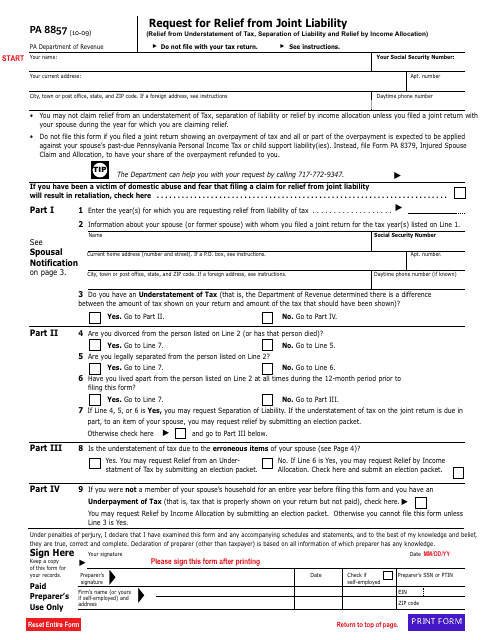

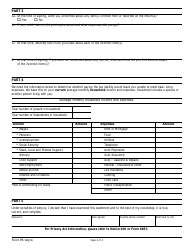

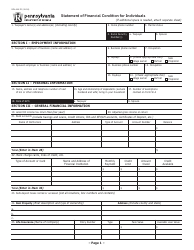

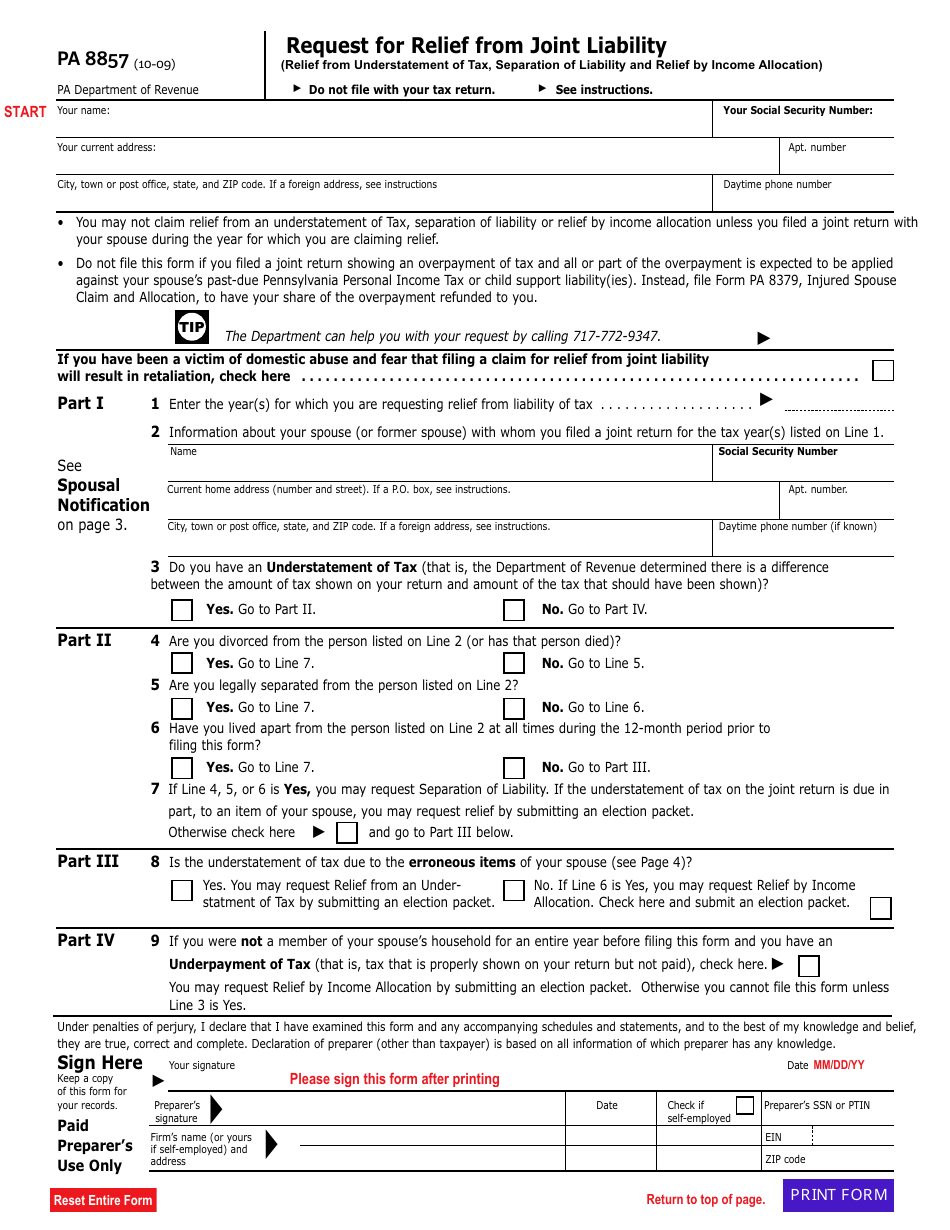

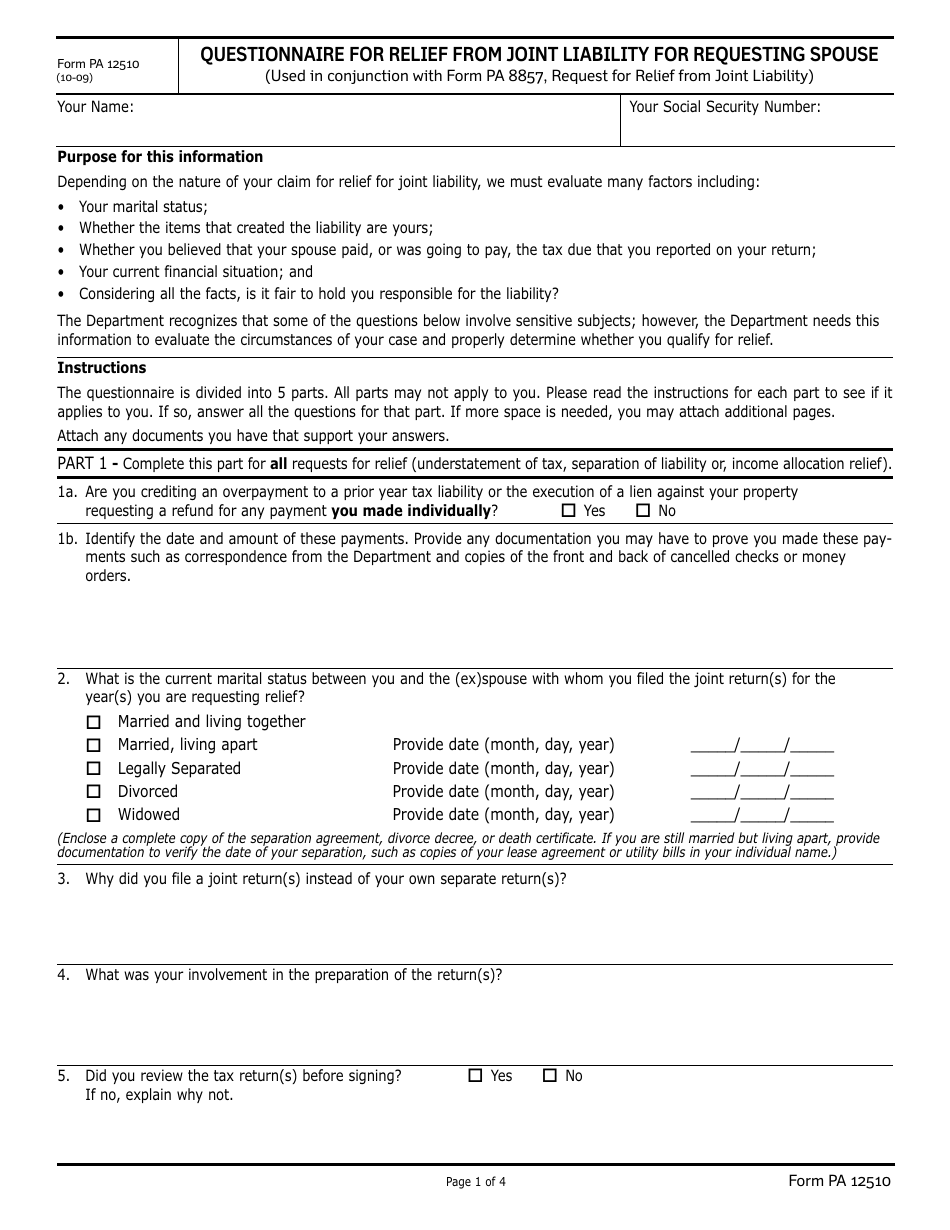

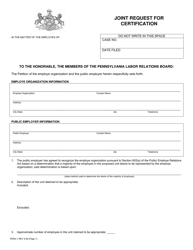

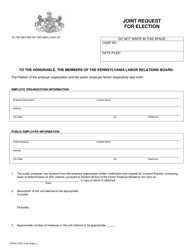

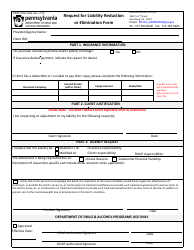

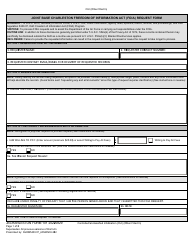

Form PA8857 Request for Relief From Joint Liability - Pennsylvania

What Is Form PA8857?

