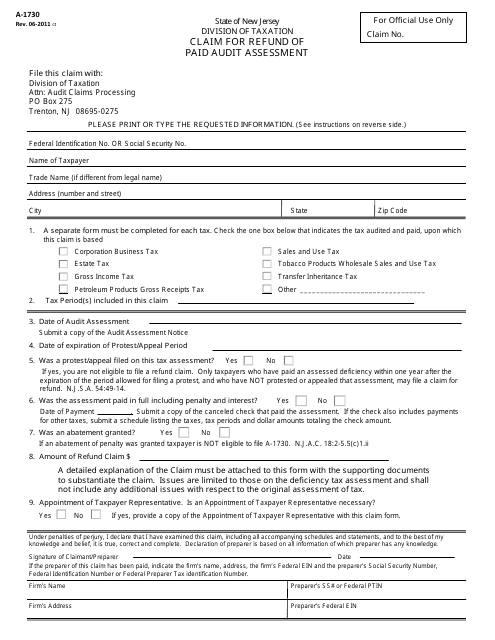

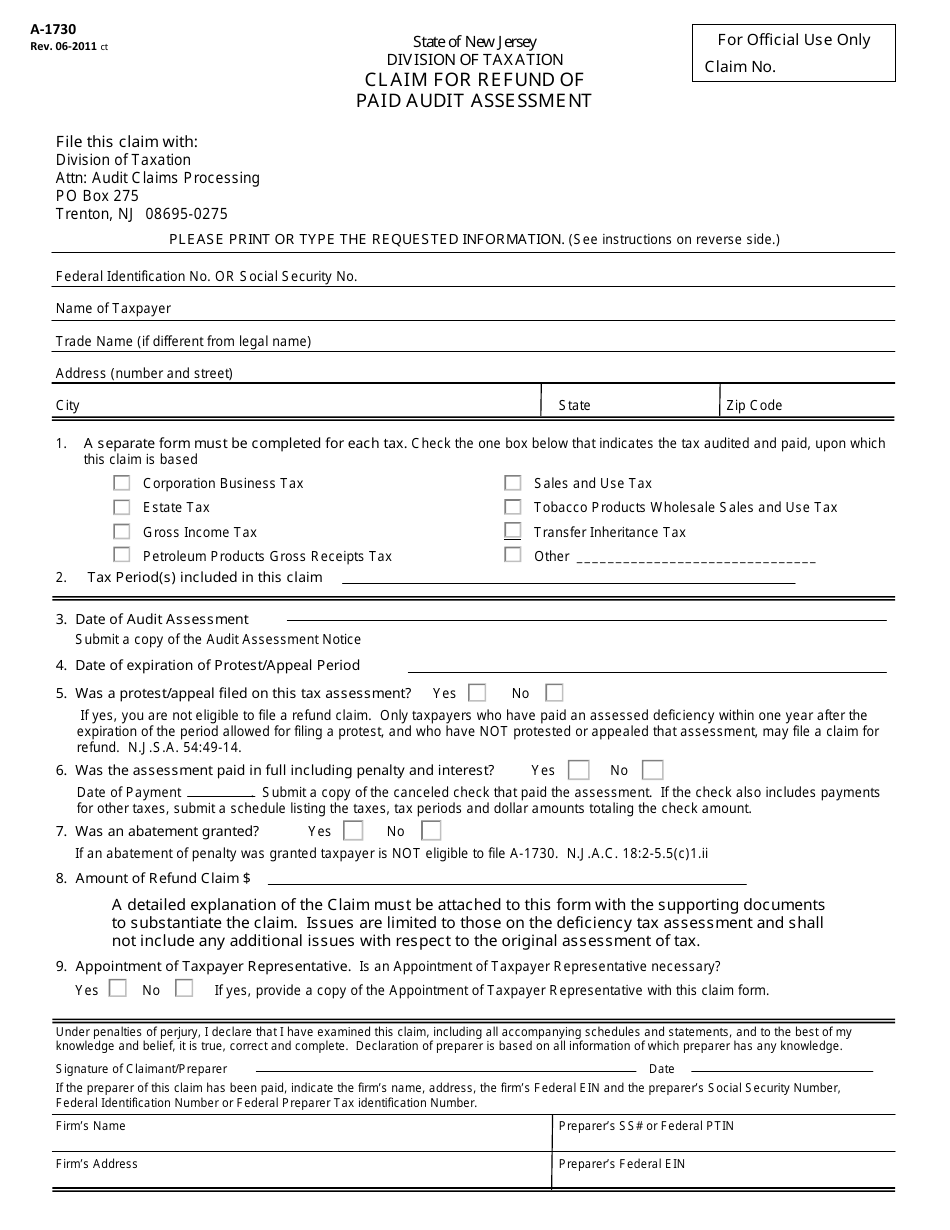

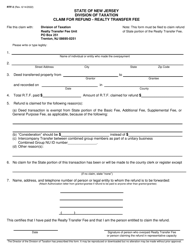

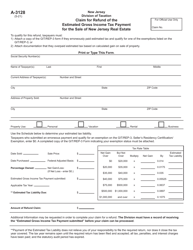

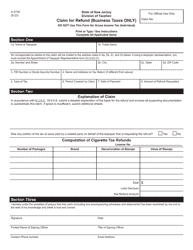

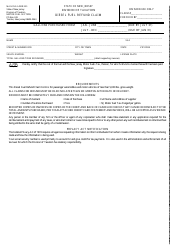

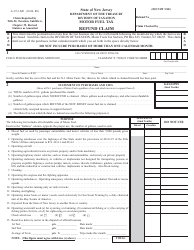

Form A-1730 Claim for Refund of Paid Audit Assessment - New Jersey

What Is Form A-1730?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-1730?

