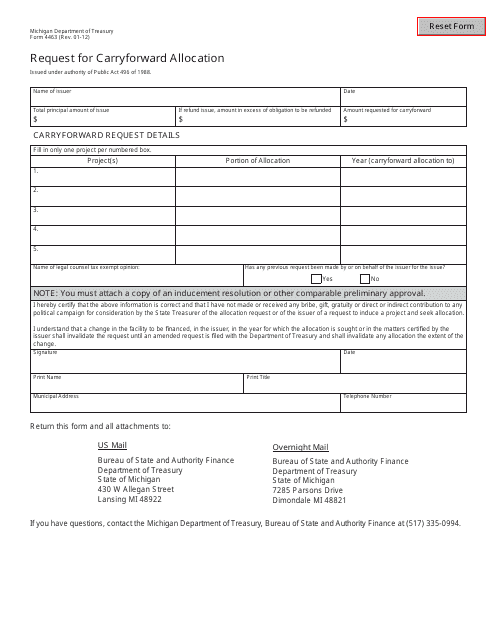

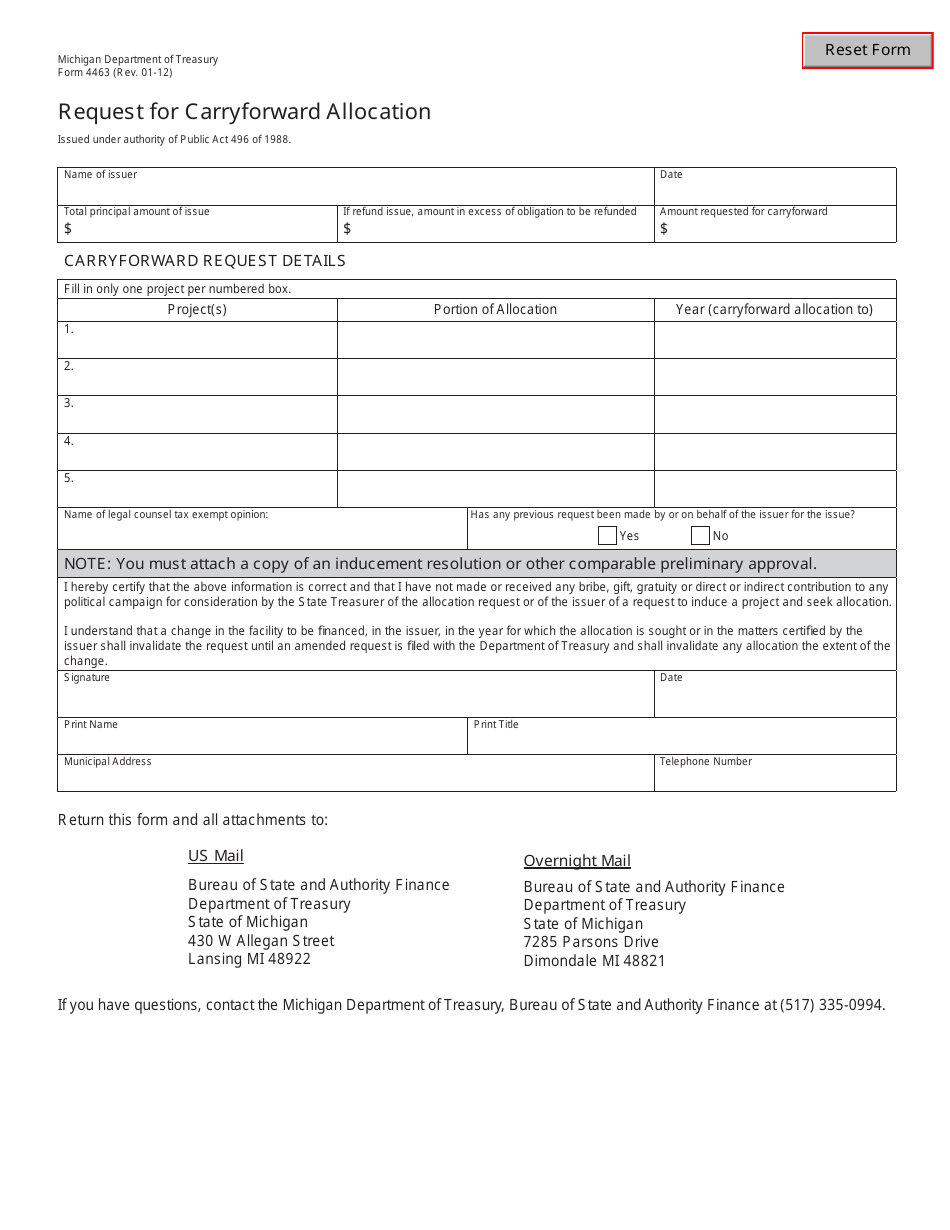

Form 4463 Request for Carryforward Allocation - Michigan

What Is Form 4463?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4463?

A: Form 4463 is the Request for Carryforward Allocation form for Michigan.

Q: What is the purpose of Form 4463?

A: The purpose of Form 4463 is to request an allocation of unused business tax credits.

Q: Who can use Form 4463?

A: Form 4463 can be used by businesses and individuals who have unused business tax credits to carry forward.

Q: How do I fill out Form 4463?

A: You need to provide information about your business tax credits and details for the allocation request.

Q: Is there a deadline for submitting Form 4463?

A: Yes, the deadline for submitting Form 4463 is generally April 15th of the tax year following the year the credits were earned.

Q: Can I file Form 4463 electronically?

A: No, Form 4463 cannot be filed electronically and must be submitted by mail.

Form Details:

- Released on January 1, 2012;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4463 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.