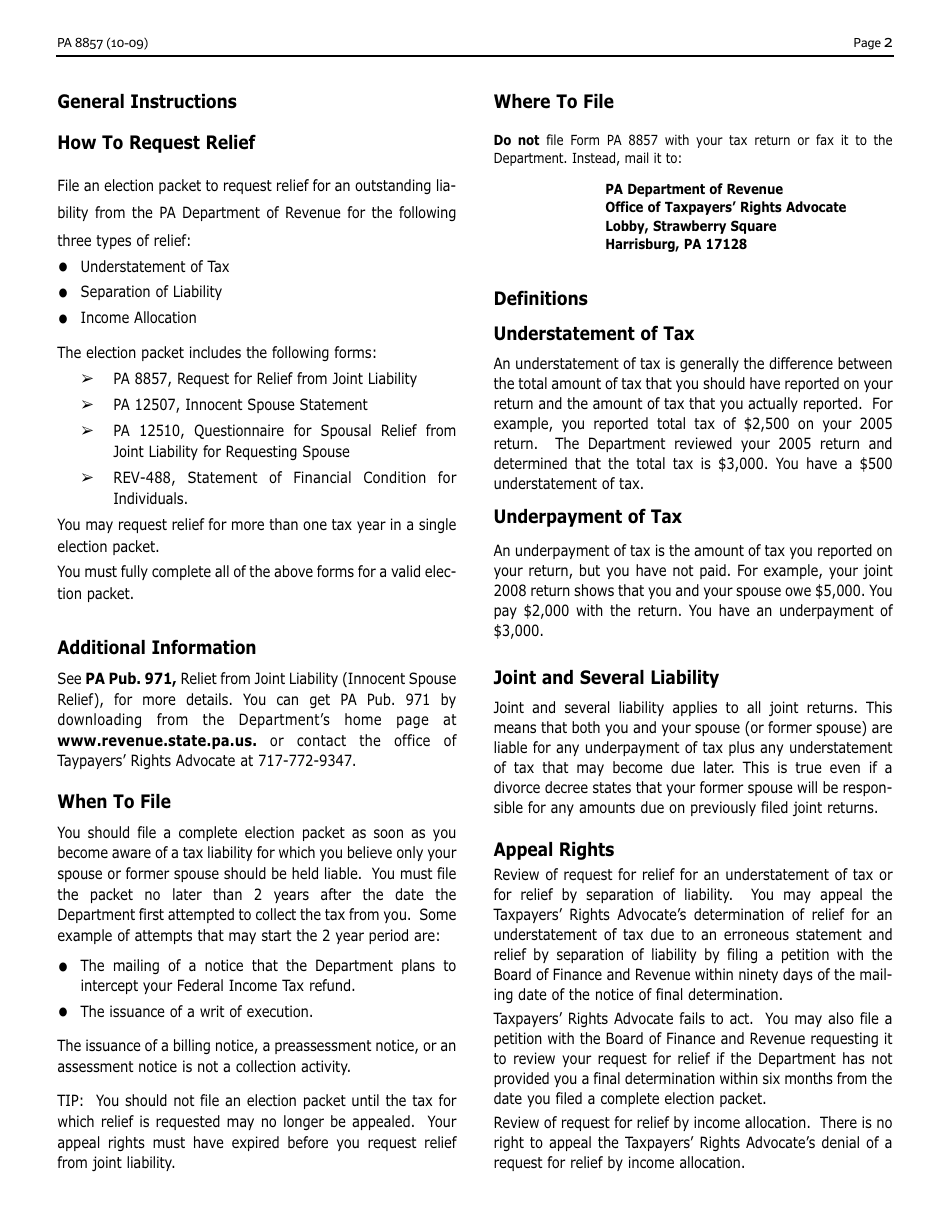

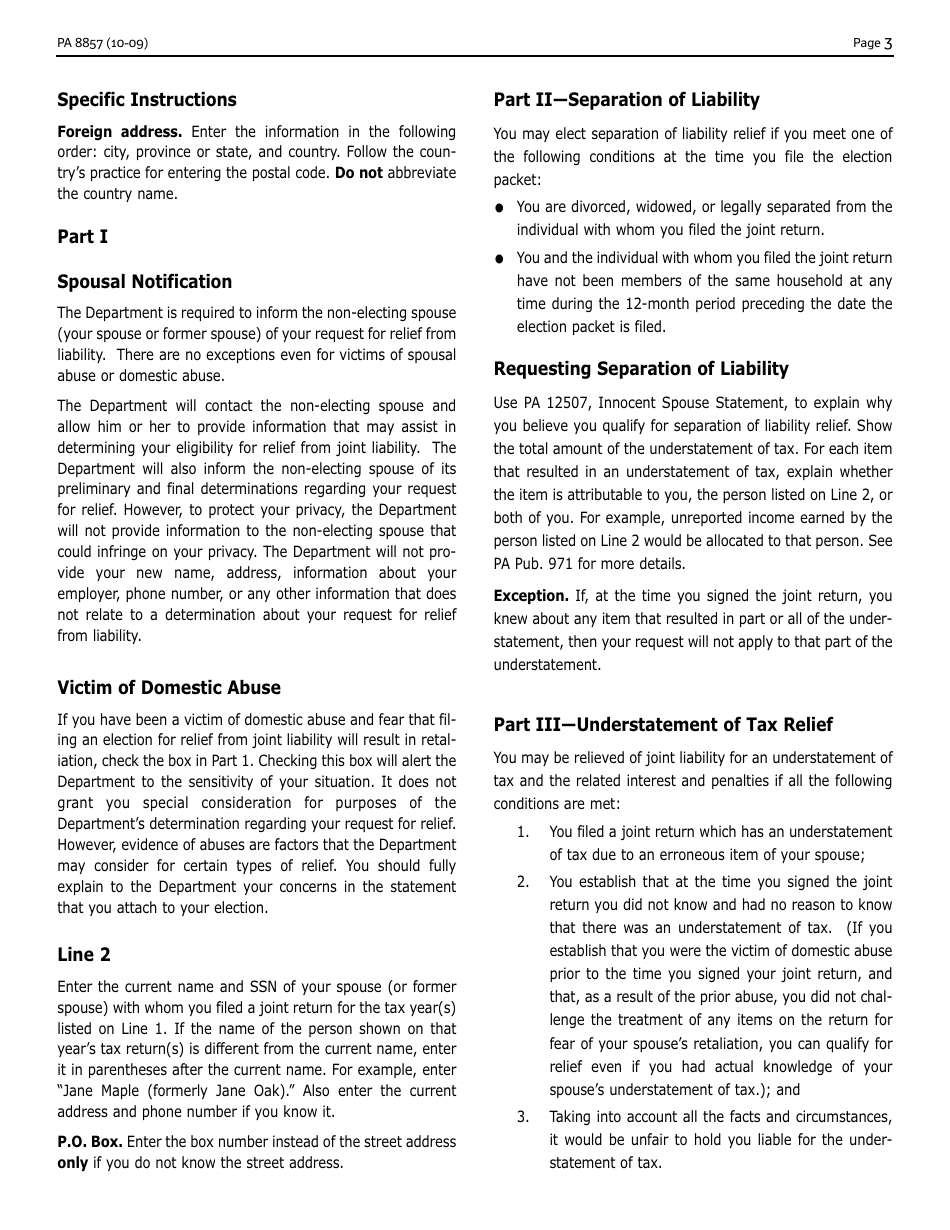

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA8857?

