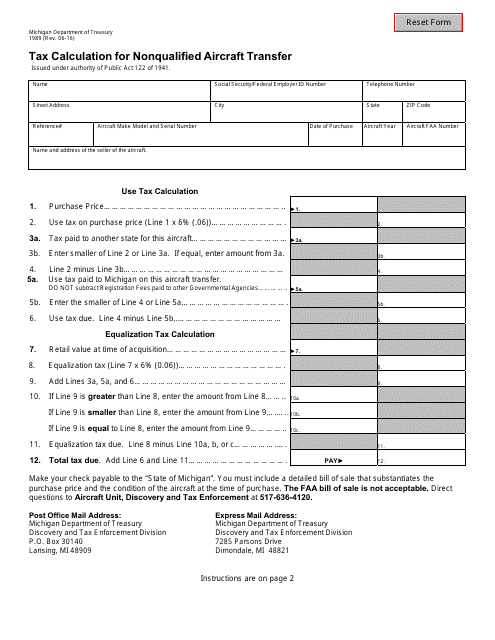

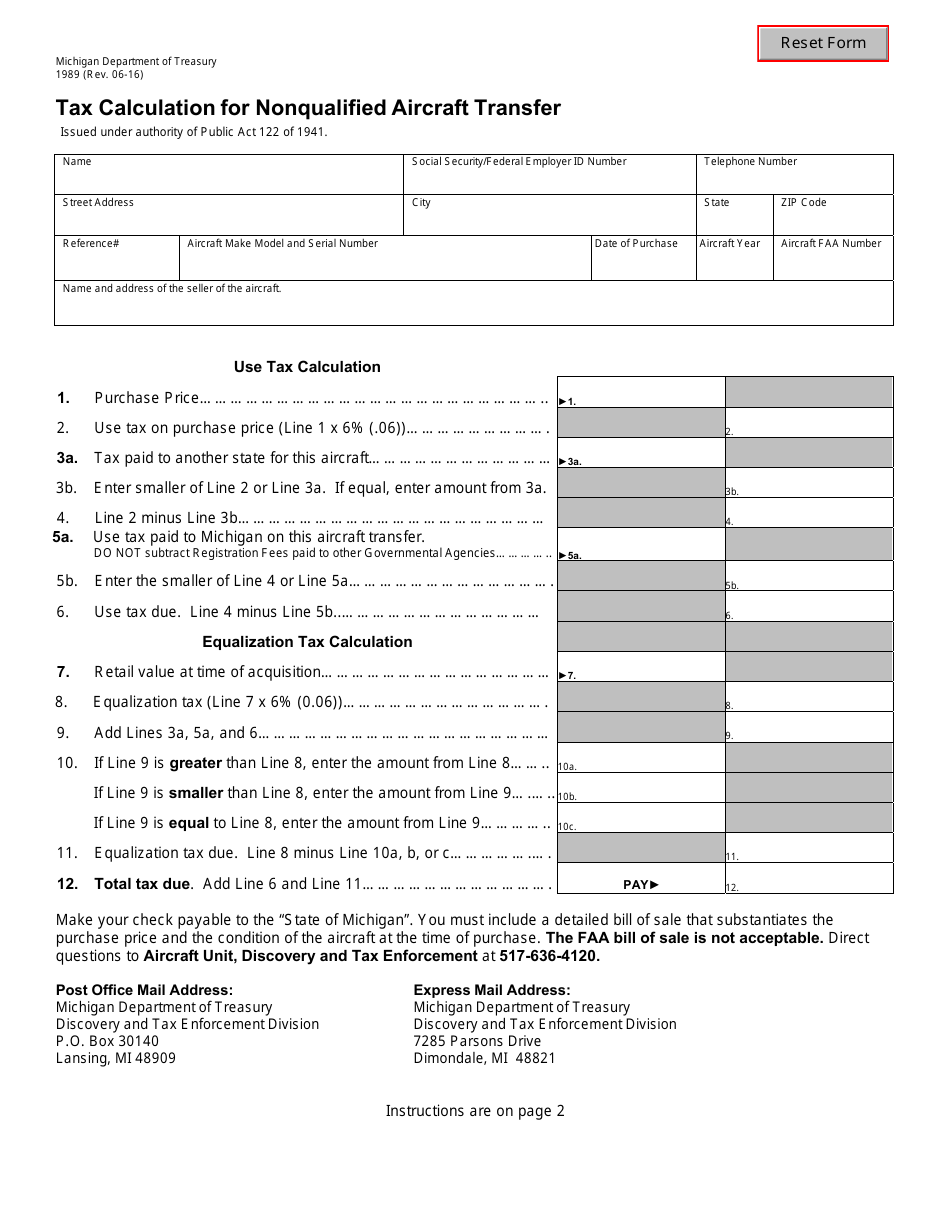

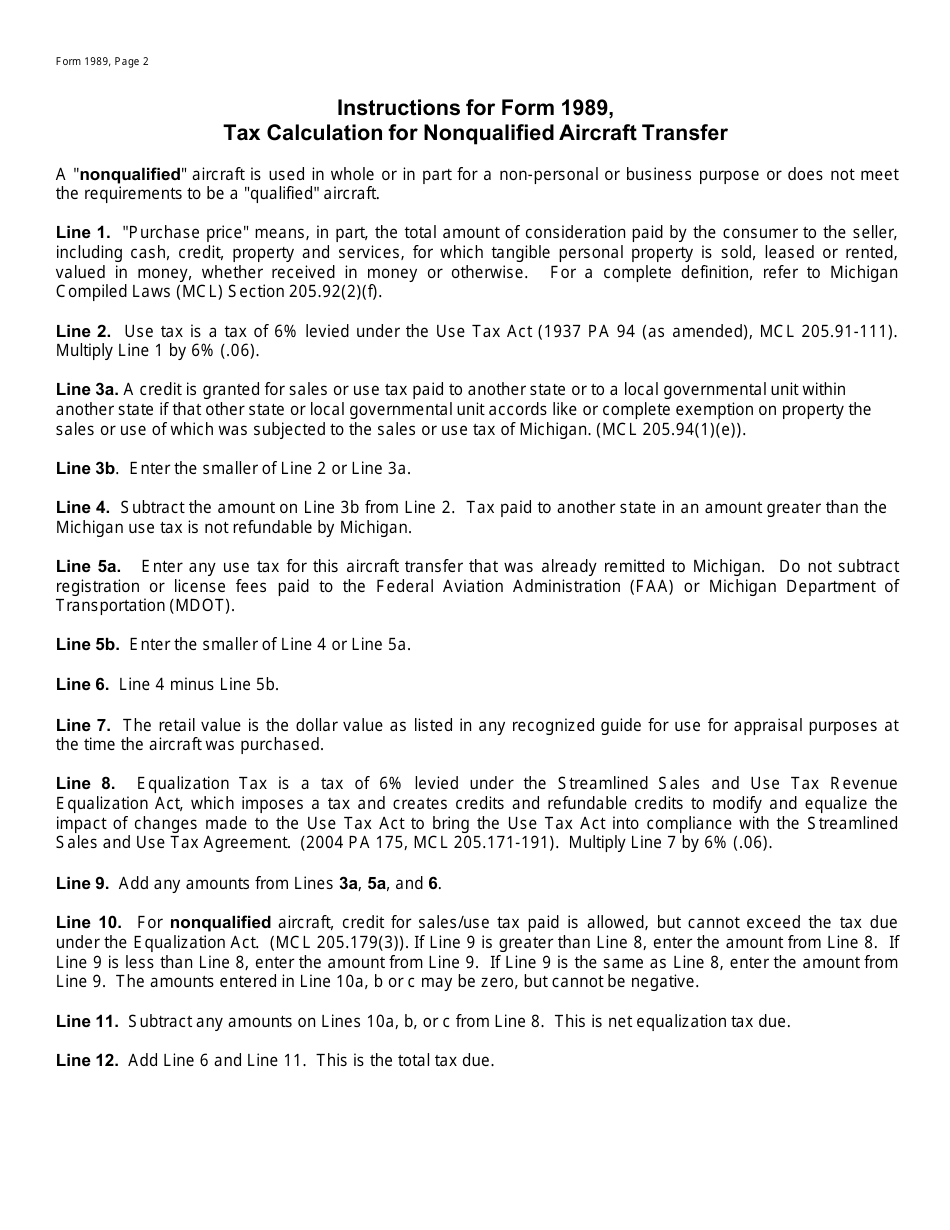

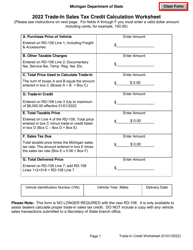

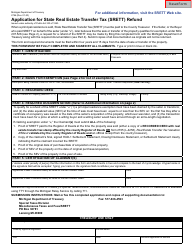

Form 1989 Tax Calculation for Nonqualified Aircraft Transfer - Michigan

What Is Form 1989?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

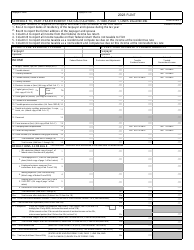

Q: What is the 1989 Tax Calculation for Nonqualified Aircraft Transfer?

A: The 1989 Tax Calculation for Nonqualified Aircraft Transfer is a tax form used in Michigan to calculate taxes related to the transfer of nonqualified aircraft.

Q: Who needs to use this form?

A: This form is used by individuals and organizations involved in the transfer of nonqualified aircraft in Michigan.

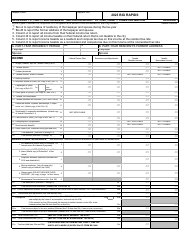

Q: What is a nonqualified aircraft?

A: A nonqualified aircraft refers to an aircraft that does not meet the criteria for exemption or exclusion from taxation in Michigan.

Q: What taxes are calculated using this form?

A: This form calculates the use tax and sales tax related to the transfer of nonqualified aircraft.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1989 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.