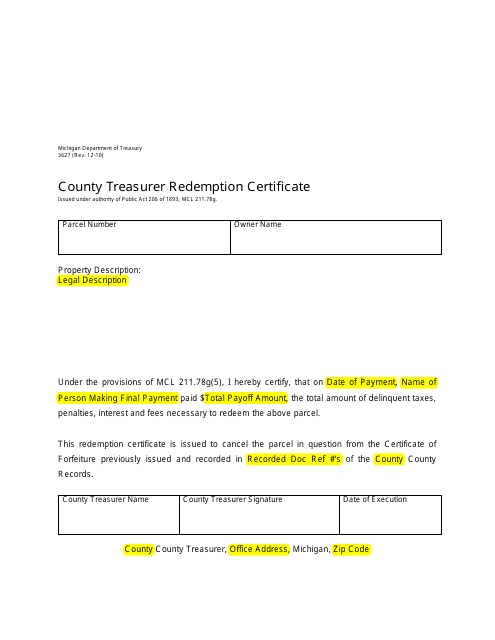

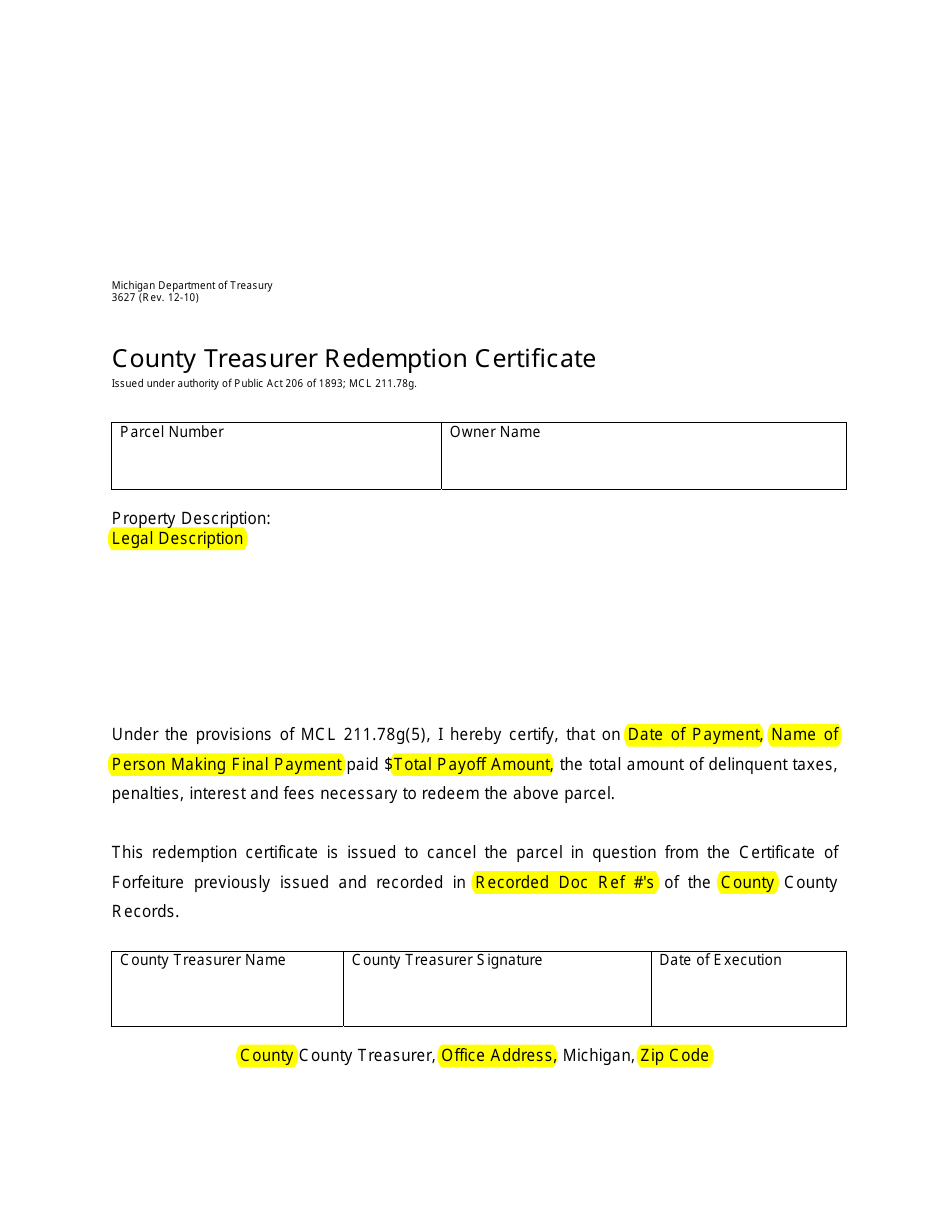

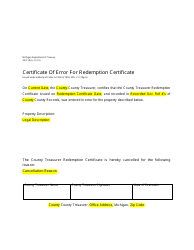

Sample Form 3627 County Treasurer Redemption Certificate - Michigan

What Is Form 3627?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3627?

A: Form 3627 is a County Treasurer Redemption Certificate in Michigan.

Q: What is a County Treasurer Redemption Certificate?

A: A County Treasurer Redemption Certificate is a document used in Michigan to certify the redemption of property by a delinquent taxpayer.

Q: Who uses Form 3627?

A: County Treasurers in Michigan use Form 3627.

Q: What is the purpose of Form 3627?

A: The purpose of Form 3627 is to provide proof that a delinquent taxpayer has redeemed their property by paying all outstanding taxes and penalties.

Q: How do I obtain Form 3627?

A: You can obtain Form 3627 from your local County Treasurer's office in Michigan.

Q: What information is required on Form 3627?

A: Form 3627 requires information such as the property owner's name, address, and tax identification number, as well as details about the redemption amount and date.

Q: Is there a fee for obtaining Form 3627?

A: There may be a fee for obtaining a copy of Form 3627 from the County Treasurer's office. Please check with your local office for more information.

Form Details:

- Released on December 1, 2010;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 3627 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.