A: Form PA8857 is the Request for Relief From Joint Liability form used in Pennsylvania.

Q: What is the purpose of Form PA8857?

A: The purpose of Form PA8857 is to request relief from joint liability for taxes owed in Pennsylvania.

Q: Who can use Form PA8857?

A: Form PA8857 can be used by individuals who filed a joint tax return and wish to be relieved from joint liability.

Q: What does it mean to be relieved from joint liability?

A: Being relieved from joint liability means that you will not be held responsible for the tax debt owed on a joint tax return.

Q: When should Form PA8857 be filed?

A: Form PA8857 should be filed as soon as possible if you believe you are entitled to relief from joint liability.

Q: Are there any eligibility criteria to use Form PA8857?

A: Yes, there are eligibility criteria that must be met to use Form PA8857. These criteria are explained in the instructions accompanying the form.

Q: Is there a fee for filing Form PA8857?

A: No, there is no fee for filing Form PA8857.

Q: Can I e-file Form PA8857?

A: No, Form PA8857 cannot be e-filed. It must be mailed to the Pennsylvania Department of Revenue.

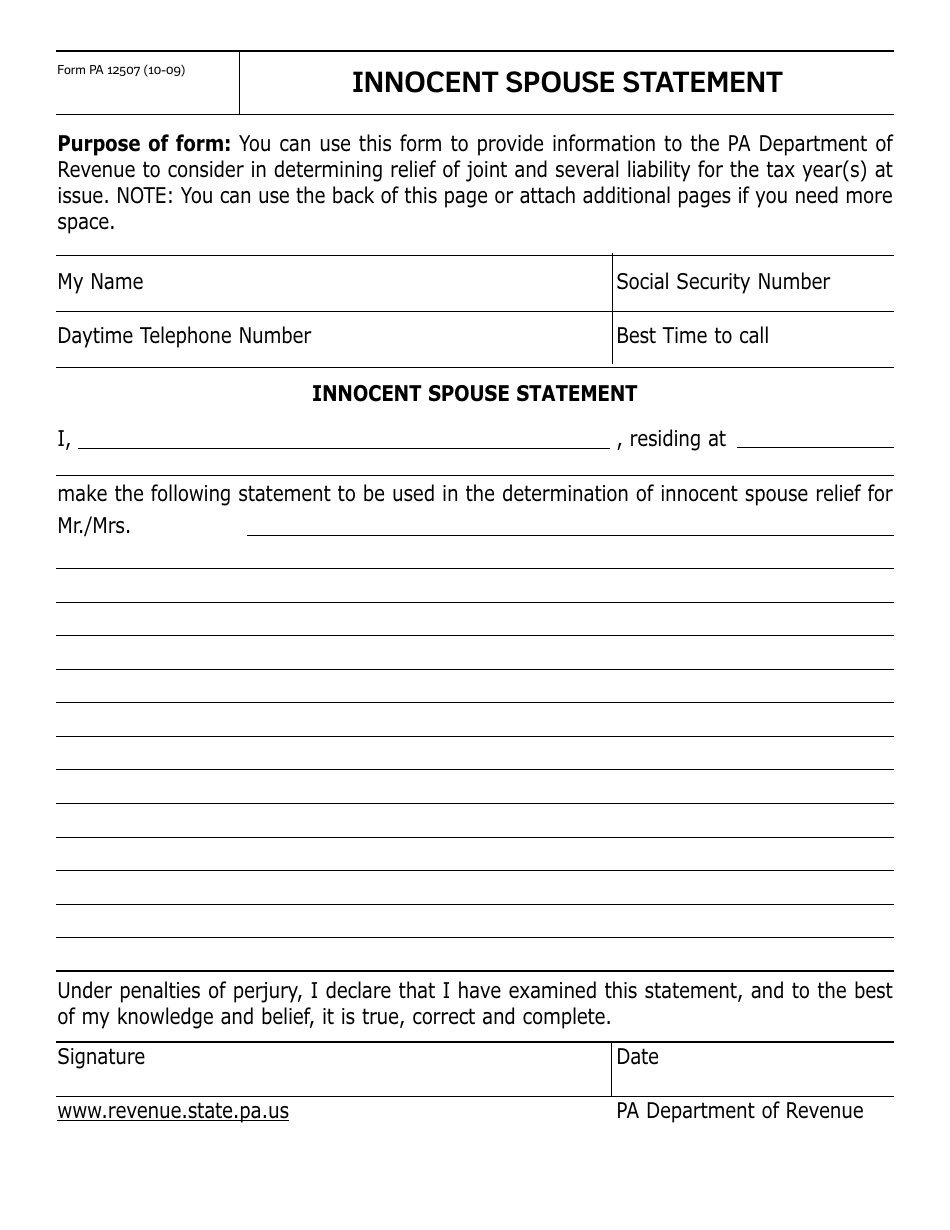

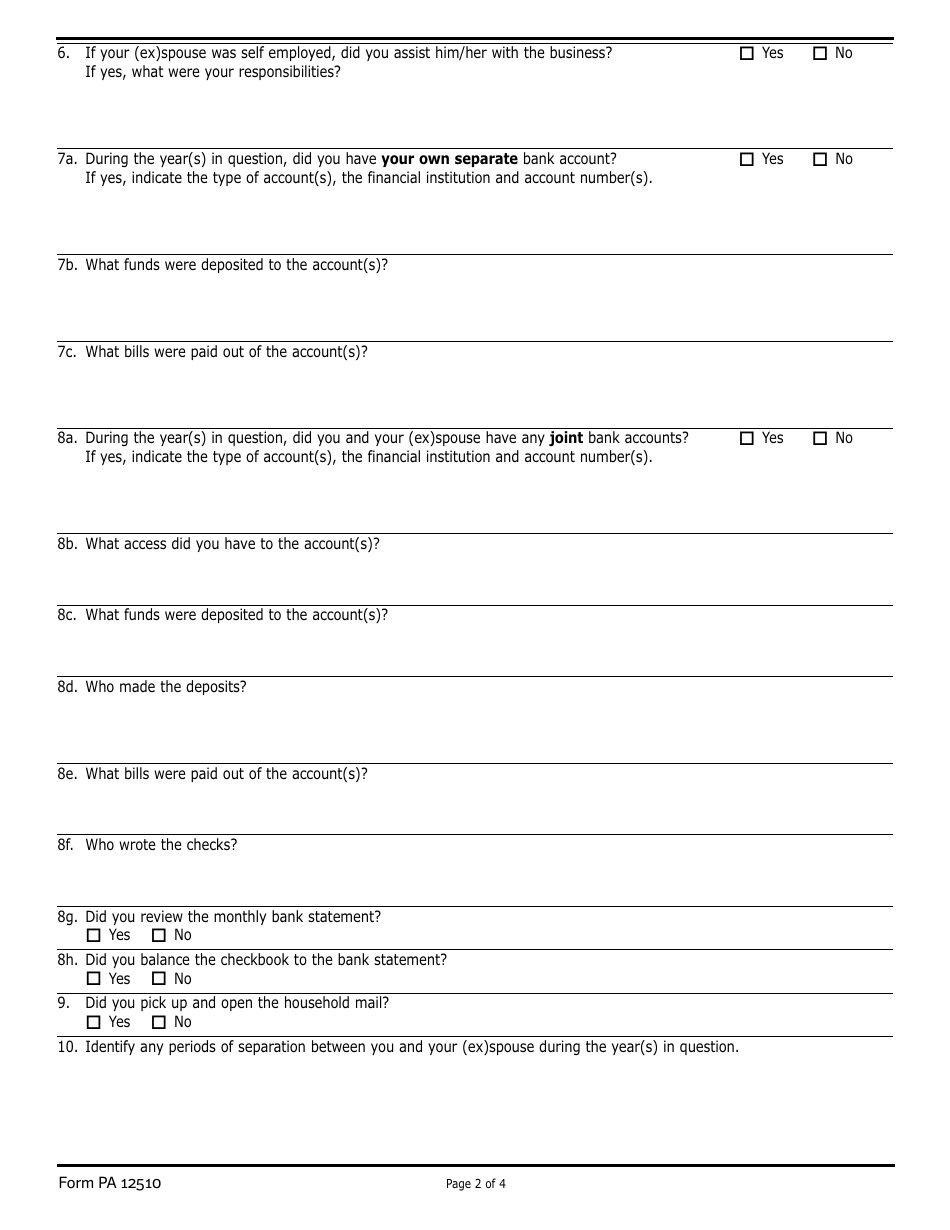

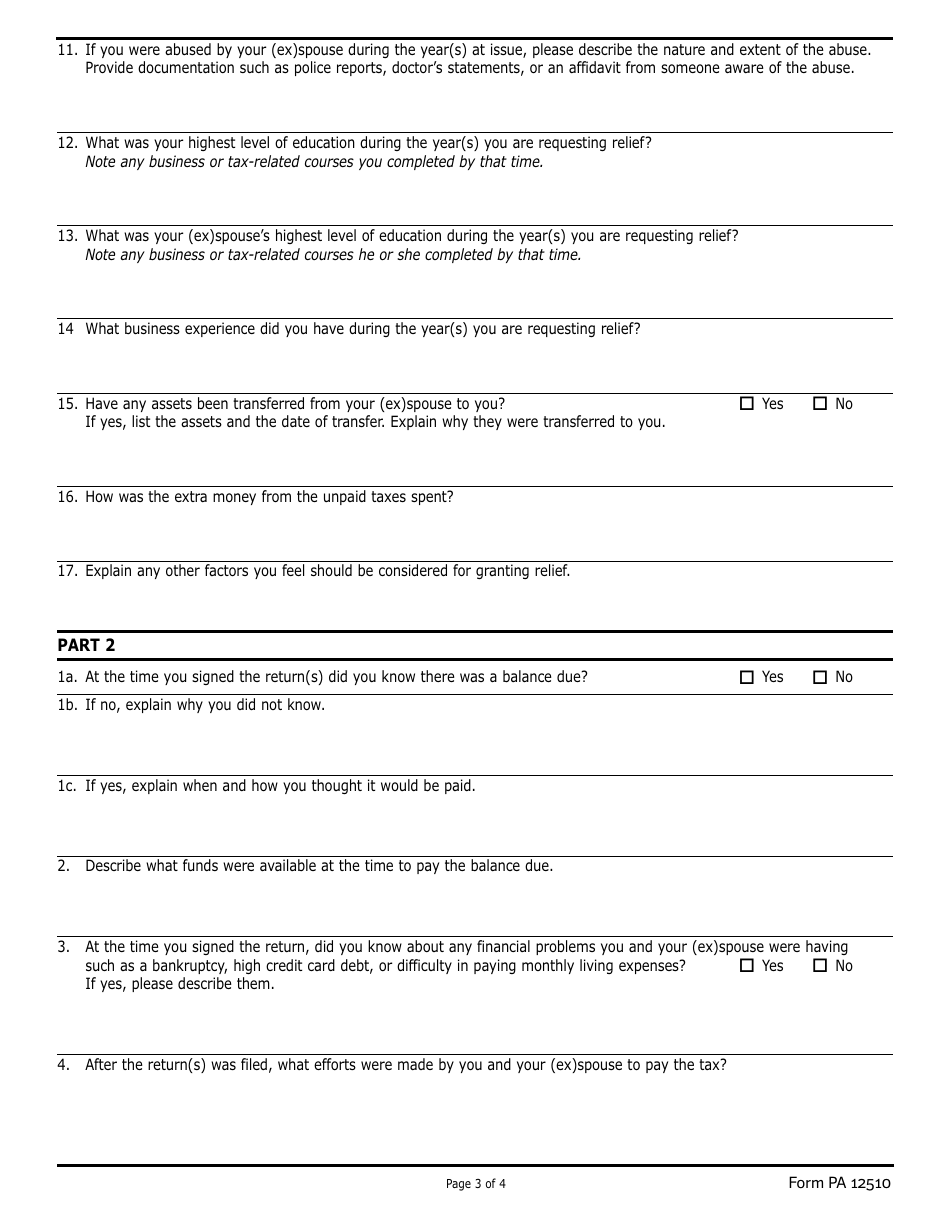

