This version of the form is not currently in use and is provided for reference only. Download this version of

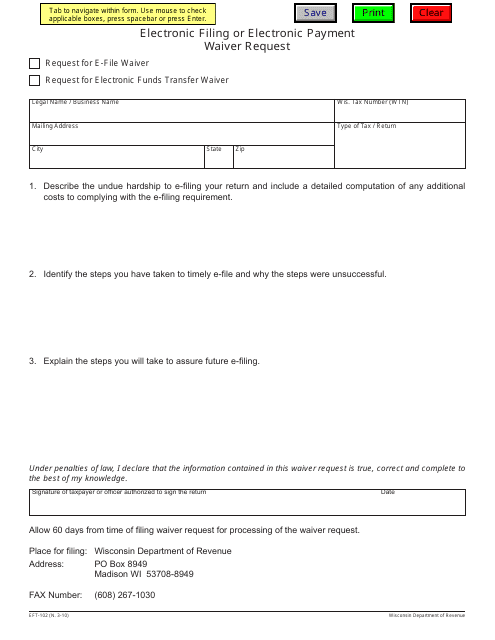

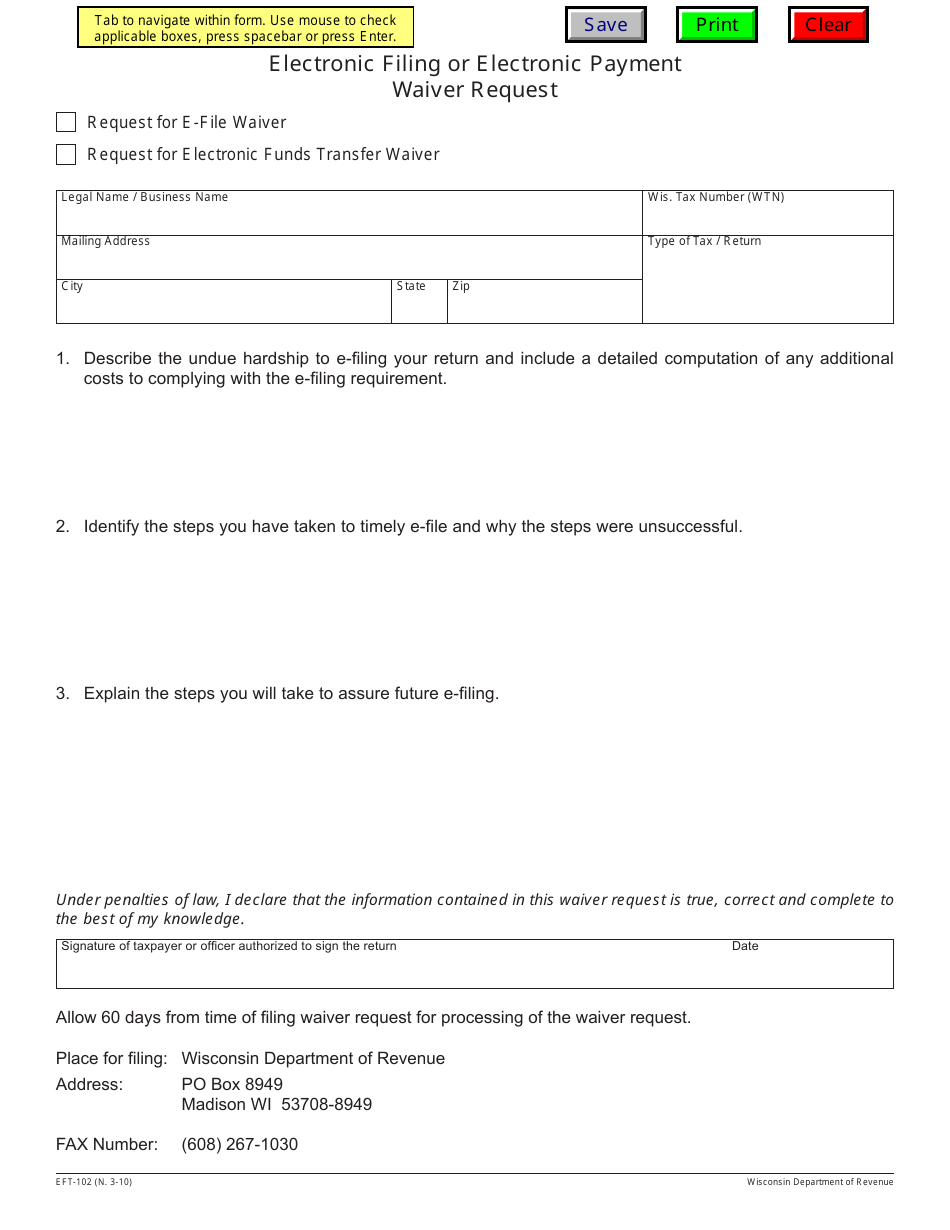

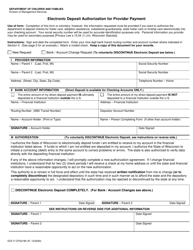

Form EFT-102

for the current year.

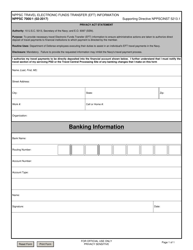

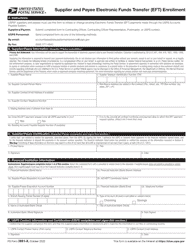

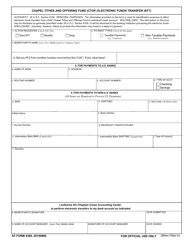

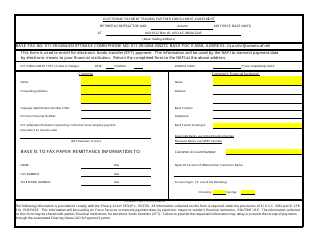

Form EFT-102 Electronic Filing or Electronic Payment Waiver Request - Wisconsin

What Is Form EFT-102?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EFT-102?

A: Form EFT-102 is a waiver request forelectronic filing or electronic payment in Wisconsin.

Q: Who needs to file Form EFT-102?

A: Anyone who wishes to request a waiver for electronic filing or electronic payment in Wisconsin.

Q: What is the purpose of Form EFT-102?

A: The purpose of Form EFT-102 is to request a waiver from the requirement to file or pay electronically in Wisconsin.

Q: Is there a deadline for filing Form EFT-102?

A: Yes, the deadline for filing Form EFT-102 is determined by the Wisconsin Department of Revenue.

Q: Are there any fees associated with filing Form EFT-102?

A: No, there are no fees associated with filing Form EFT-102.

Q: What information do I need to provide on Form EFT-102?

A: You will need to provide your contact information, the reason for the waiver request, and any supporting documentation.

Q: How long does it take to process a Form EFT-102 waiver request?

A: The processing time for Form EFT-102 waiver requests varies, but you can contact the Wisconsin Department of Revenue for an estimated timeline.

Q: Can I submit additional documentation with Form EFT-102?

A: Yes, you can submit additional documentation to support your waiver request with Form EFT-102.

Form Details:

- Released on March 1, 2010;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EFT-102 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.