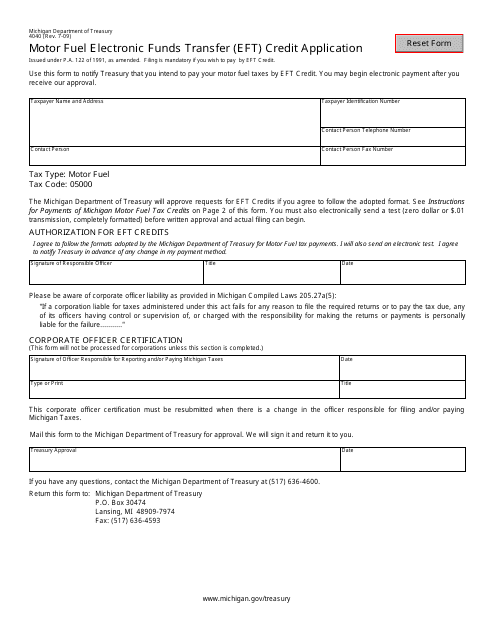

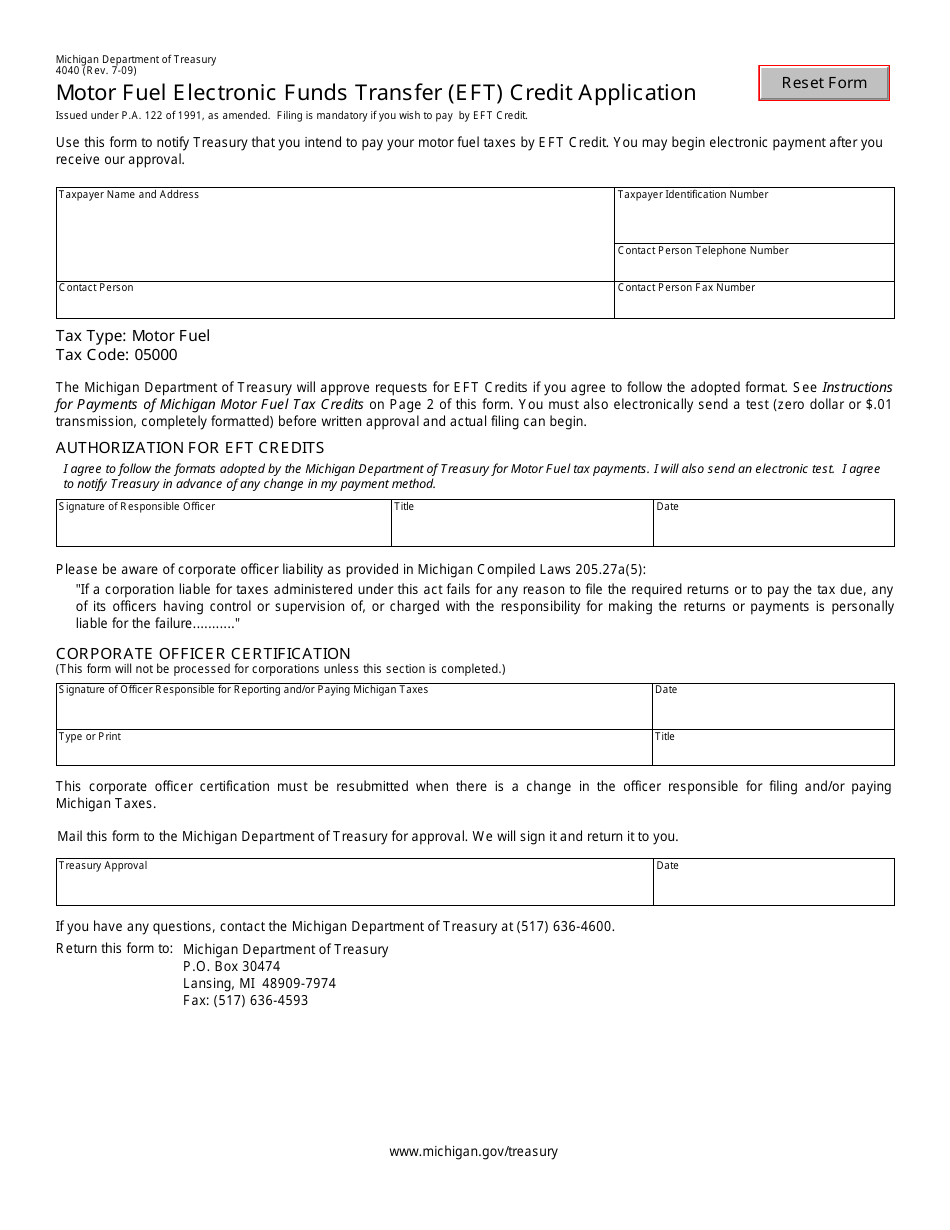

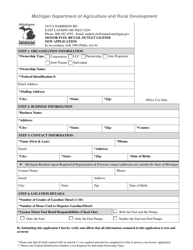

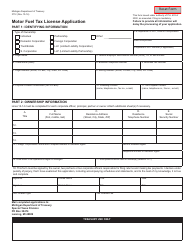

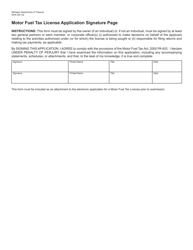

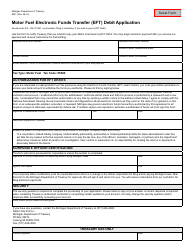

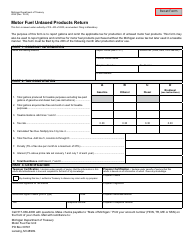

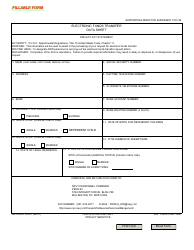

Form 4040 Motor Fuel Electronic Funds Transfer (Eft) Credit Application - Michigan

What Is Form 4040?

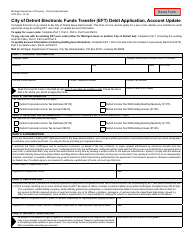

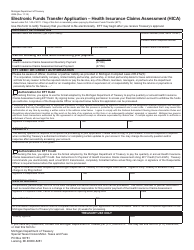

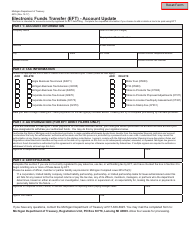

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

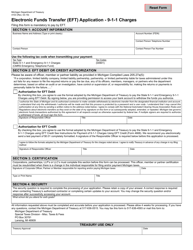

