This version of the form is not currently in use and is provided for reference only. Download this version of

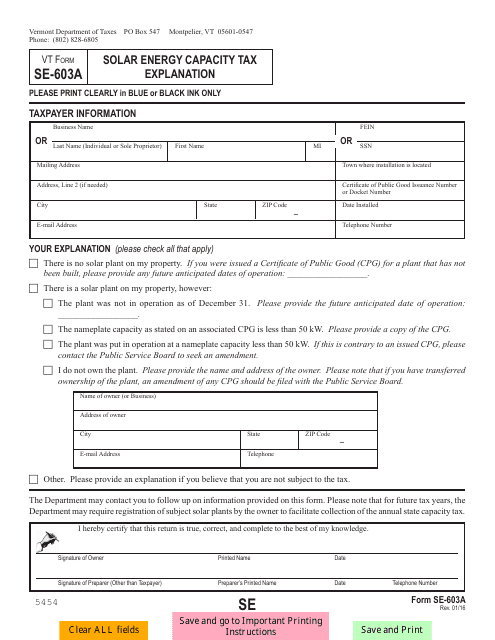

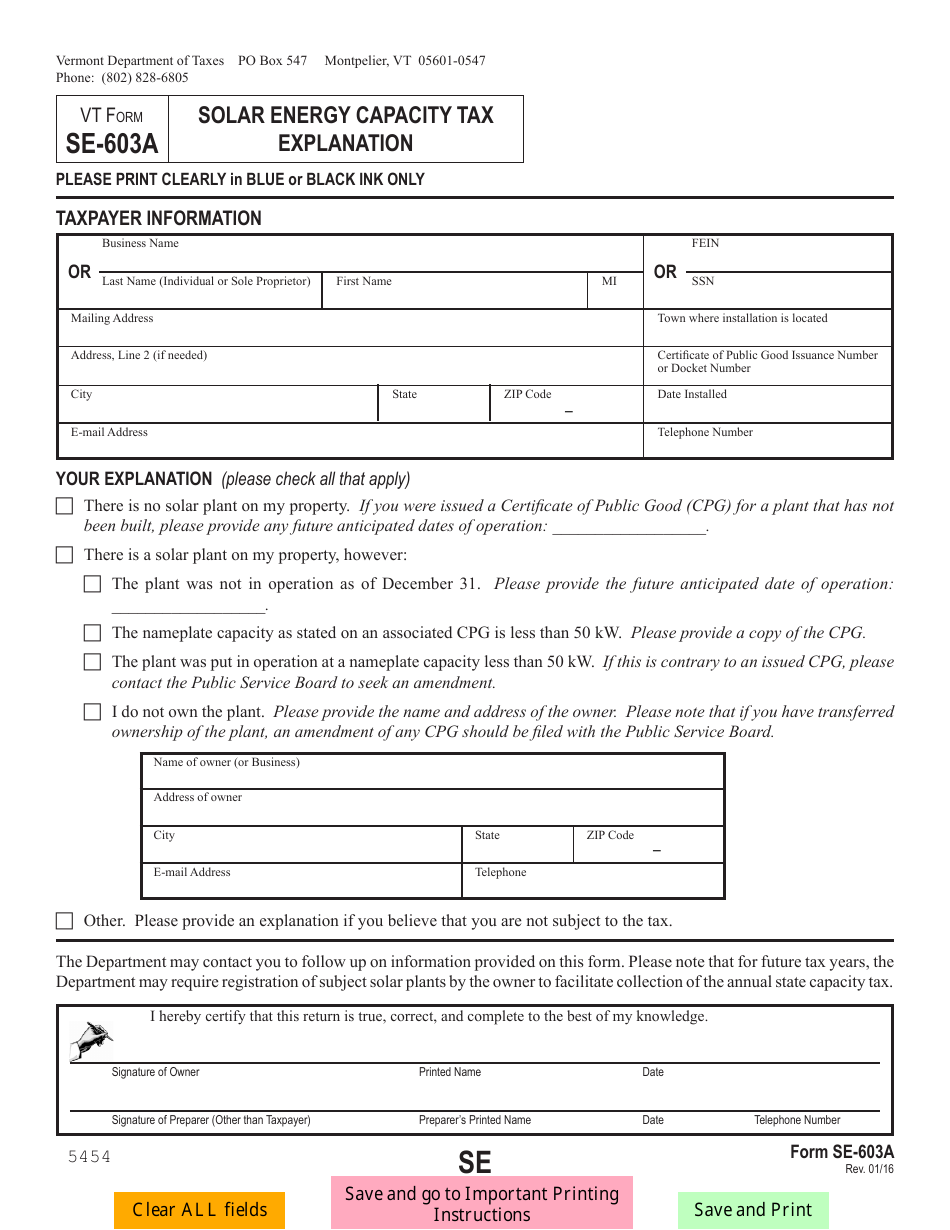

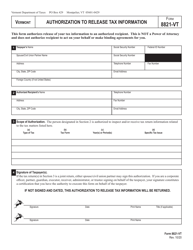

VT Form SE-603A

for the current year.

VT Form SE-603A Solar Energy Capacity Tax Explanation - Vermont

What Is VT Form SE-603A?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the VT Form SE-603A?

A: VT Form SE-603A is the Solar Energy Capacity Tax form used in Vermont.

Q: What is the purpose of VT Form SE-603A?

A: The purpose of VT Form SE-603A is to report and calculate the Solar Energy Capacity Tax in Vermont.

Q: Who needs to file VT Form SE-603A?

A: Anyone in Vermont who has installed solar energy capacity or purchased solar energy credits needs to file VT Form SE-603A.

Q: What information is needed to fill out VT Form SE-603A?

A: You will need information about your solar energy capacity, including the capacity amount, the date it was installed, and any tax credits you have received.

Q: When is VT Form SE-603A due?

A: VT Form SE-603A is due on or before April 15th of the year following the installation of the solar energy capacity.

Q: What happens if I don't file VT Form SE-603A?

A: If you don't file VT Form SE-603A, you may be subject to penalties and interest on the unpaid Solar Energy Capacity Tax.

Q: Are there any exemptions or credits available for the Solar Energy Capacity Tax?

A: Yes, there are exemptions and credits available for the Solar Energy Capacity Tax in Vermont. You should consult the instructions for VT Form SE-603A or contact the Vermont Department of Taxes for more information.

Q: Can I e-file VT Form SE-603A?

A: As of now, VT Form SE-603A can only be filed by mail and cannot be e-filed.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form SE-603A by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.