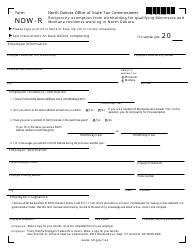

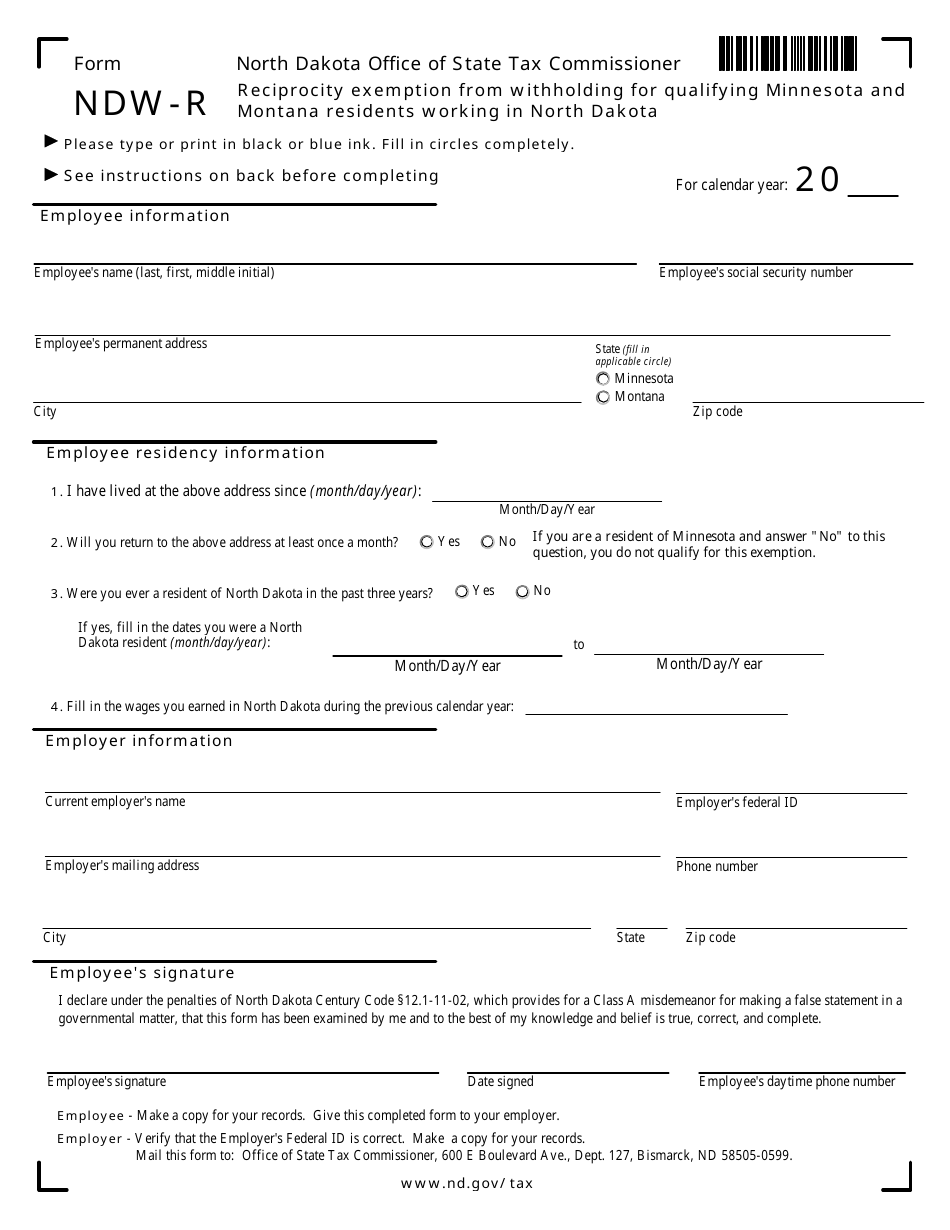

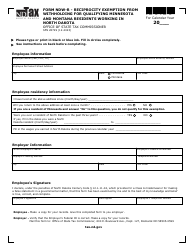

Form NDW-R Reciprocity Exemption From Withholding for Qualifying Minnesota and Montana Residents Working in North Dakota - North Dakota

What Is Form NDW-R?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NDW-R?

A: Form NDW-R is a form used to apply for reciprocity exemption from withholding for qualifying Minnesota and Montana residents working in North Dakota.

Q: Who can use Form NDW-R?

A: Qualifying Minnesota and Montana residents working in North Dakota can use Form NDW-R.

Q: What is the purpose of Form NDW-R?

A: The purpose of Form NDW-R is to claim a reciprocity exemption from withholding for qualifying Minnesota and Montana residents.

Q: What is reciprocity exemption from withholding?

A: Reciprocity exemption from withholding is an agreement between states that allows residents of one state to be exempt from tax withholding in another state.

Q: How can I apply for reciprocity exemption from withholding?

A: You can apply for reciprocity exemption from withholding by completing and submitting Form NDW-R.

Q: Is there a fee for applying for reciprocity exemption from withholding?

A: No, there is no fee for applying for reciprocity exemption from withholding.

Q: Are there any eligibility requirements for claiming reciprocity exemption from withholding?

A: Yes, you must be a qualifying Minnesota or Montana resident working in North Dakota to be eligible for claiming reciprocity exemption from withholding.

Q: When should I submit Form NDW-R?

A: You should submit Form NDW-R as soon as you start working in North Dakota and wish to claim reciprocity exemption from withholding.

Q: How long does it take to process Form NDW-R?

A: The processing time for Form NDW-R may vary, but it generally takes a few weeks to process.

Form Details:

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NDW-R by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.