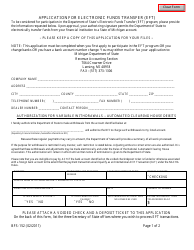

Q: What is Form 4040?

A: Form 4040 is the Motor Fuel Electronic Funds Transfer (EFT) Credit Application for the state of Michigan.

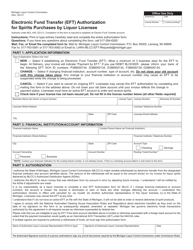

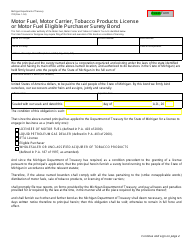

Q: What is the purpose of Form 4040?

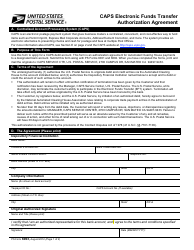

A: The purpose of Form 4040 is to apply for electronic funds transfer (EFT) credits for motor fuel taxes in Michigan.

Q: Who needs to fill out Form 4040?

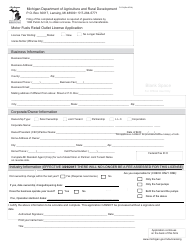

A: Any person or entity who wants to apply for motor fuel tax credits through electronic funds transfer in Michigan needs to fill out Form 4040.

