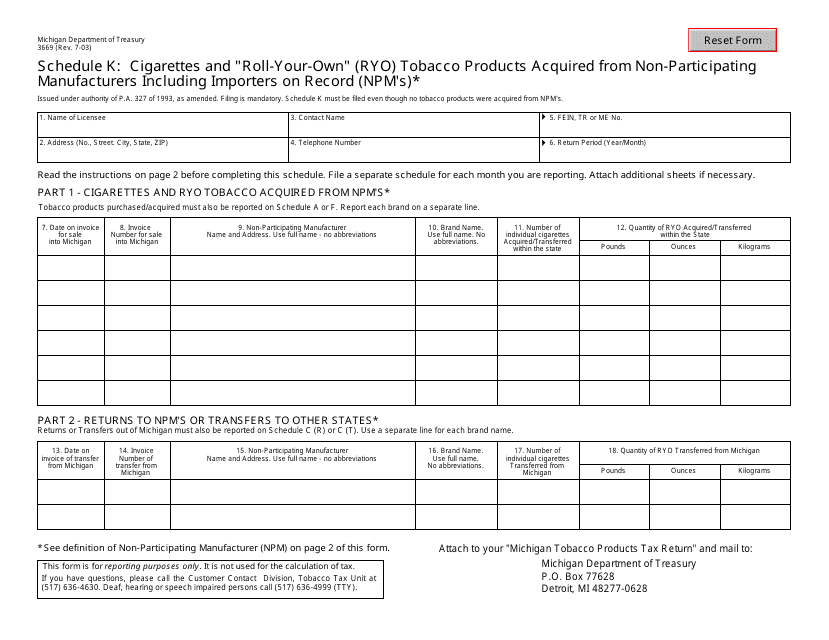

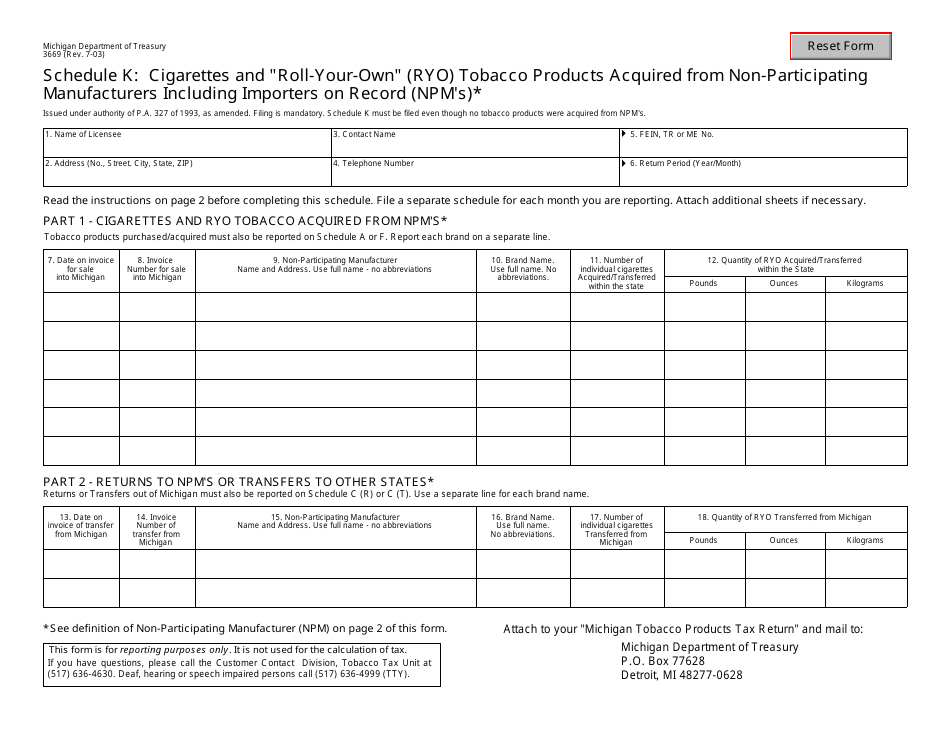

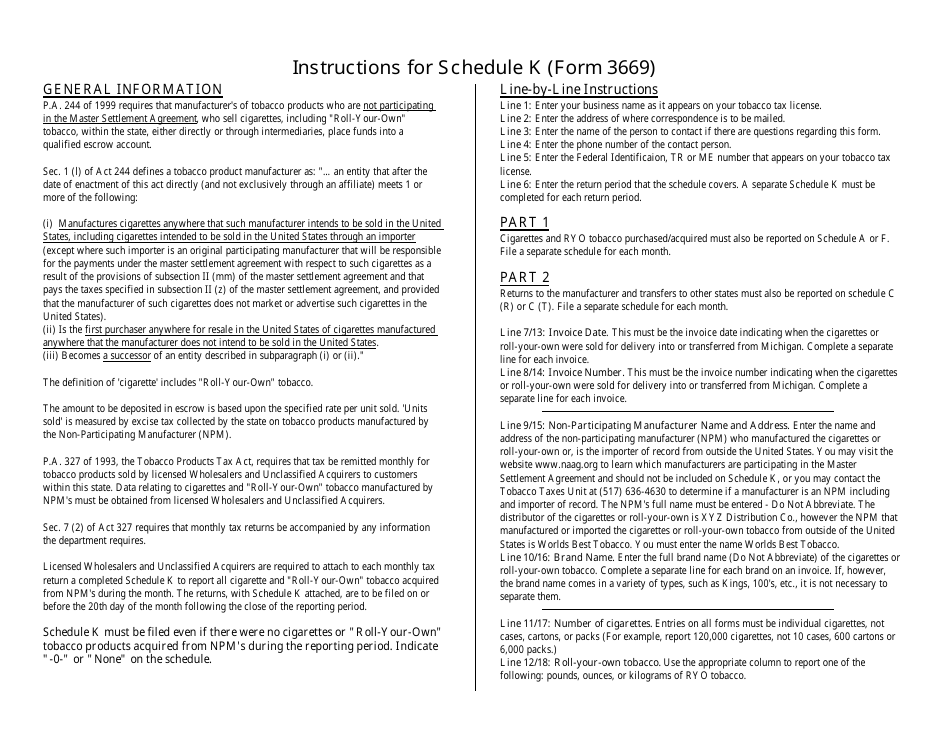

Form 3669 Schedule K Cigarettes and "roll-Your-Own" (Ryo) Tobacco Products Acquired From Non-participating Manufacturers Including Importers on Record (Npm's) - Michigan

What Is Form 3669 Schedule K?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3669 Schedule K?

A: Form 3669 Schedule K is used for reporting cigarettes and 'roll-your-own' tobacco products acquired from non-participating manufacturers including importers on record.

Q: Who should use Form 3669 Schedule K?

A: This form should be used by individuals or businesses in Michigan who have acquired cigarettes or 'roll-your-own' tobacco products from non-participating manufacturers including importers on record.

Q: What is the purpose of Form 3669 Schedule K?

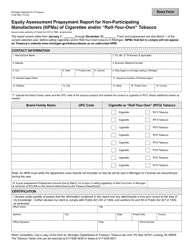

A: The purpose of Form 3669 Schedule K is to report the acquisition of cigarettes and 'roll-your-own' tobacco products for tax purposes.

Q: What is meant by non-participating manufacturers?

A: Non-participating manufacturers refer to those who have not joined the Master Settlement Agreement (MSA) with the states.

Q: What information is required to be reported on Form 3669 Schedule K?

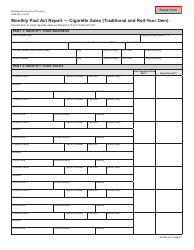

A: Form 3669 Schedule K requires the reporting of the quantity and total wholesale cost of cigarettes and 'roll-your-own' tobacco products acquired from non-participating manufacturers.

Form Details:

- Released on July 1, 2003;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3669 Schedule K by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.