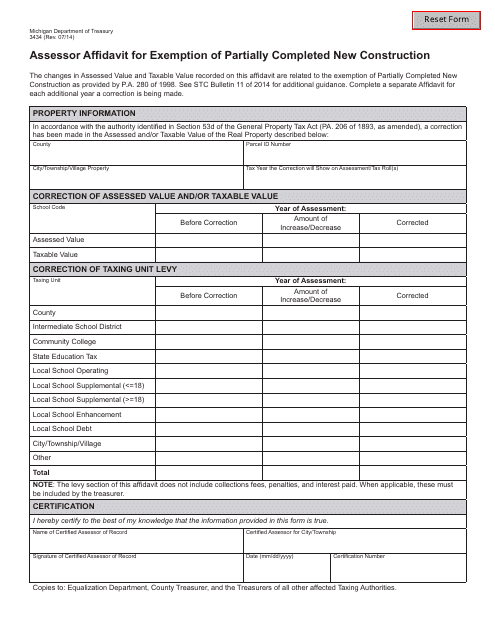

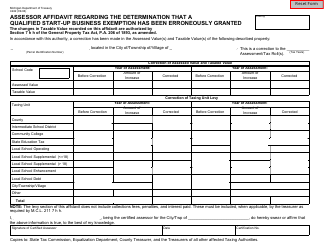

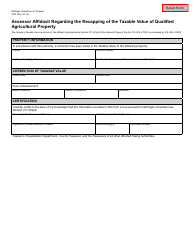

Form 3434 Assessor Affidavit for Exemption of Partially Completed New Construction - Michigan

What Is Form 3434?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 3434?

A: Form 3434 is the Assessor Affidavit for Exemption of Partially Completed New Construction in Michigan.

Q: Who needs to fill out form 3434?

A: Property owners who have partially completed new construction in Michigan.

Q: What is the purpose of form 3434?

A: The purpose of form 3434 is to apply for an exemption from property taxes on partially completed new construction.

Q: What information is required on form 3434?

A: Form 3434 requires information such as the property owner's name, address, and tax identification number, as well as details about the partially completed construction.

Q: When should form 3434 be submitted?

A: Form 3434 should be submitted to the Assessor's office no later than February 20th of the year following the year in which the construction began.

Q: Are there any fees associated with form 3434?

A: No, there are no fees associated with submitting form 3434.

Q: What happens after submitting form 3434?

A: After submitting form 3434, the Assessor will review the application and determine if the property qualifies for the exemption.

Q: Can I appeal if my application for exemption is denied?

A: Yes, if your application for exemption is denied, you can appeal the decision to the Michigan Tax Tribunal.

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3434 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.