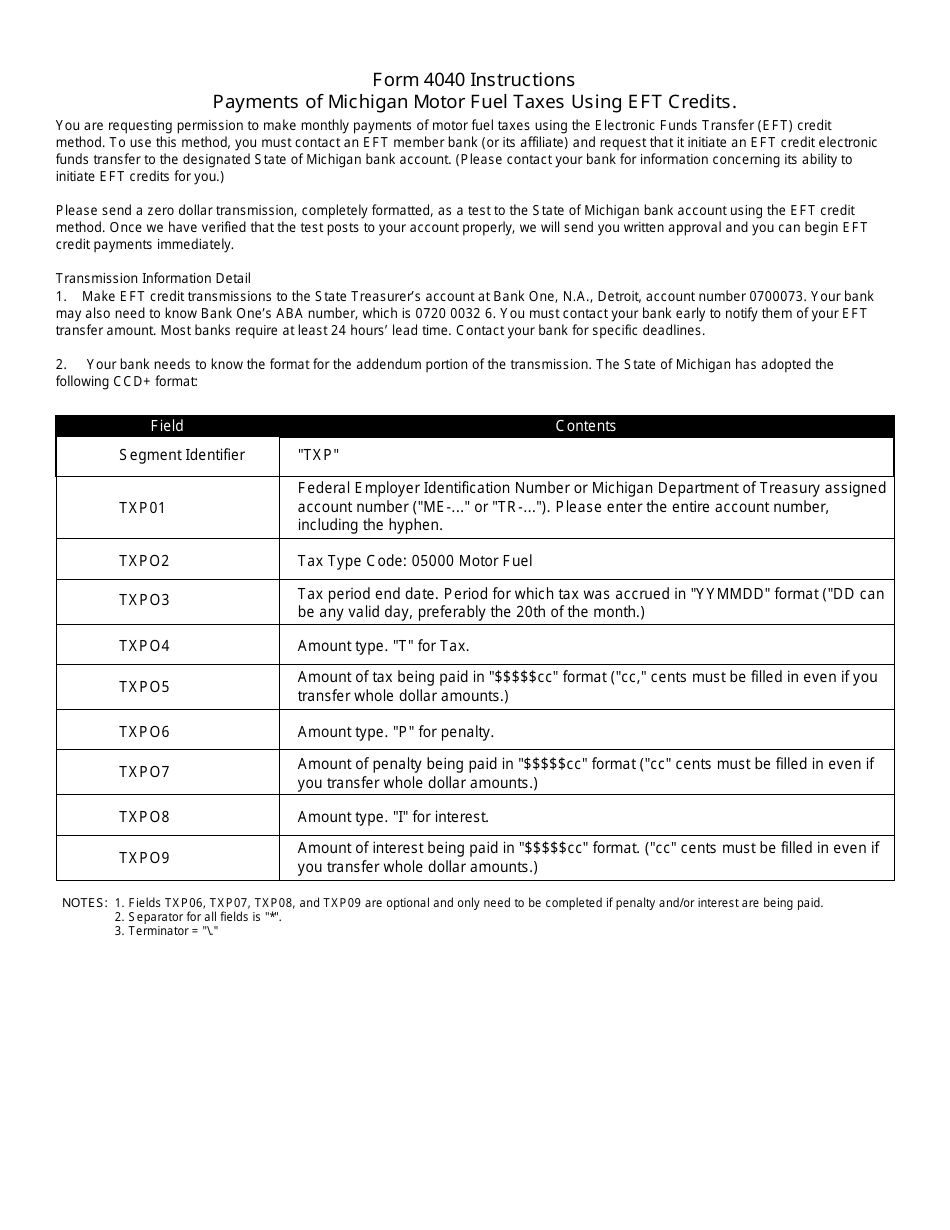

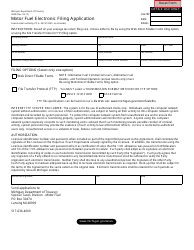

Q: How do I fill out Form 4040?

A: You should fill out Form 4040 by providing accurate and complete information requested in the form, including your personal or business information, tax periods, banking and contact details.

Q: Is there a fee to submit Form 4040?

A: No, there is no fee to submit Form 4040.

Q: What should I do after filling out Form 4040?

A: After filling out Form 4040, you should submit it to the Michigan Department of Treasury along with any required supporting documents.

Q: How long does it take to process Form 4040?

A: The processing time for Form 4040 may vary, but you can expect a response from the Michigan Department of Treasury within a reasonable timeframe.

Q: Who should I contact for more information about Form 4040?

A: For more information about Form 4040 or any questions you have, you can contact the Michigan Department of Treasury directly.

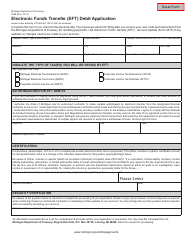

Form Details:

- Released on July 1, 2009;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4040 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.