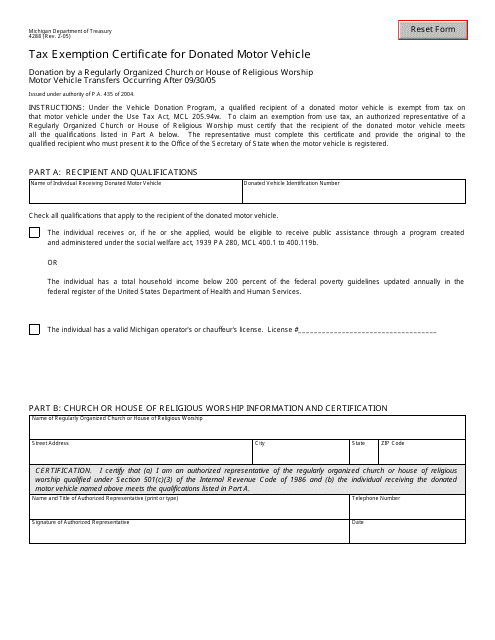

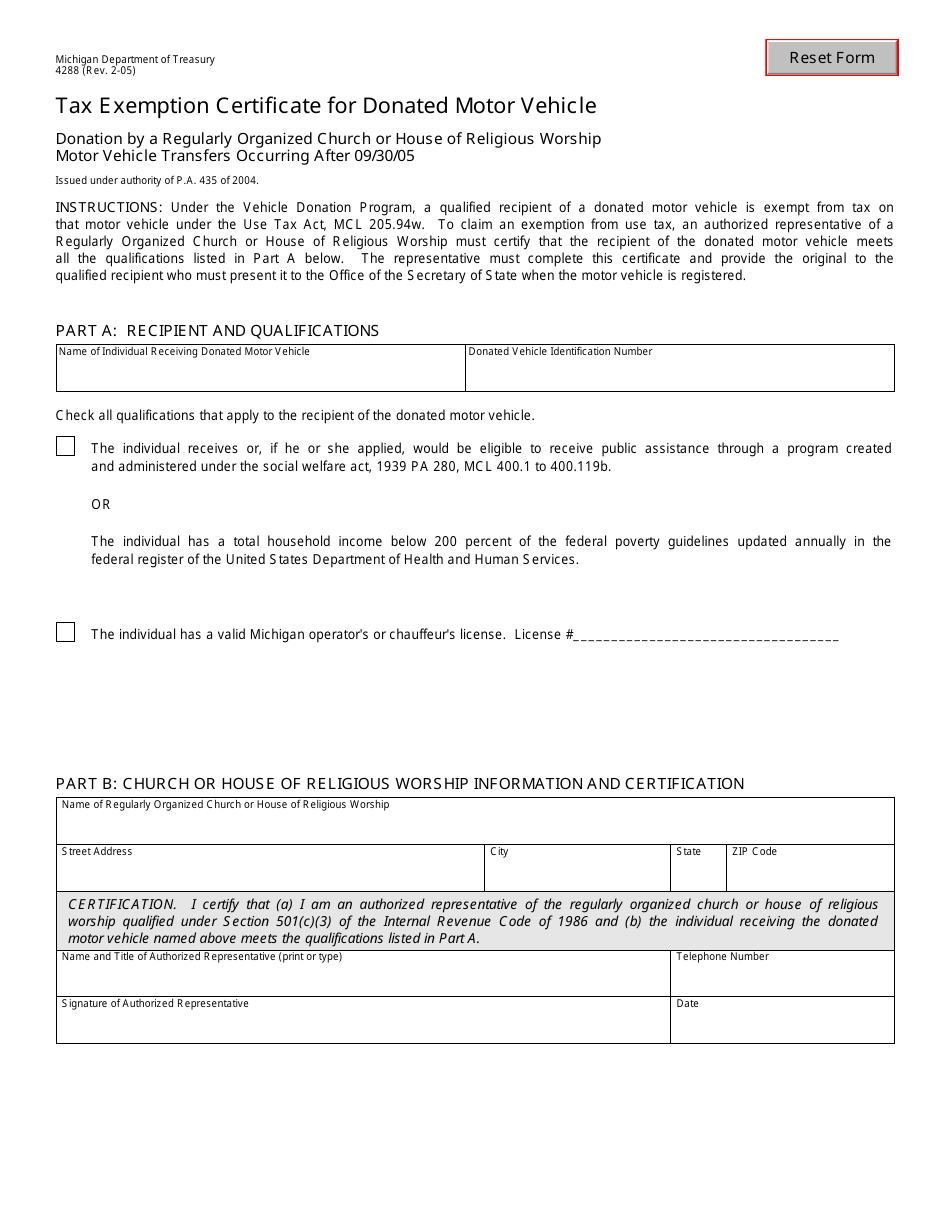

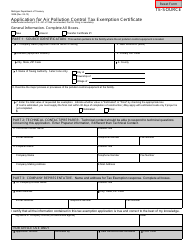

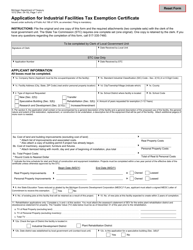

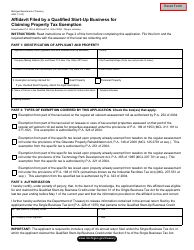

Form 4288 Tax Exemption Certificate for Donated Motor Vehicle - Michigan

What Is Form 4288?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4288?

A: Form 4288 is the Tax Exemption Certificate for Donated Motor Vehicle in Michigan.

Q: What is the purpose of Form 4288?

A: The purpose of Form 4288 is to claim a tax exemption for a donated motor vehicle in Michigan.

Q: Who can use Form 4288?

A: Individuals and organizations who have donated a motor vehicle in Michigan can use Form 4288.

Q: What information is required on Form 4288?

A: Form 4288 requires information about the donor, vehicle, and the recipient organization.

Q: How do I submit Form 4288?

A: Form 4288 should be submitted to the Michigan Department of Treasury along with supporting documentation.

Q: What is the deadline for submitting Form 4288?

A: Form 4288 must be submitted within 15 days of the donation.

Form Details:

- Released on February 1, 2005;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4288 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.