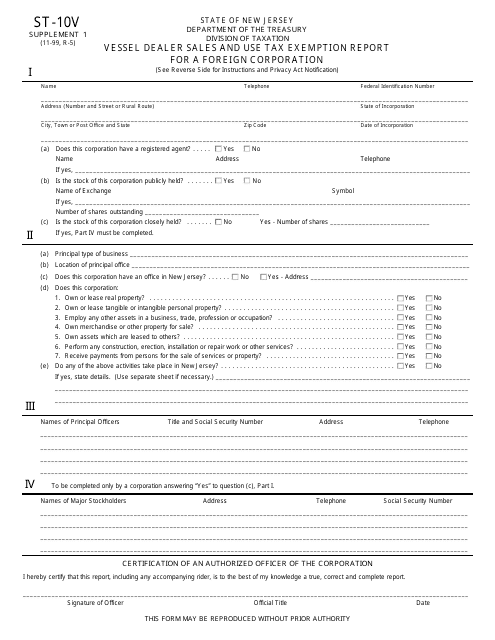

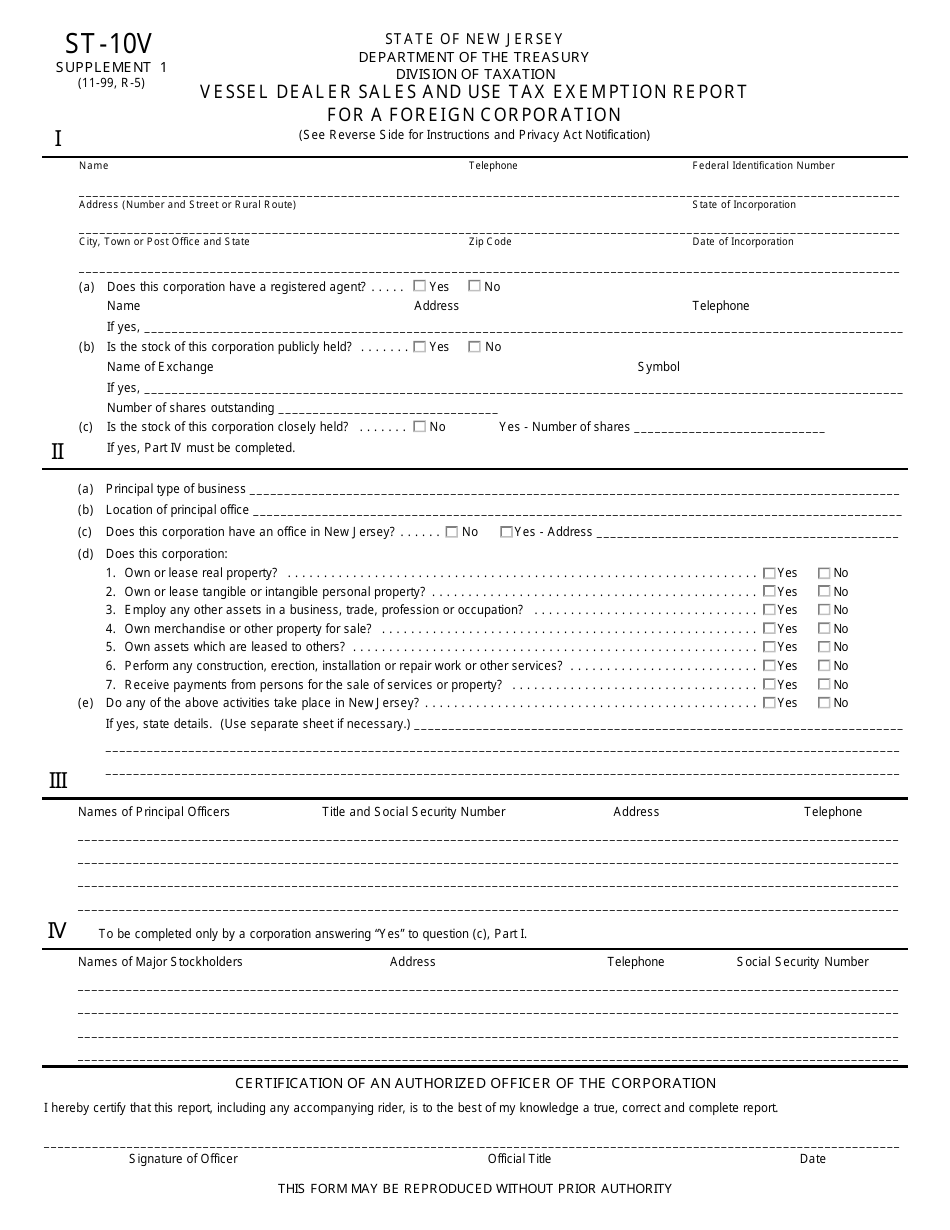

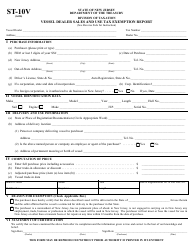

Form ST-10V Vessel Dealer Sales and Use Tax Exemption Report for a Foreign Corporation - New Jersey

What Is Form ST-10V?

