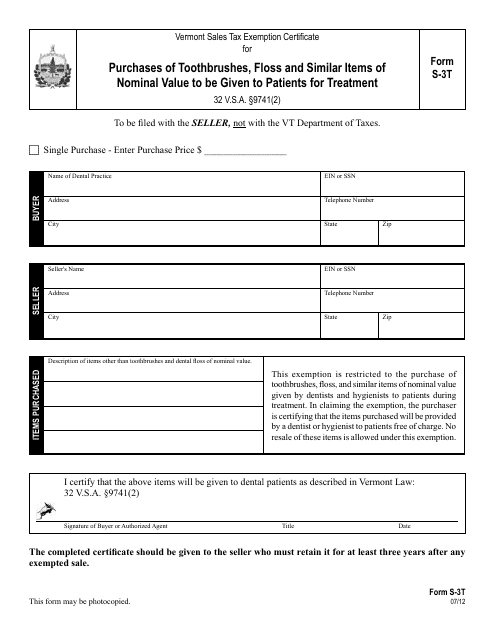

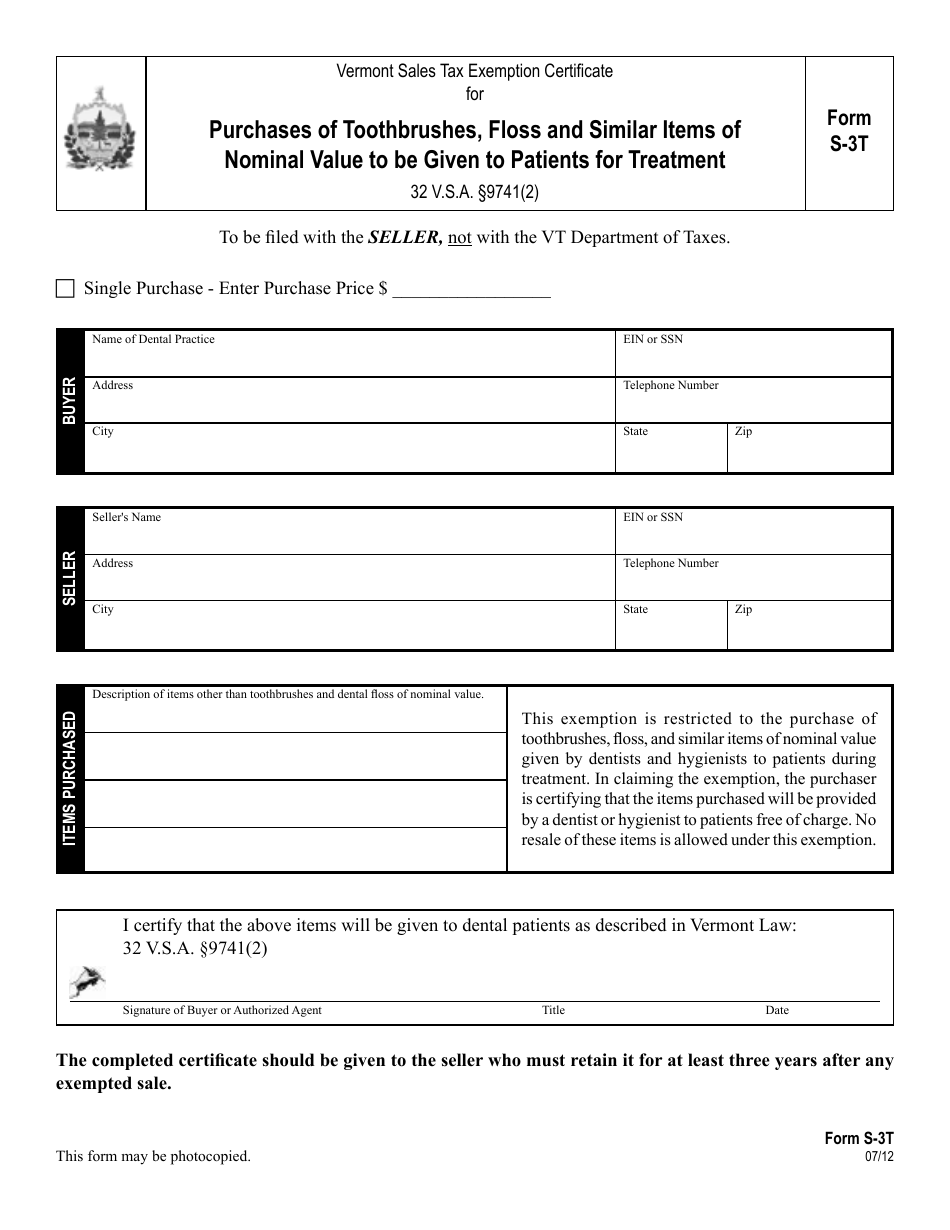

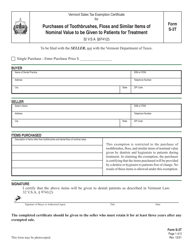

VT Form S-3T Vermont Sales Tax Exemption Certificate for Purchases of Toothbrushes, Floss and Similar Items of Nominal Value to Be Given to Patients for Treatment - Vermont

What Is VT Form S-3T?

