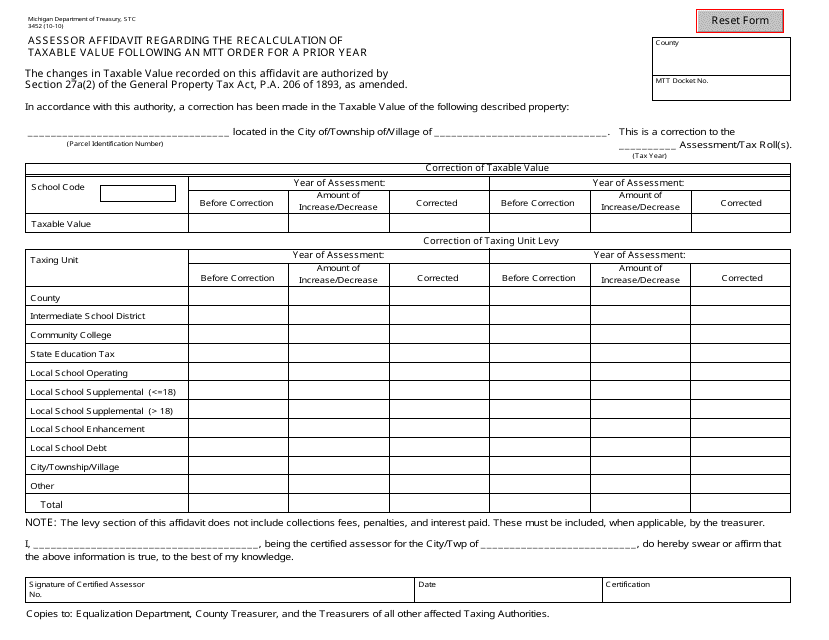

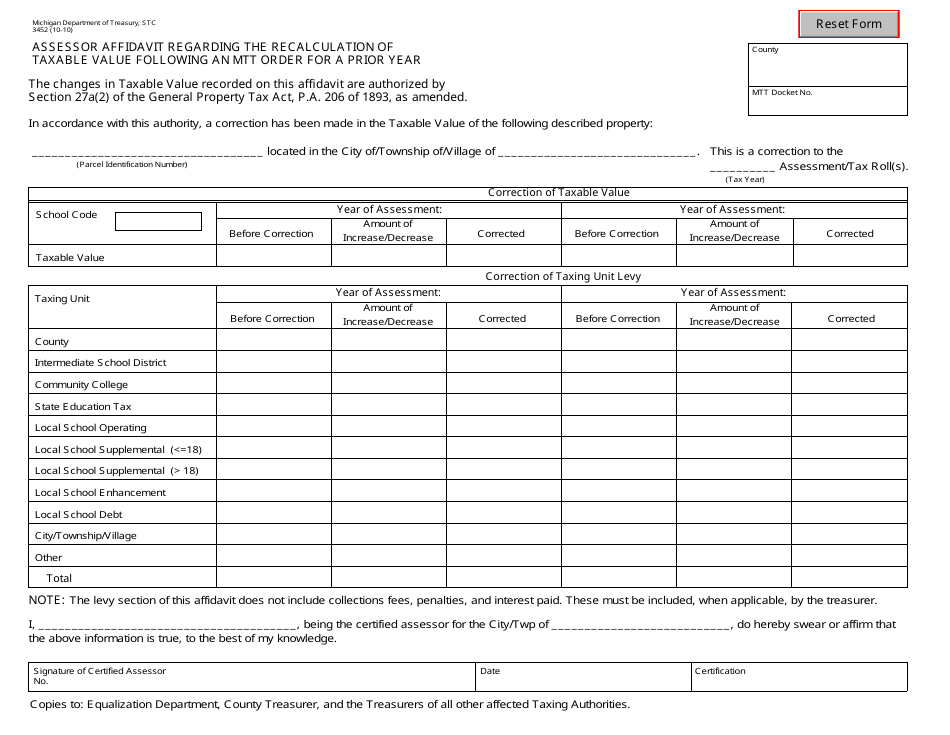

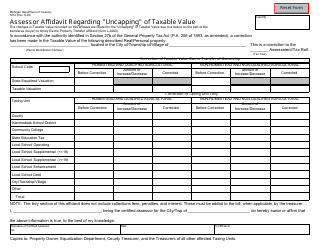

Form 3452 Assessor Affidavit Regarding the Recalculation of Taxable Value Following an Mtt Order for a Prior Year - Michigan

What Is Form 3452?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3452?

A: Form 3452 is an Assessor Affidavit regarding the recalculation of taxable value following an MTT order for a prior year in Michigan.

Q: Who needs to fill out Form 3452?

A: This form needs to be filled out by the assessor.

Q: What is the purpose of Form 3452?

A: The purpose of Form 3452 is to report the recalculation of taxable value on a property following an MTT order for a prior year.

Q: What information is required to fill out Form 3452?

A: Information such as the property address, the prior year's assessed value, taxable value, and the recalculated taxable value are required to fill out Form 3452.

Form Details:

- Released on October 1, 2010;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3452 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.