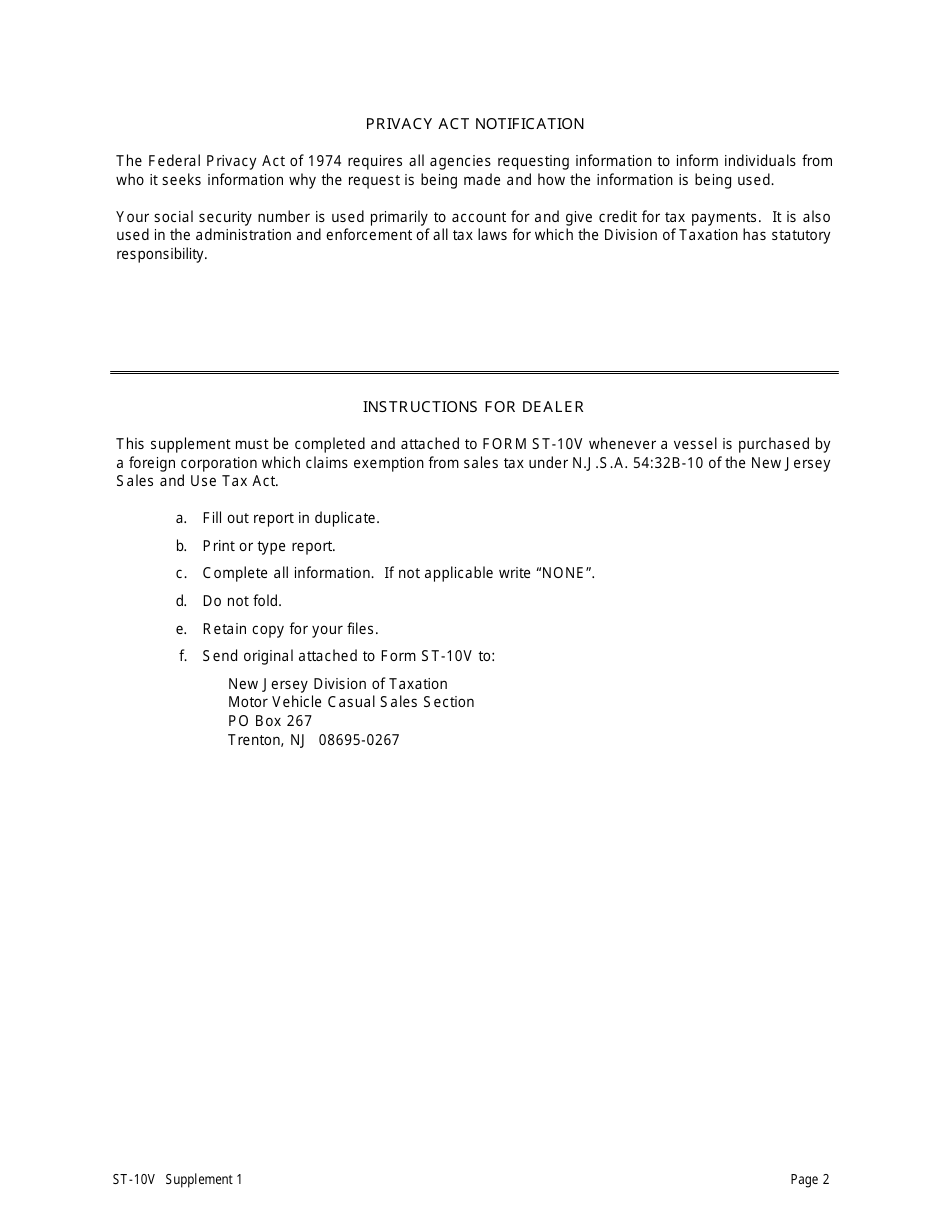

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ST-10V?

A: Form ST-10V is the Vessel Dealer Sales and Use TaxExemption Report for a Foreign Corporation in New Jersey.

Q: Who is required to file Form ST-10V?

A: Foreign corporations engaged in the business of selling vessels and seeking a sales and use tax exemption in New Jersey are required to file Form ST-10V.

Q: What is the purpose of Form ST-10V?

A: The purpose of Form ST-10V is to report vessel sales made by a foreign corporation and to claim the sales and use tax exemption in New Jersey.

Q: What information is required to be reported on Form ST-10V?

A: Form ST-10V requires the foreign corporation to provide details about the vessel sales made in New Jersey, including the buyer's information, vessel description, and sales price.

Q: When is the deadline to file Form ST-10V?

A: Form ST-10V must be filed annually by March 15th for the previous calendar year.

Q: Are there any penalties for late filing of Form ST-10V?

A: Yes, late filing of Form ST-10V may result in penalties, interest, and additional fees.

Q: Is there any fee associated with filing Form ST-10V?

A: No, there is no fee for filing Form ST-10V.

Form Details:

- Released on November 1, 1999;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-10V by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.