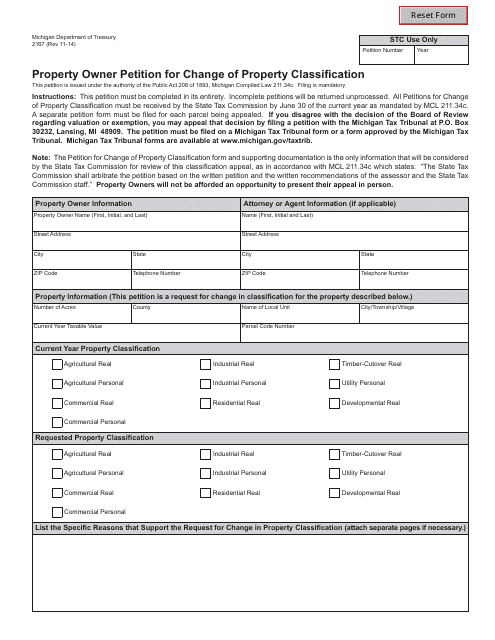

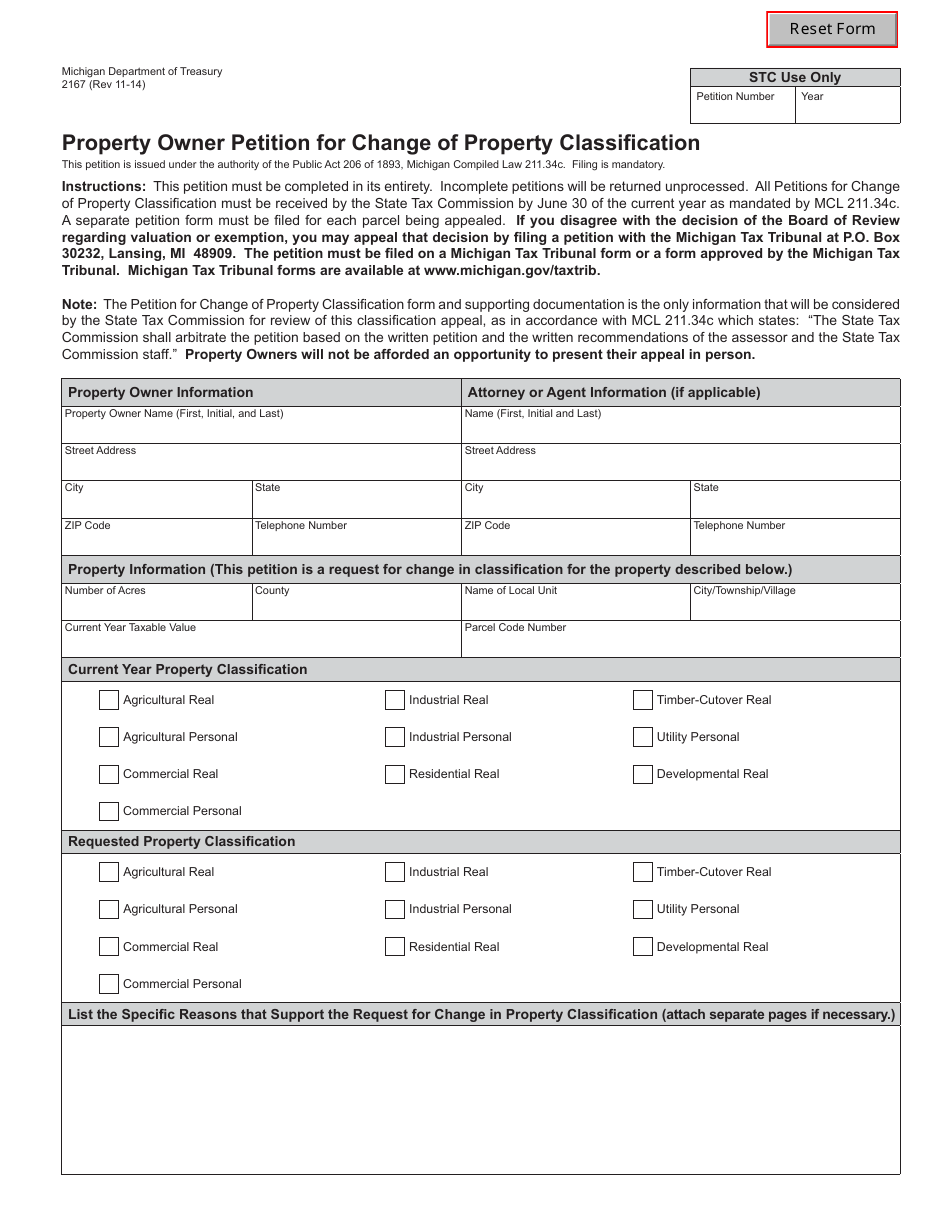

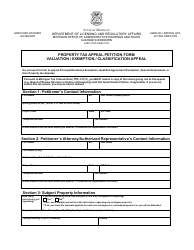

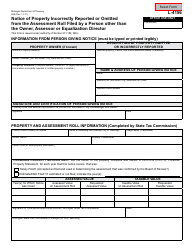

Form 2167 Property Owner Petition for Change of Property Classification - Michigan

What Is Form 2167?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

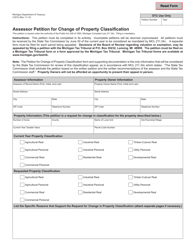

Q: What is Form 2167?

