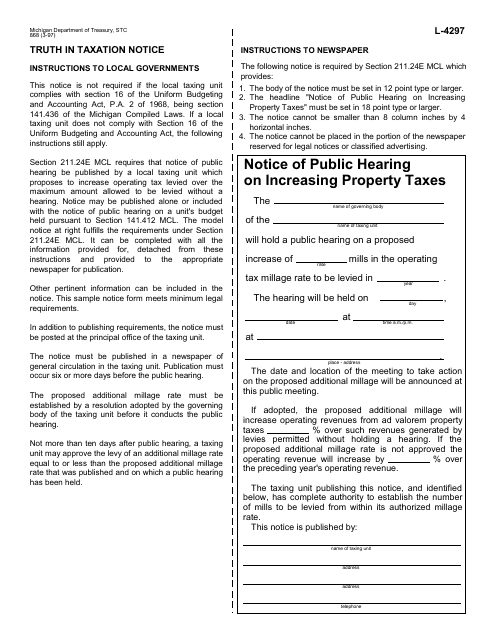

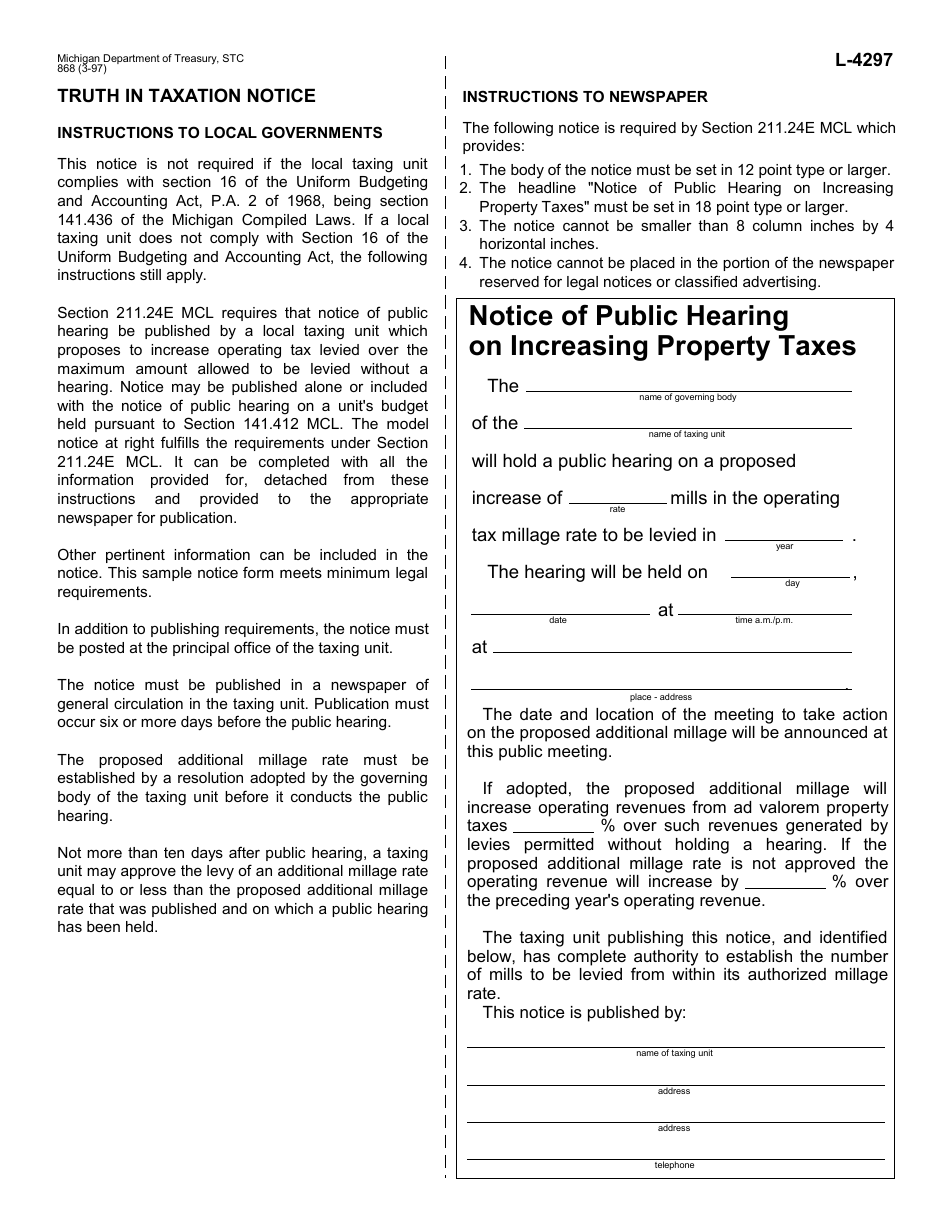

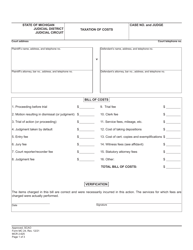

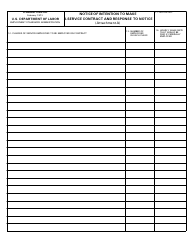

Form 868 (L-4297) Truth in Taxation Notice - Michigan

What Is Form 868 (L-4297)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

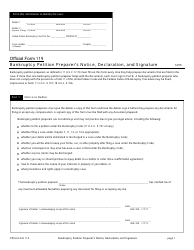

Q: What is Form 868?

A: Form 868 is the Truth in Taxation Notice in Michigan.

Q: What is the purpose of Form 868?

A: The purpose of Form 868 is to provide taxpayers with information about proposed changes in property taxes.

Q: Who receives Form 868?

A: Property owners in Michigan receive Form 868.

Q: When is Form 868 sent out?

A: Form 868 is sent out annually, usually in July or August.

Q: What information does Form 868 provide?

A: Form 868 provides information about proposed property tax rates, millages, and assessment changes.

Q: Can I appeal my property taxes based on the information in Form 868?

A: Yes, you can appeal your property taxes based on the information provided in Form 868.

Form Details:

- Released on March 1, 1997;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 868 (L-4297) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.