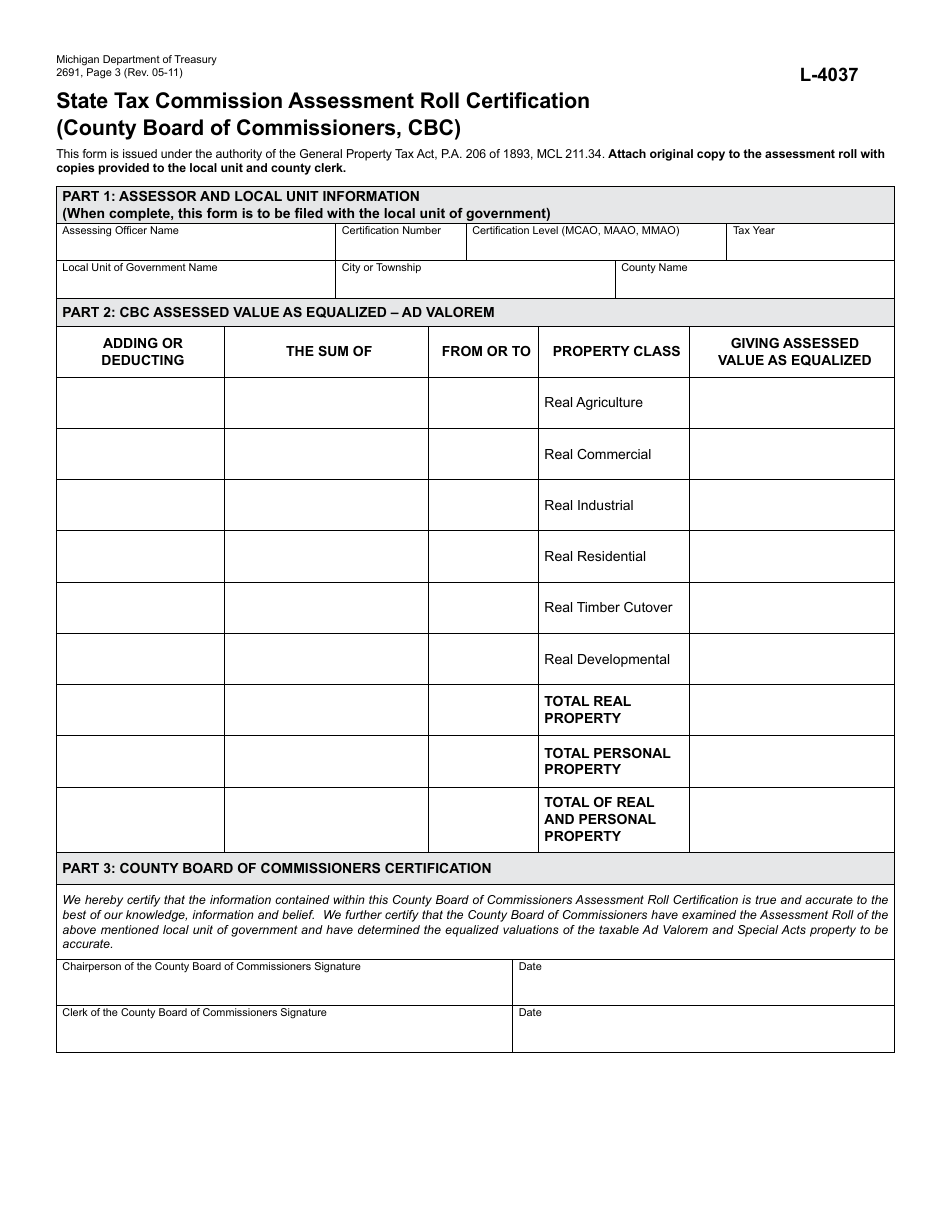

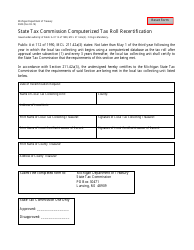

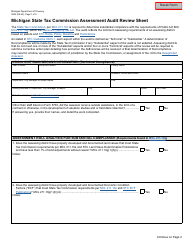

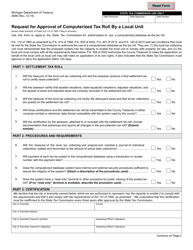

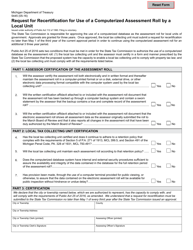

Form 2691 (L-4037) State Tax Commission Assessment Roll Certification - Michigan

What Is Form 2691 (L-4037)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2691 (L-4037)?

A: Form 2691 (L-4037) is a State Tax Commission Assessment Roll Certification used in Michigan.

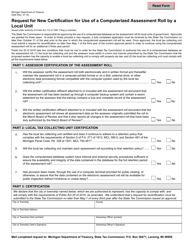

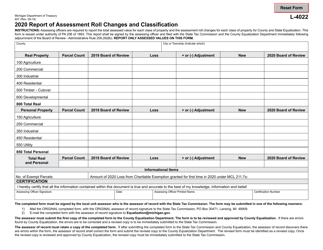

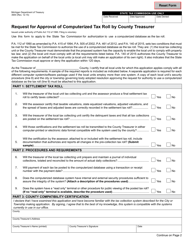

Q: What is the purpose of Form 2691 (L-4037)?

A: The purpose of Form 2691 (L-4037) is to certify the assessment roll for property tax purposes in Michigan.

Q: Who uses Form 2691 (L-4037)?

A: Form 2691 (L-4037) is used by the State Tax Commission and local assessing officers in Michigan.

Q: Is Form 2691 (L-4037) required for all property owners in Michigan?

A: No, Form 2691 (L-4037) is not required for all property owners. It is used by the State Tax Commission and local assessing officers for assessment roll certification.

Q: Are there any fees associated with filing Form 2691 (L-4037)?

A: There are no fees associated with filing Form 2691 (L-4037).

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2691 (L-4037) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.