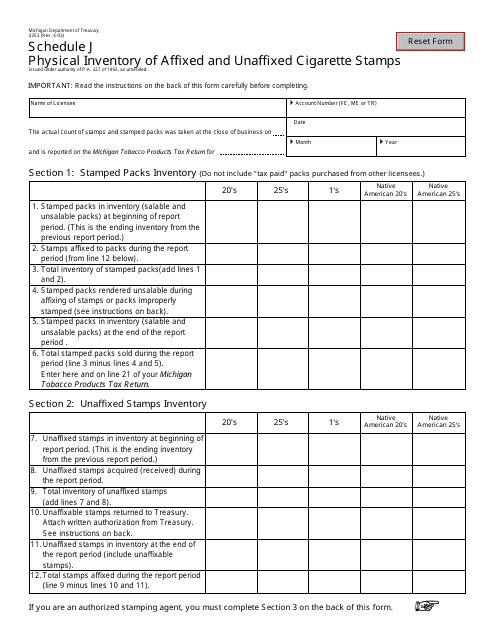

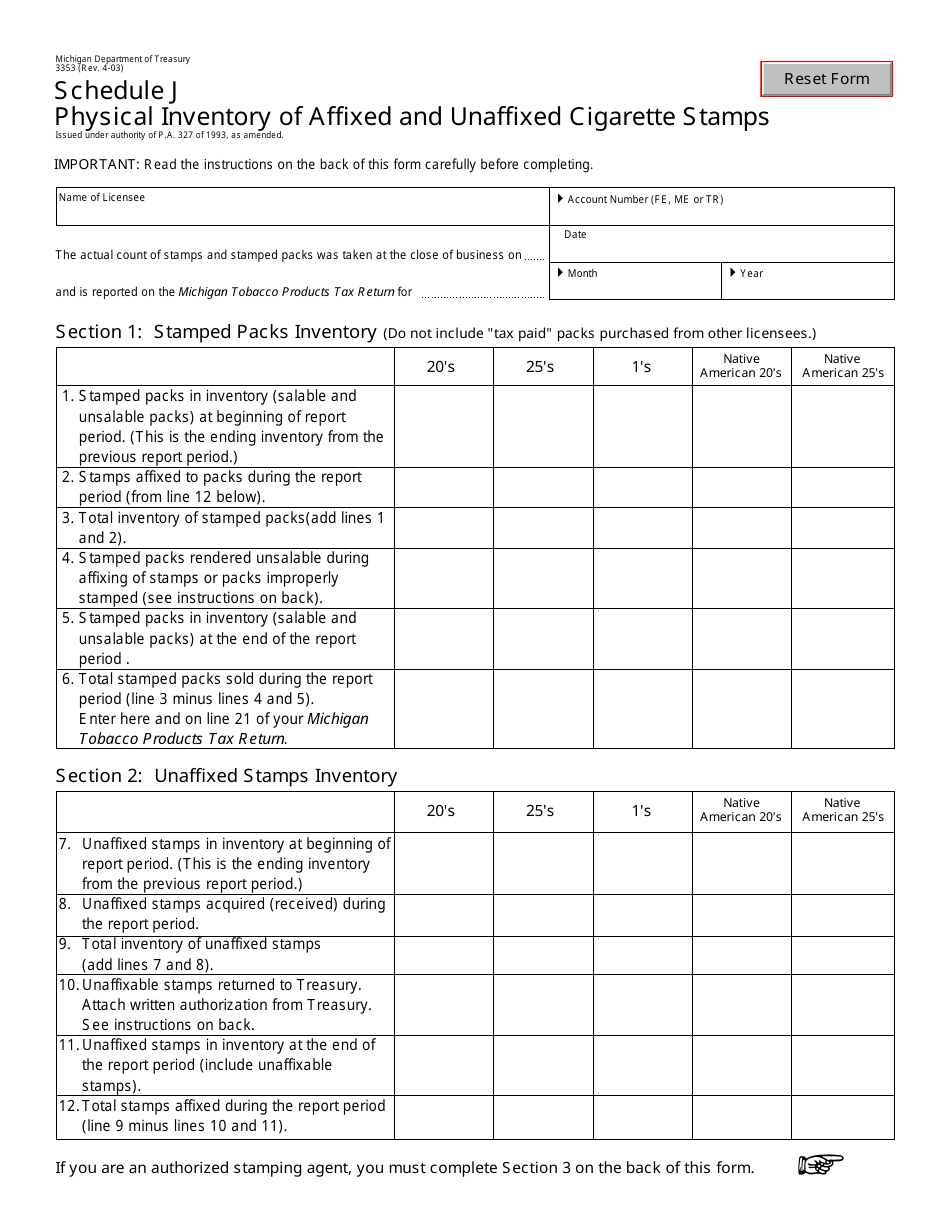

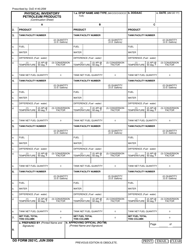

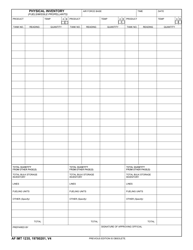

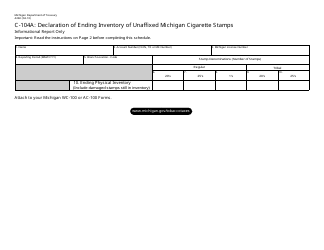

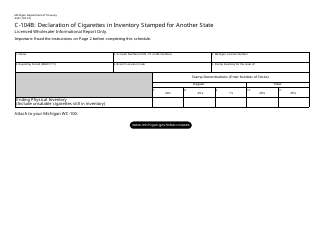

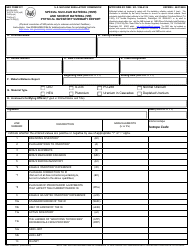

Form 3353 Schedule J Physical Inventory of Affixed and Unaffixed Cigarette Stamps - Michigan

What Is Form 3353 Schedule J?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3353 Schedule J?