A: Form A-1730 is a claim for refund of a paid audit assessment in the state of New Jersey.

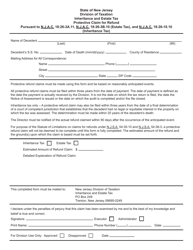

Q: Who can use Form A-1730?

A: Taxpayers who have paid an audit assessment in New Jersey and want to request a refund can use Form A-1730.

Q: What is an audit assessment?

A: An audit assessment is an amount of money owed to the state of New Jersey as a result of an audit.

Q: What information is required on Form A-1730?

A: The form requires information such as the taxpayer's name, address, Social Security Number or Employer Identification Number, audit assessment details, and supporting documentation.

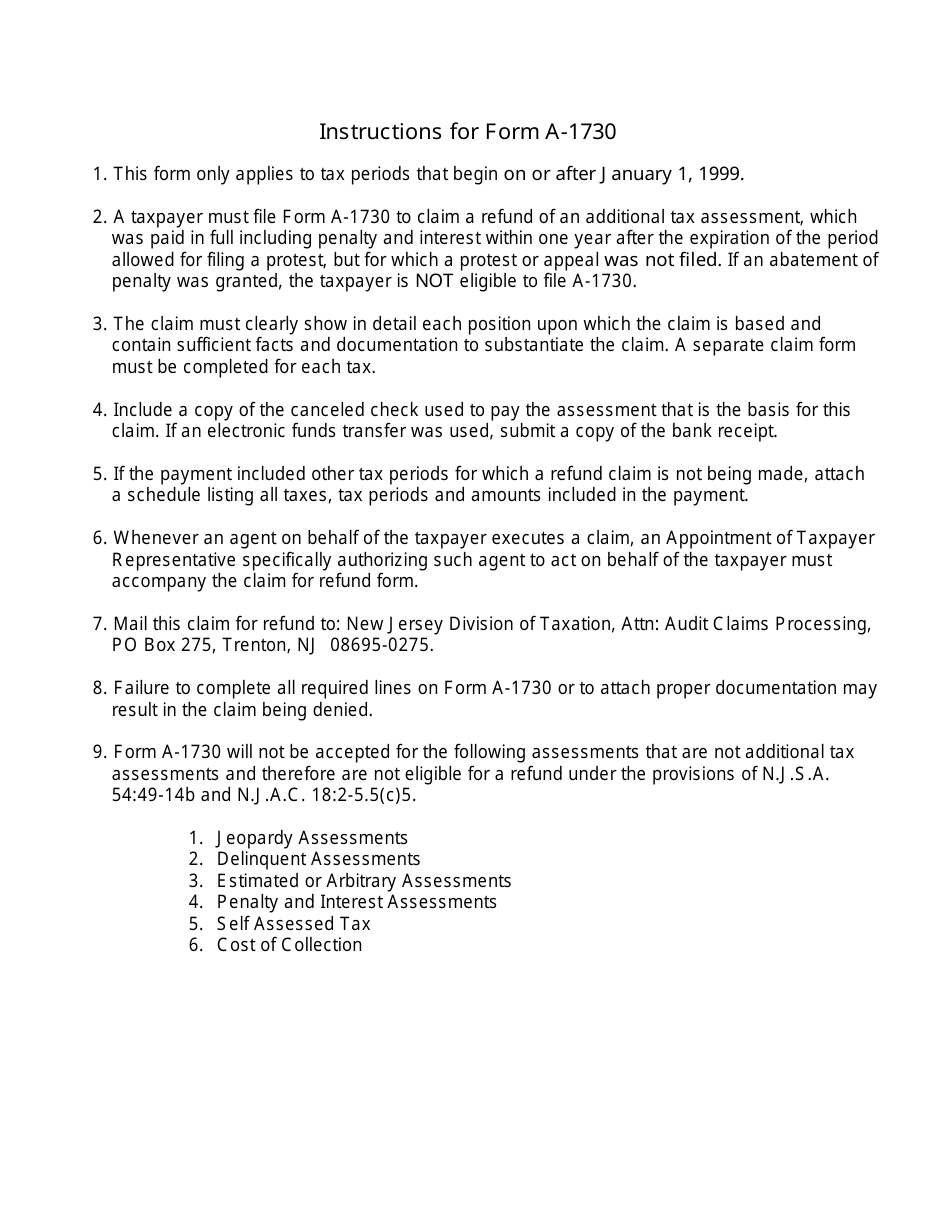

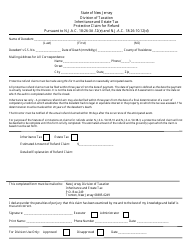

Q: Is there a deadline for filing Form A-1730?

A: Yes, Form A-1730 must be filed within four years from the date the audit assessment was paid.

Q: How long does it take to process a refund claim on Form A-1730?

A: The processing time for refund claims on Form A-1730 may vary, but it typically takes several weeks to several months.

Form Details:

- Released on June 1, 2011;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-1730 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.