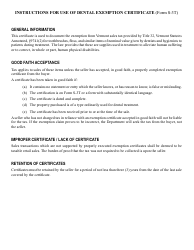

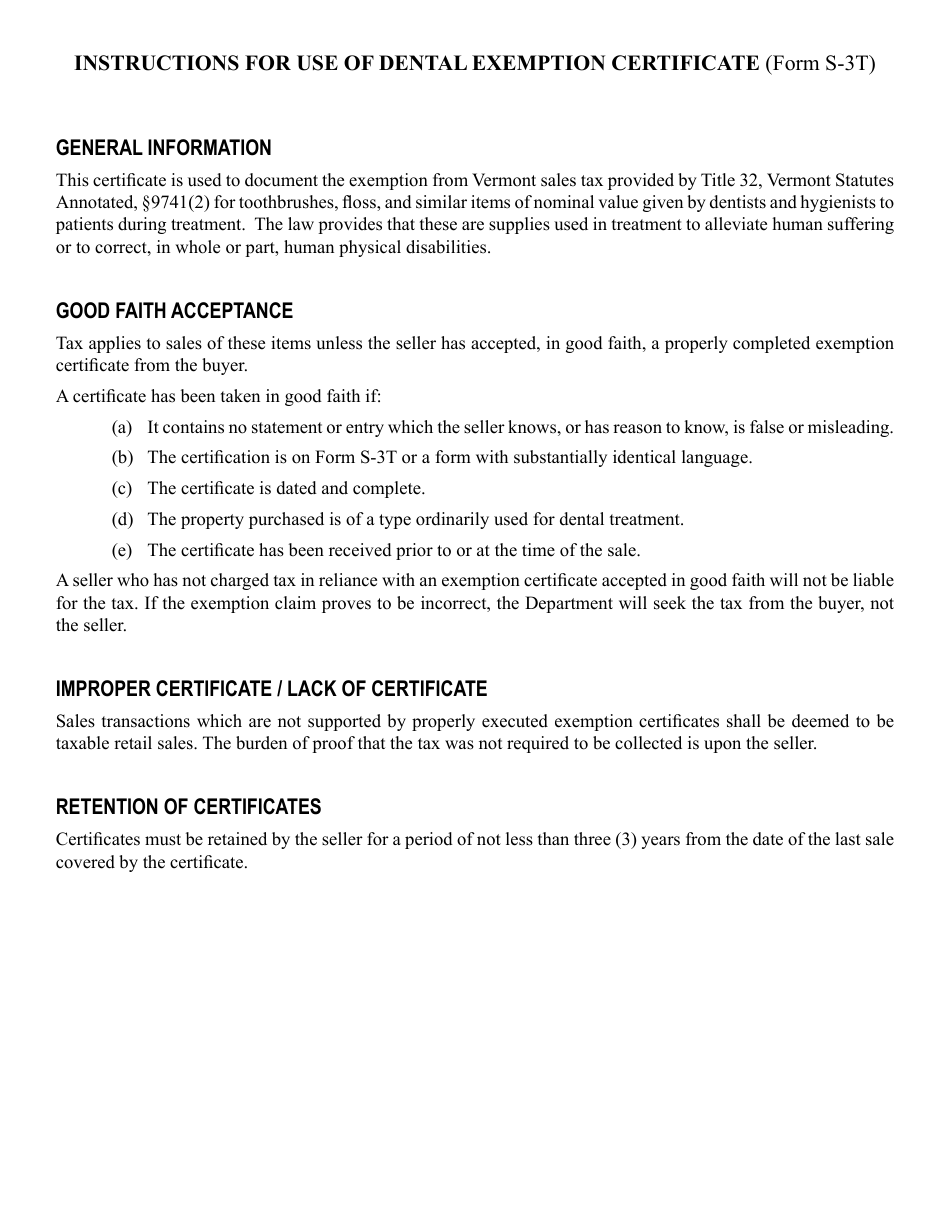

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form S-3T?

A: VT Form S-3T is a Vermont Sales Tax Exemption Certificate.

Q: What is the purpose of VT Form S-3T?

A: The purpose of VT Form S-3T is to exempt purchases of toothbrushes, floss, and similar items of nominal value that will be given to patients for treatment from Vermont sales tax.

Q: What type of items are covered by VT Form S-3T?

A: VT Form S-3T covers toothbrushes, floss, and similar items of nominal value that will be given to patients for treatment.

Q: What is the benefit of using VT Form S-3T?

A: Using VT Form S-3T allows for the exemption of Vermont sales tax on qualifying purchases of toothbrushes, floss, and similar items for patient treatment.

Q: Who should use VT Form S-3T?

A: Dentists or dental practices in Vermont who purchase toothbrushes, floss, and similar items of nominal value for patient treatment should use VT Form S-3T.

Form Details:

- Released on July 1, 2012;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form S-3T by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.