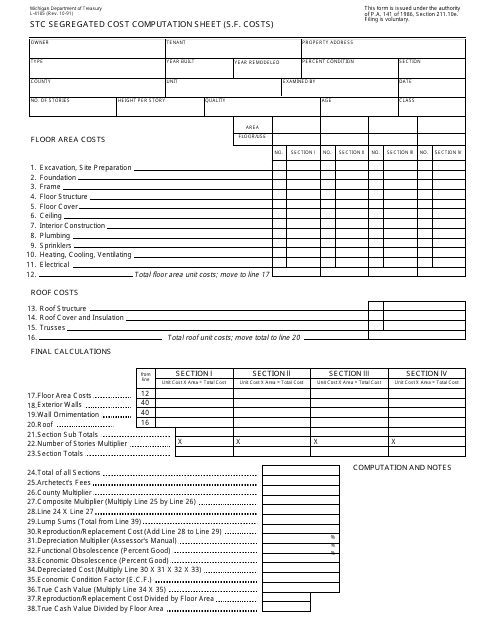

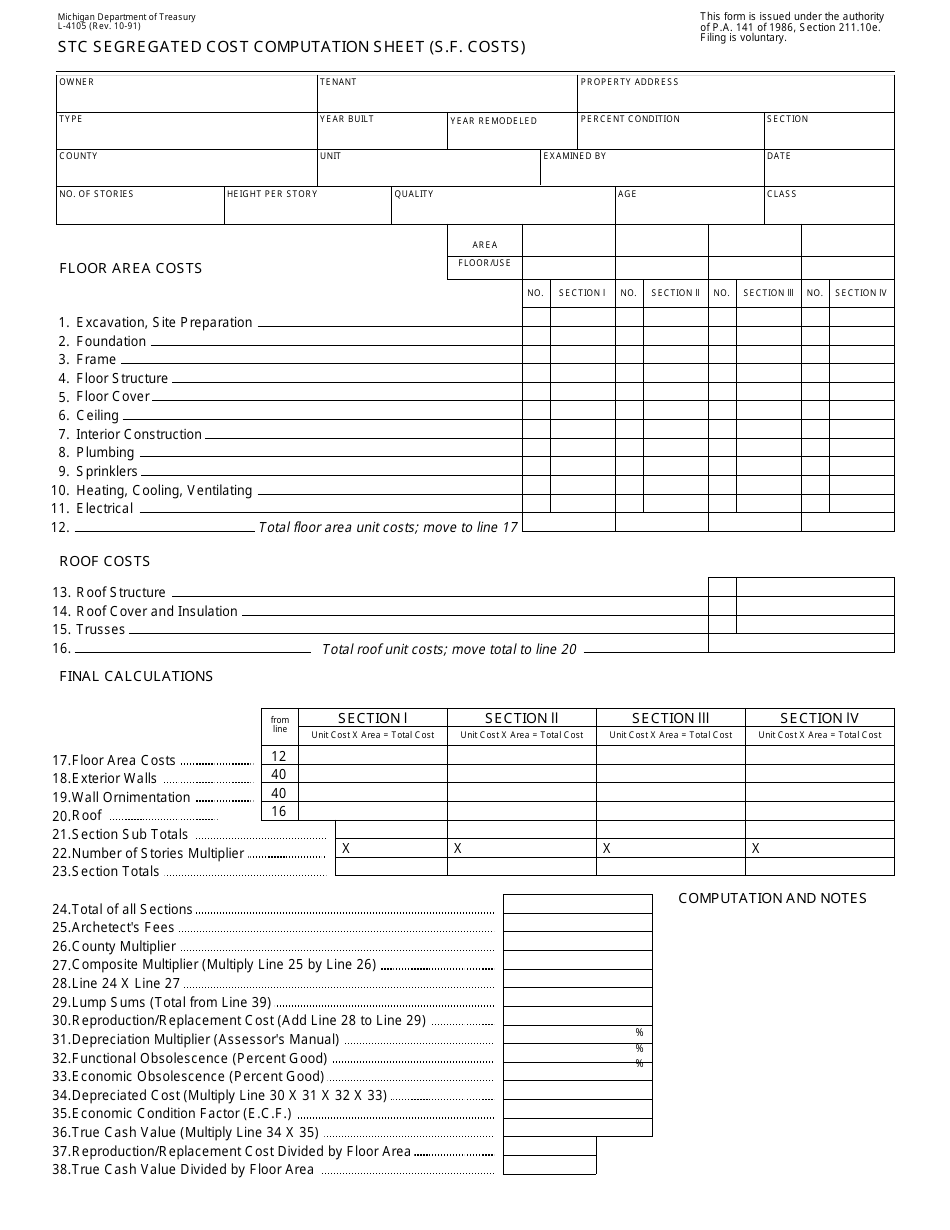

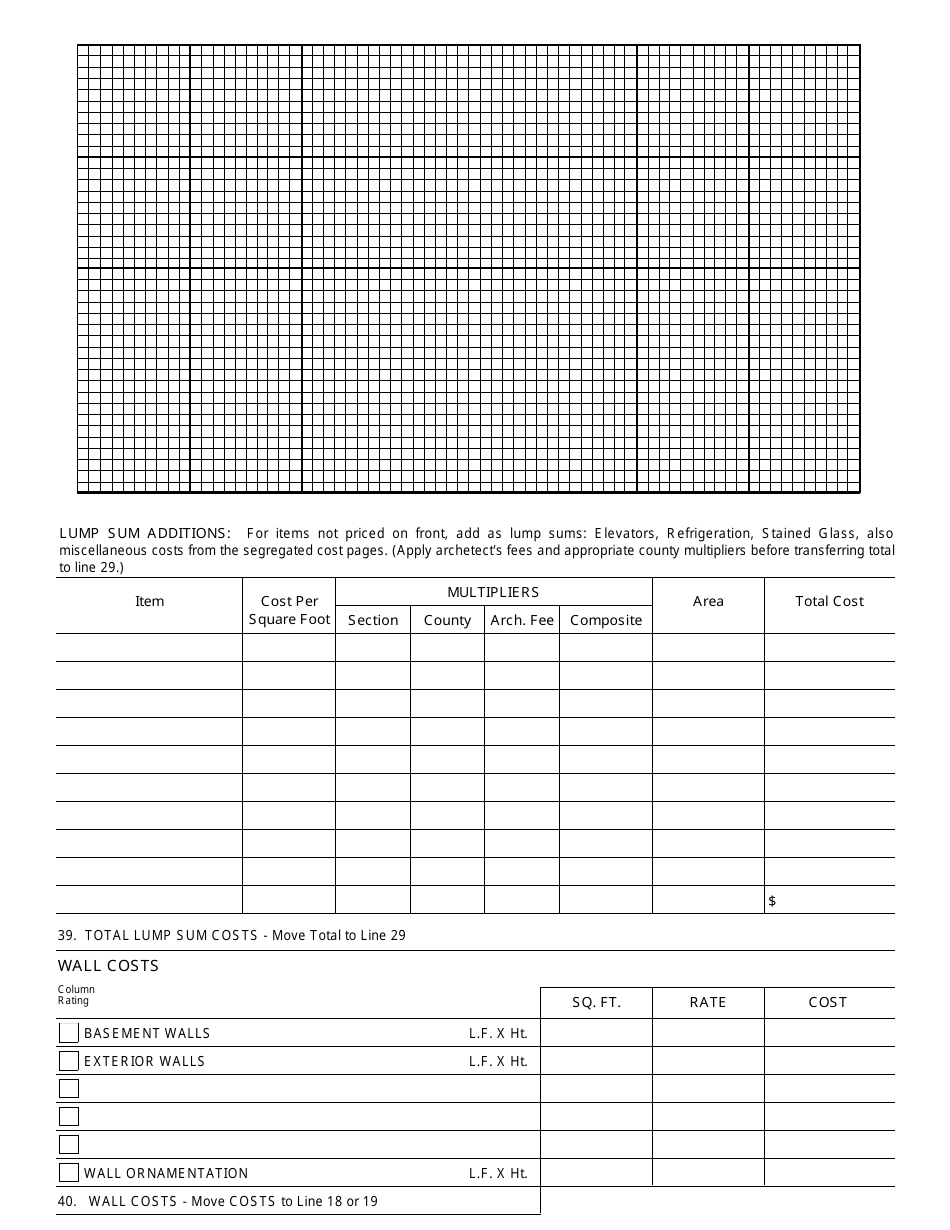

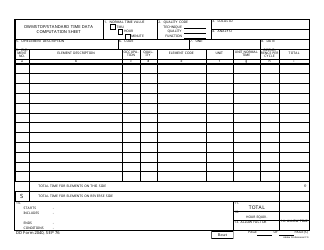

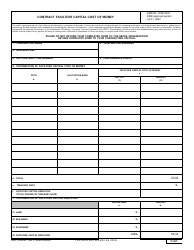

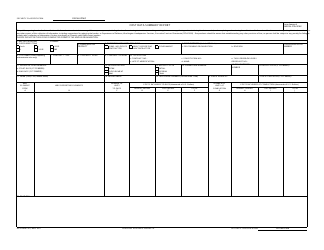

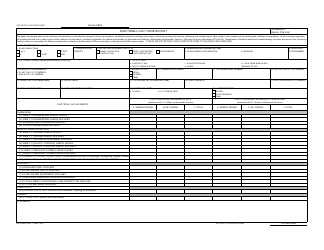

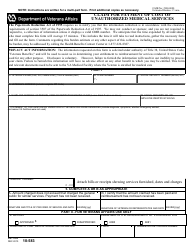

Form L-4105 Stc Segregated Cost Computation Sheet (S.f. Costs) - Michigan

What Is Form L-4105?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-4105?

A: Form L-4105 is the Segregated Cost Computation Sheet.

Q: What does STC stand for in Form L-4105?

A: STC stands for Segregated Cost.

Q: What is the purpose of Form L-4105?

A: Form L-4105 is used to calculate segregated costs in Michigan.

Q: What are segregated costs?

A: Segregated costs are costs that are separated or allocated to specific activities or functions.

Q: Who uses Form L-4105?

A: Form L-4105 is used by individuals or businesses in Michigan.

Q: How can I obtain Form L-4105?

A: You can obtain the Form L-4105 from the Michigan Department of Treasury.

Q: What are S.F. costs on Form L-4105?

A: S.F. costs refer to specific function costs on the Segregated Cost Computation Sheet.

Q: What is the importance of Form L-4105?

A: Form L-4105 is important for calculating accurate segregated costs in Michigan.

Q: Is Form L-4105 mandatory?

A: Yes, if you need to calculate segregated costs in Michigan.

Q: Are there any filing deadlines for Form L-4105?

A: Specific filing deadlines may be imposed by the Michigan Department of Treasury.

Form Details:

- Released on October 1, 1991;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form L-4105 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.