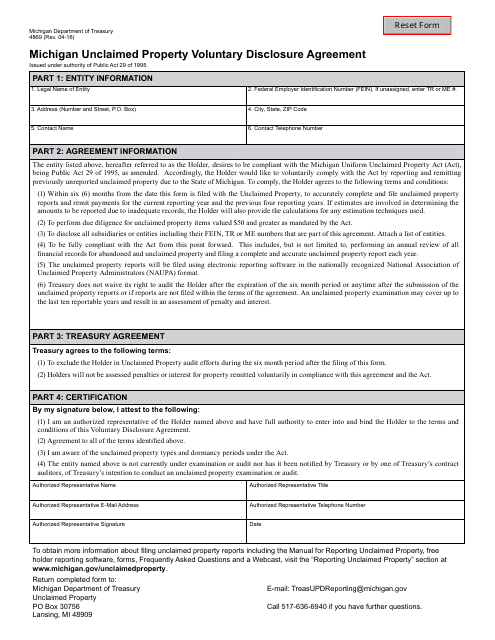

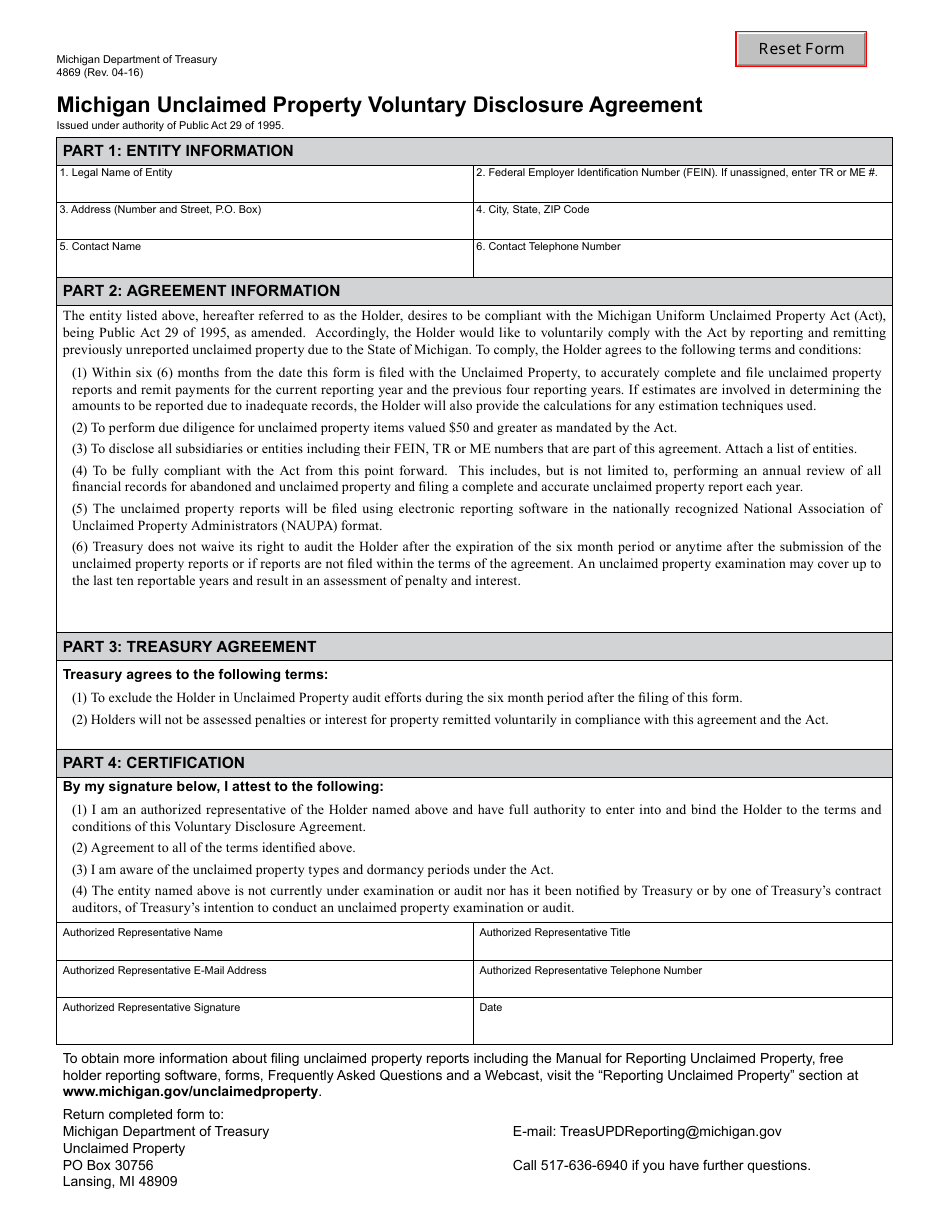

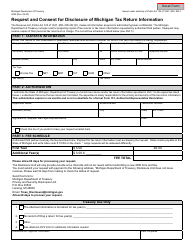

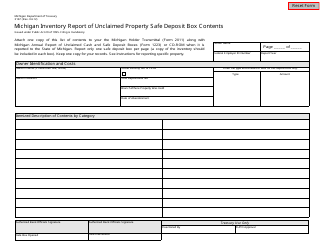

Form 4869 Michigan Unclaimed Property Voluntary Disclosure Agreement - Michigan

What Is Form 4869?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

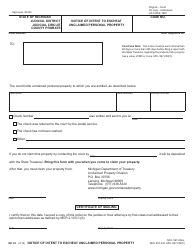

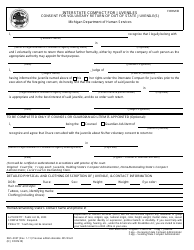

Q: What is the Form 4869 Michigan Unclaimed Property Voluntary Disclosure Agreement?

A: Form 4869 is a voluntary disclosure agreement for unclaimed property in Michigan.

Q: Who should use Form 4869?

A: Businesses or individuals that have unclaimed property in Michigan and want to voluntarily disclose it should use Form 4869.

Q: What is unclaimed property?

A: Unclaimed property refers to assets or funds that have been abandoned or left inactive by their owner for a certain period of time.

Q: Why would someone want to disclose unclaimed property voluntarily?

A: Voluntarily disclosing unclaimed property can help businesses or individuals avoid penalties or legal consequences for non-compliance with the law.

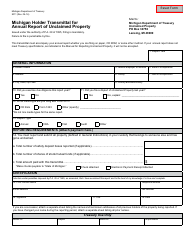

Q: How do I complete Form 4869?

A: To complete Form 4869, you will need to provide information about the unclaimed property, including its value, owner information, and a description of the property.

Q: Is there a deadline for submitting Form 4869?

A: Yes, Form 4869 should be submitted by November 1st of the year in which the voluntary disclosure is being made.

Q: Are there any penalties for failing to disclose unclaimed property?

A: Yes, failure to disclose unclaimed property may result in penalties, interest, or legal actions.

Q: Can I use Form 4869 for unclaimed property in other states?

A: No, Form 4869 is specific to the voluntary disclosure of unclaimed property in Michigan.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4869 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.