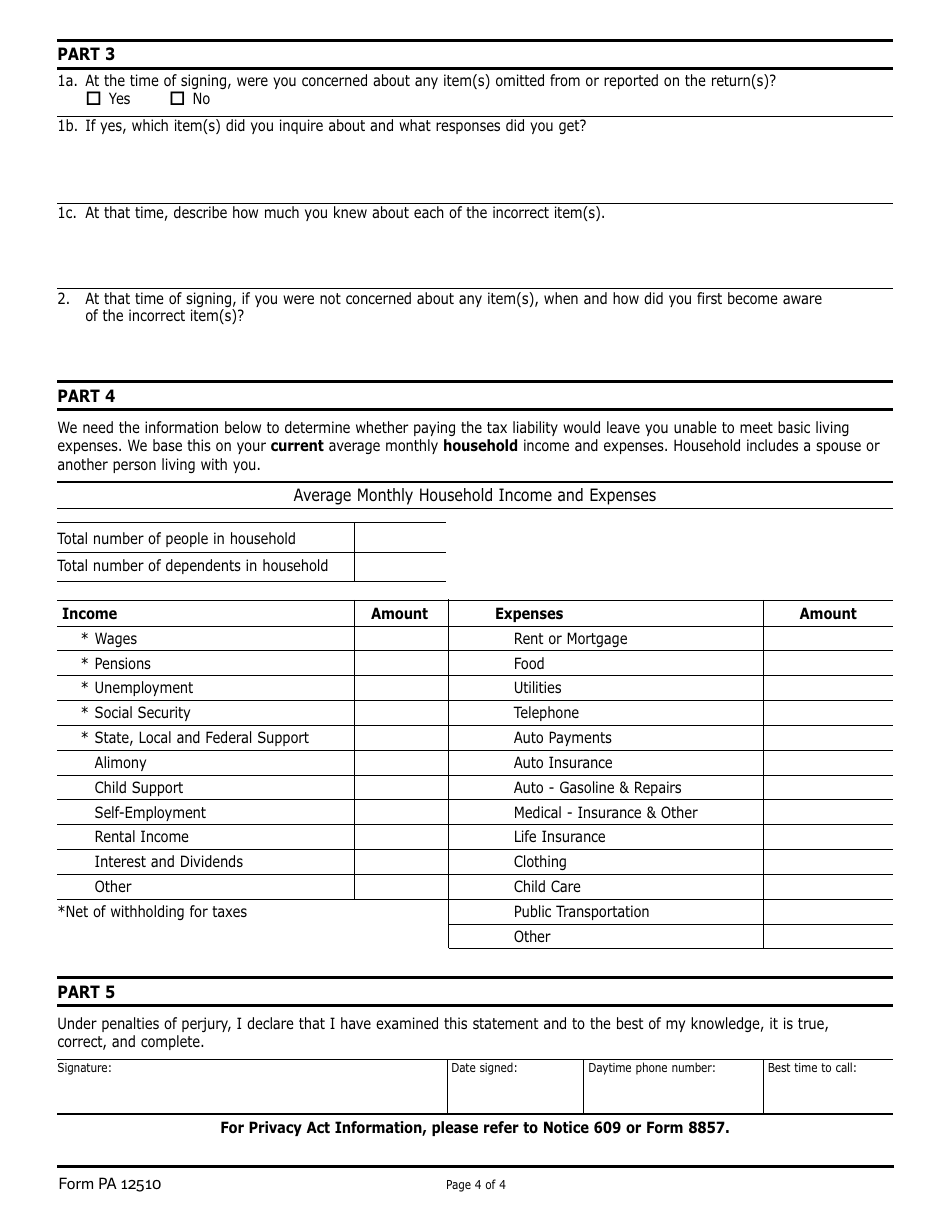

Q: What supporting documentation is required for Form PA8857?

A: The instructions accompanying Form PA8857 will provide guidance on the supporting documentation that should be included with the form.

Form Details:

- Released on October 1, 2009;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA8857 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.