A: Form 2167 is a Property Owner Petition for Change of Property Classification in Michigan.

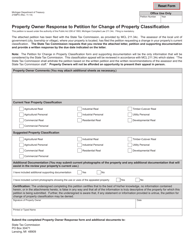

Q: What is the purpose of Form 2167?

A: The purpose of Form 2167 is to request a change in the classification of a property.

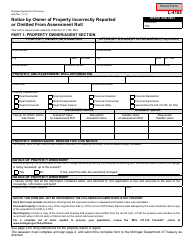

Q: Who can submit Form 2167?

A: Property owners in Michigan can submit Form 2167.

Q: What is meant by property classification?

A: Property classification refers to how a property is categorized for tax purposes.

Q: Why would someone want to change the property classification?

A: Someone may want to change the property classification to potentially lower their property taxes.

Q: Are there any fees associated with submitting Form 2167?

A: There may be a fee for submitting Form 2167, depending on the specific circumstances.

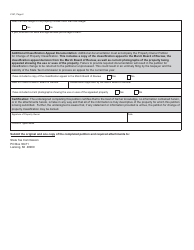

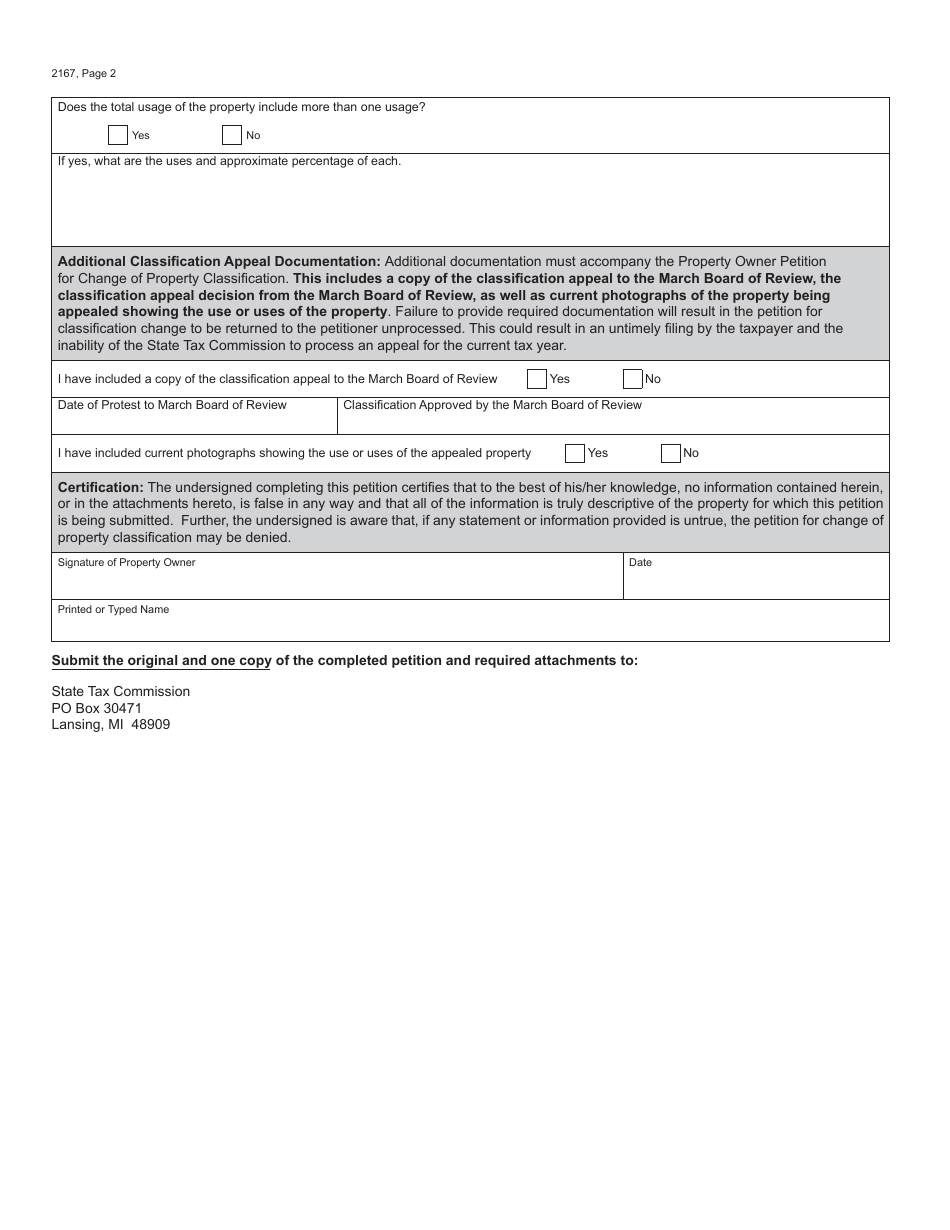

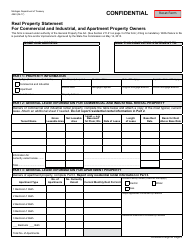

Q: What supporting documentation is required with Form 2167?

A: Supporting documentation may include property appraisals, income statements, or any other relevant information.

Q: What happens after submitting Form 2167?

A: After submitting Form 2167, the local assessing officer will review the request and make a determination.

Q: Can the decision be appealed?

A: Yes, if the property owner disagrees with the decision, they can appeal it to the Michigan Tax Tribunal.

Form Details:

- Released on November 1, 2014;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2167 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.