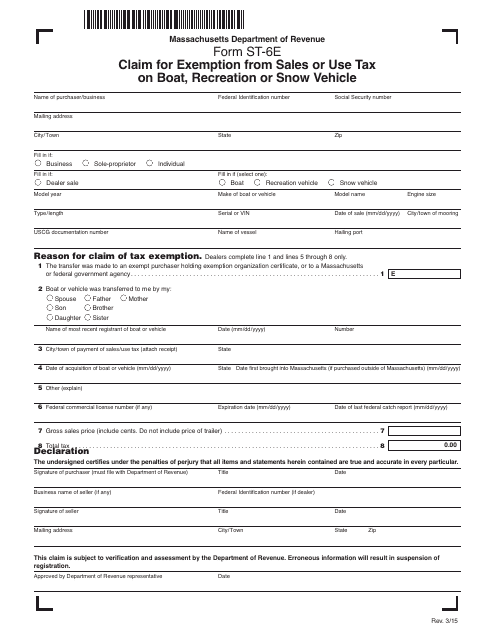

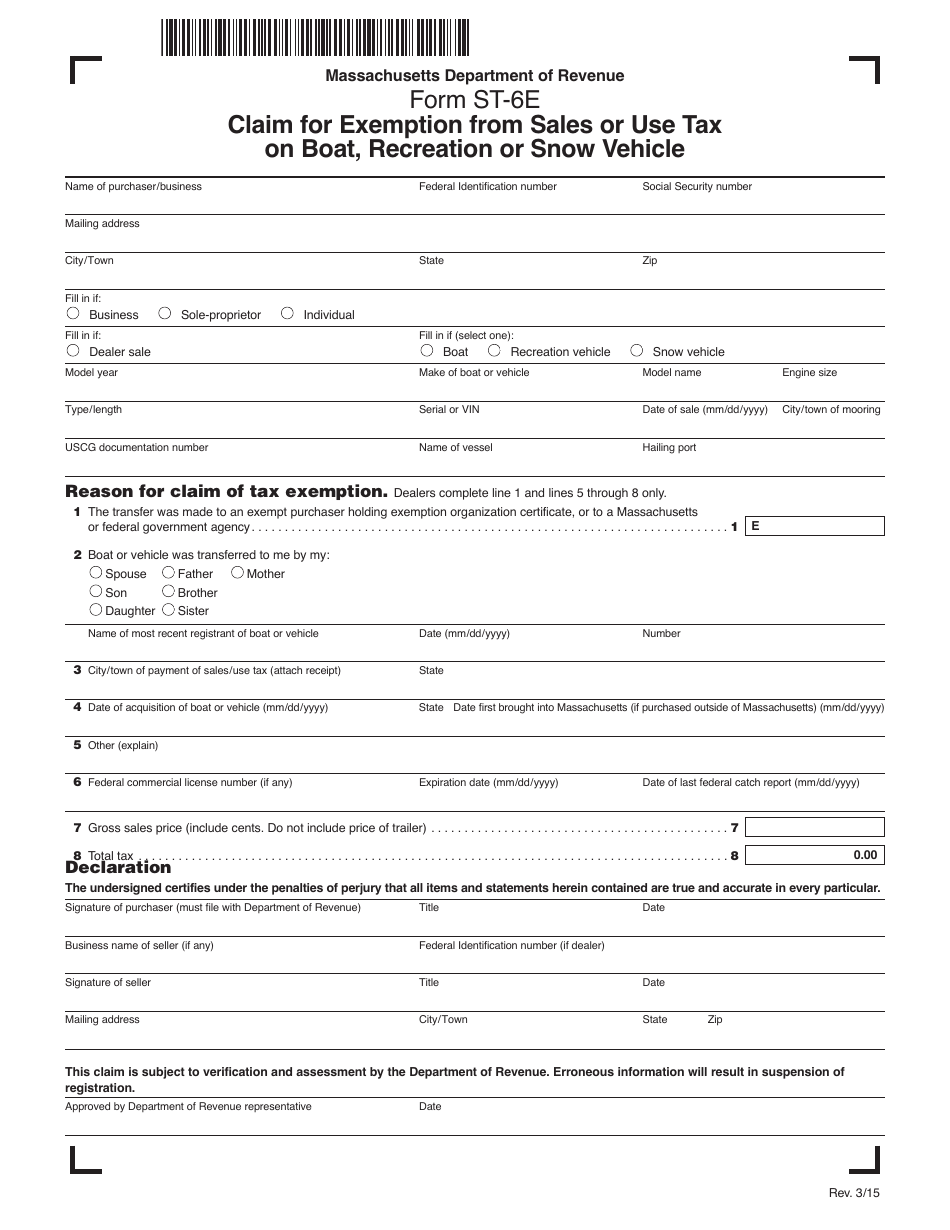

Form ST-6E Claim for Exemption From Sales or Use Tax on Boat, Recreation or Snow Vehicle - Massachusetts

What Is Form ST-6E?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-6E?

A: Form ST-6E is a claim for exemption from sales or use tax on boat, recreation, or snow vehicle in Massachusetts.

Q: Who can use Form ST-6E?

A: Anyone who wants to claim exemption from sales or use tax on boat, recreation, or snow vehicle in Massachusetts can use Form ST-6E.

Q: What does the form exempt?

A: Form ST-6E exempts the sales or use tax on boat, recreation, or snow vehicle in Massachusetts.

Q: Do I need to submit any supporting documents with Form ST-6E?

A: Yes, you may need to submit supporting documents such as proof of ownership or proof of qualifying use with Form ST-6E.

Q: Is there a deadline to submit Form ST-6E?

A: Yes, you must submit Form ST-6E within 10 days of purchasing or acquiring the boat, recreation, or snow vehicle.

Q: What happens after I submit Form ST-6E?

A: After you submit Form ST-6E, the Massachusetts Department of Revenue will review your claim and notify you of their decision.

Q: Can I appeal if my claim is denied?

A: Yes, if your claim is denied, you can appeal the decision by contacting the Massachusetts Department of Revenue.

Q: Are there any fees associated with filing Form ST-6E?

A: No, there are no fees associated with filing Form ST-6E.

Q: Can I use Form ST-6E for other types of vehicles?

A: No, Form ST-6E is specifically for boats, recreation, or snow vehicles in Massachusetts.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-6E by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.