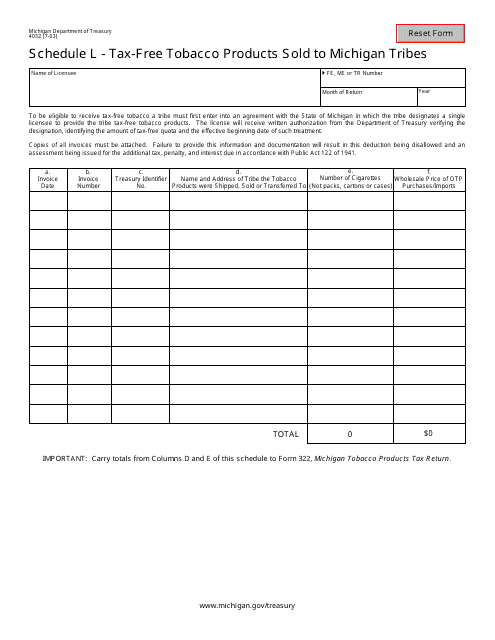

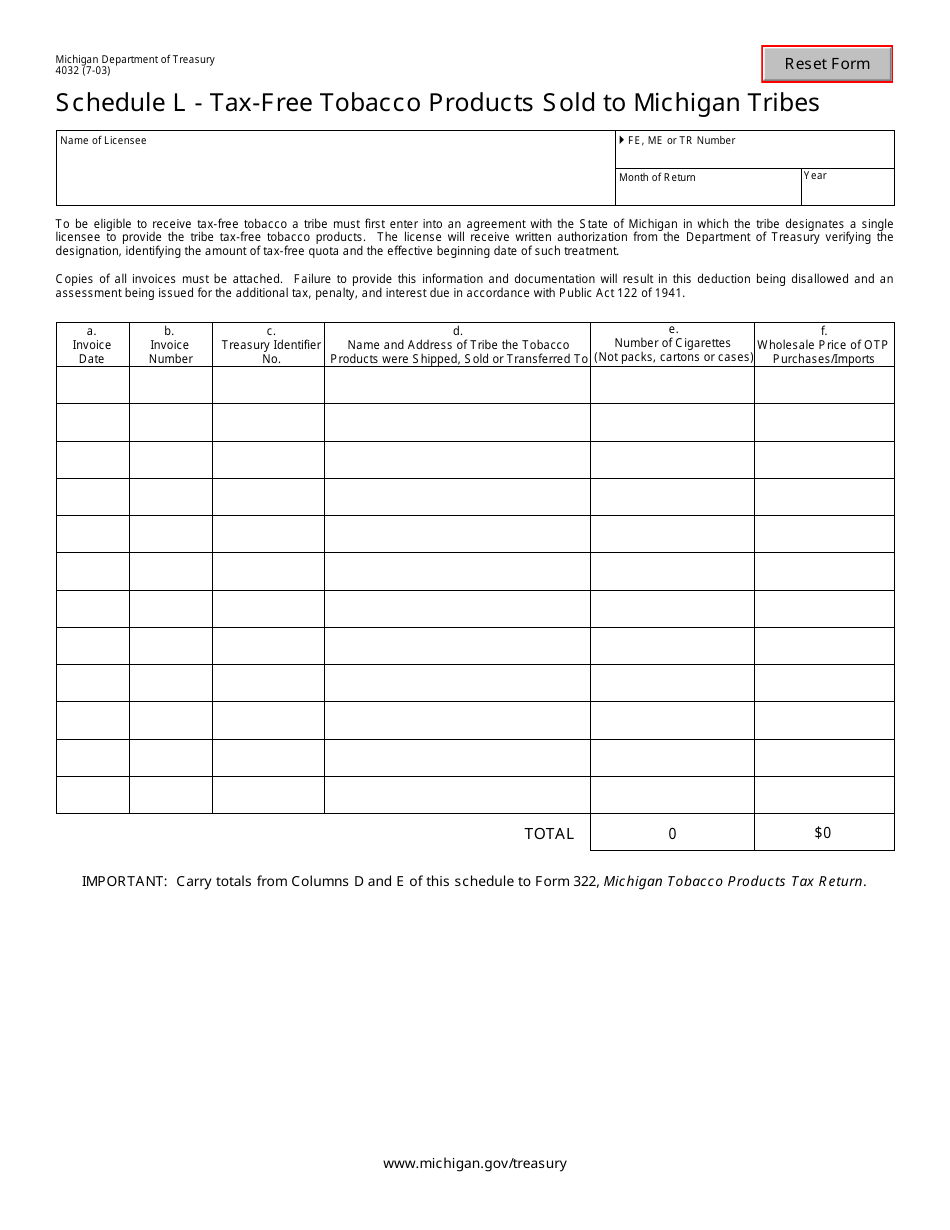

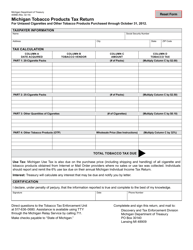

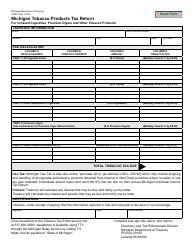

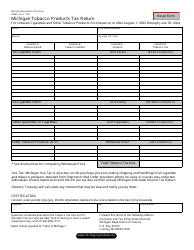

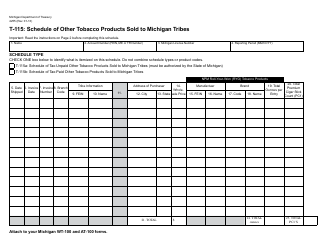

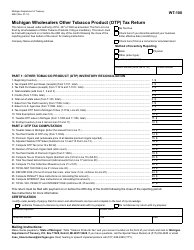

Form 4032 Schedule L Tax-Free Tobacco Products Sold to Michigan Tribes - Michigan

What Is Form 4032 Schedule L?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 4032 Schedule L?

A: Form 4032 Schedule L is a tax form used to report tax-free tobacco products sold to Michigan tribes.

Q: Who is required to file form 4032 Schedule L?

A: Any individual or business entity that sells tax-free tobacco products to Michigan tribes is required to file form 4032 Schedule L.

Q: What is the purpose of form 4032 Schedule L?

A: The purpose of form 4032 Schedule L is to report the sales of tax-free tobacco products to Michigan tribes.

Q: When is form 4032 Schedule L due?

A: Form 4032 Schedule L is due on a monthly basis by the 20th day of the month following the reporting period.

Q: What information is required to be reported on form 4032 Schedule L?

A: Form 4032 Schedule L requires you to provide information such as the number of tax-free tobacco products sold, the total sales amount, and the tribal customer information.

Q: Are there any penalties for not filing form 4032 Schedule L?

A: Yes, failure to file form 4032 Schedule L or filing it late can result in penalties and interest.

Q: Can I electronically file form 4032 Schedule L?

A: Yes, you can electronically file form 4032 Schedule L using the Michigan Department of Treasury's e-File system.

Q: Do I need to keep a copy of form 4032 Schedule L for my records?

A: Yes, it is recommended to keep a copy of form 4032 Schedule L for your records in case of future audits or inquiries.

Form Details:

- Released on July 1, 2003;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4032 Schedule L by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.