A: Form 3353 Schedule J is a document used in Michigan for reporting the physical inventory of affixed and unaffixed cigarette stamps.

Q: What is the purpose of Form 3353 Schedule J?

A: The purpose of Form 3353 Schedule J is to report the physical inventory of affixed and unaffixed cigarette stamps.

Q: Who is required to file Form 3353 Schedule J?

A: Anyone who sells cigarettes in Michigan and has affixed or unaffixed cigarette stamps is required to file Form 3353 Schedule J.

Q: When is Form 3353 Schedule J due?

A: Form 3353 Schedule J is due on the 20th day of the month following the end of the inventory period.

Q: Are there any penalties for not filing Form 3353 Schedule J?

A: Yes, there are penalties for not filing Form 3353 Schedule J, including fines and potential legal action.

Q: Is there a fee for filing Form 3353 Schedule J?

A: No, there is no fee for filing Form 3353 Schedule J.

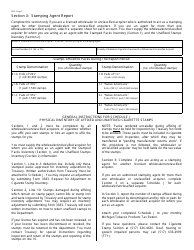

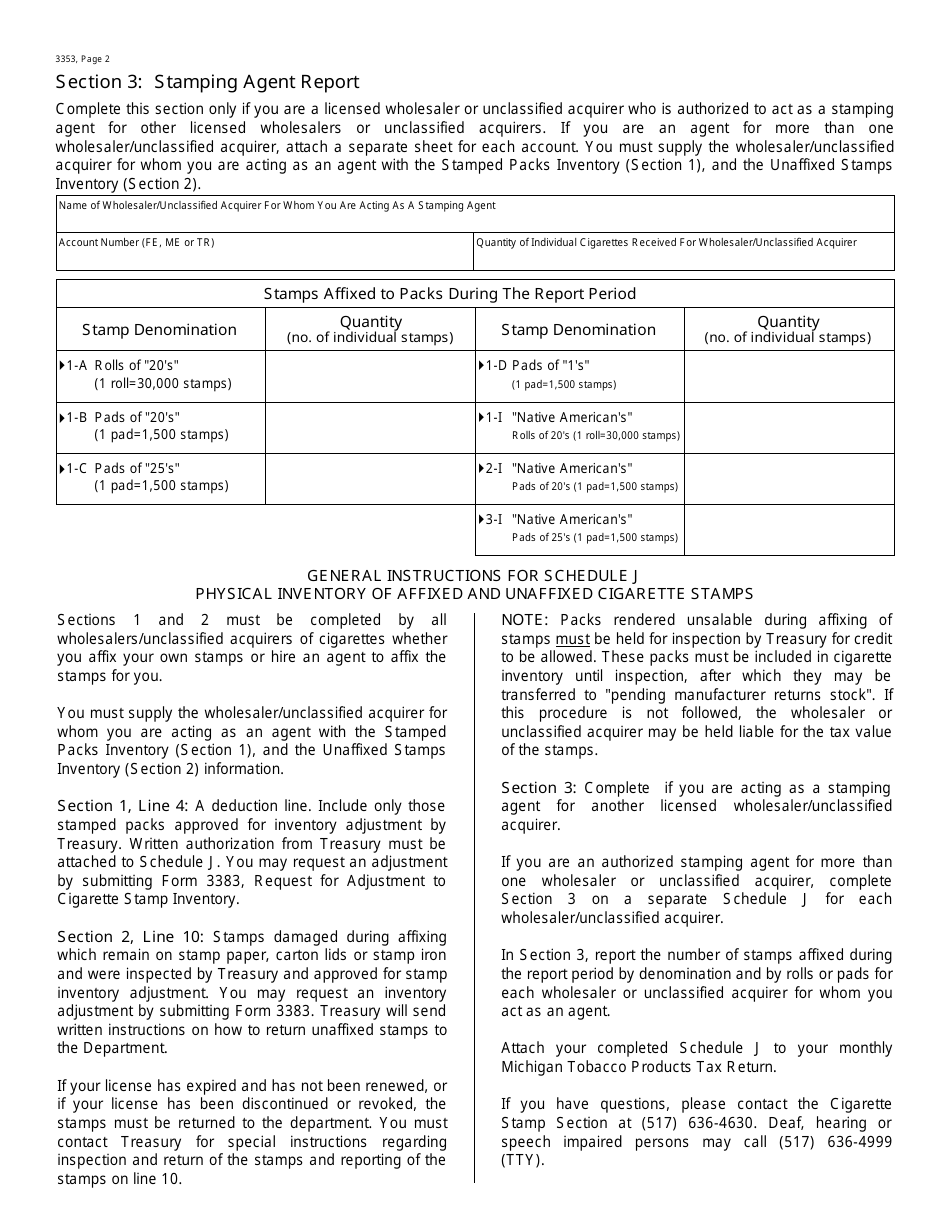

Q: Are there any specific instructions for completing Form 3353 Schedule J?

A: Yes, there are specific instructions provided with the form that should be followed for accurate completion.

Q: Can I file Form 3353 Schedule J electronically?

A: Yes, you can file Form 3353 Schedule J electronically through the Michigan Department of Treasury's eServices portal.

Form Details:

- Released on April 1, 2003;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3353 Schedule J by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.