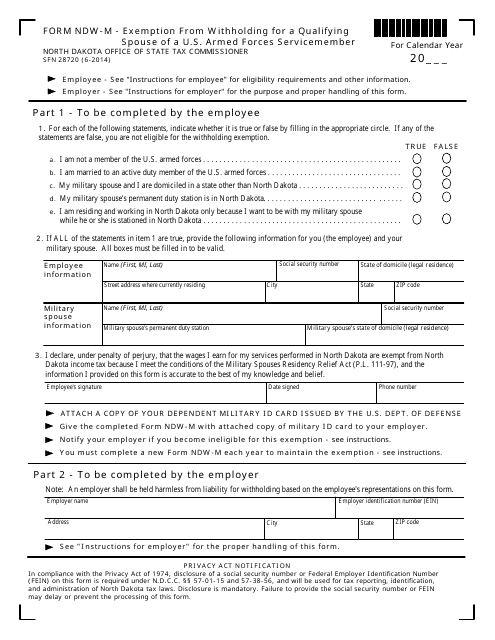

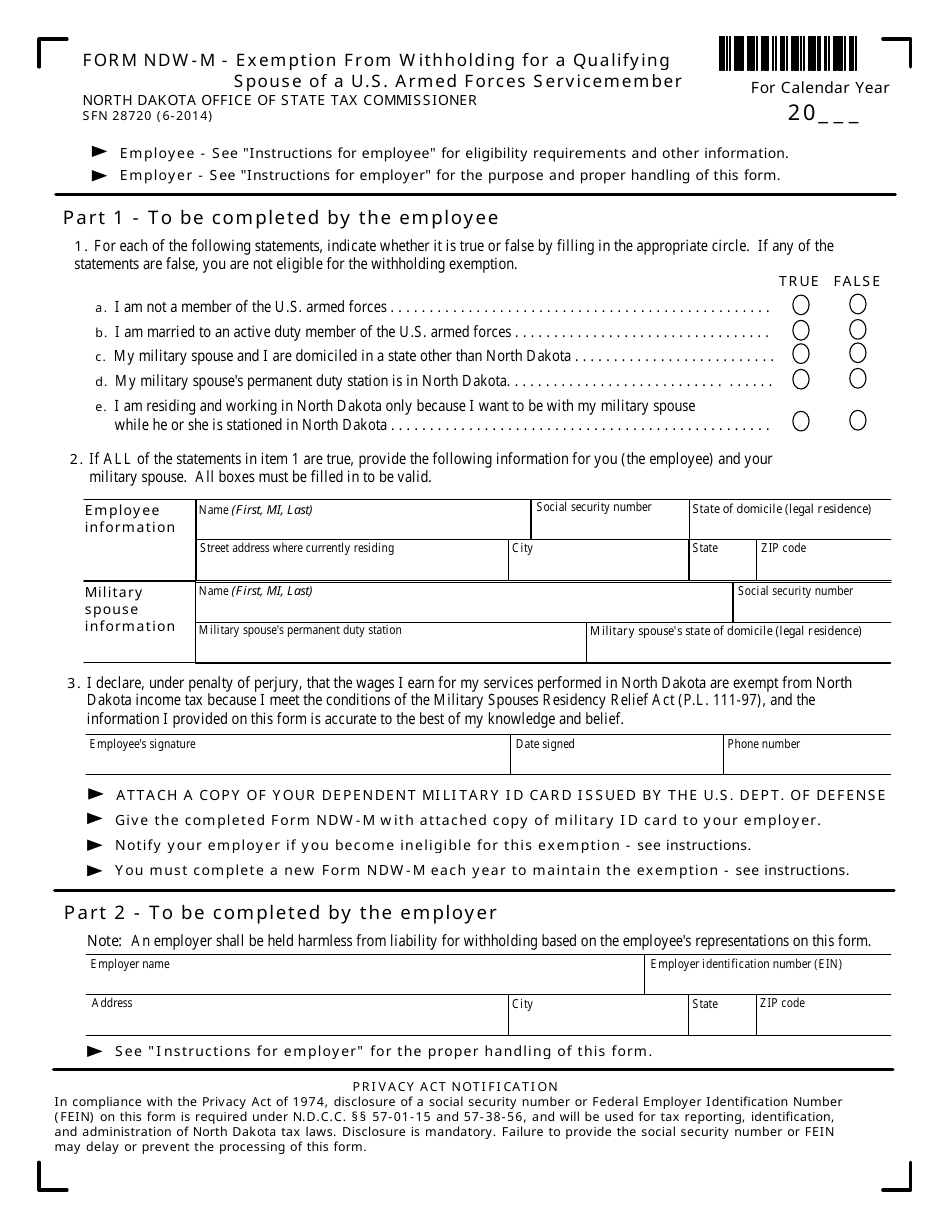

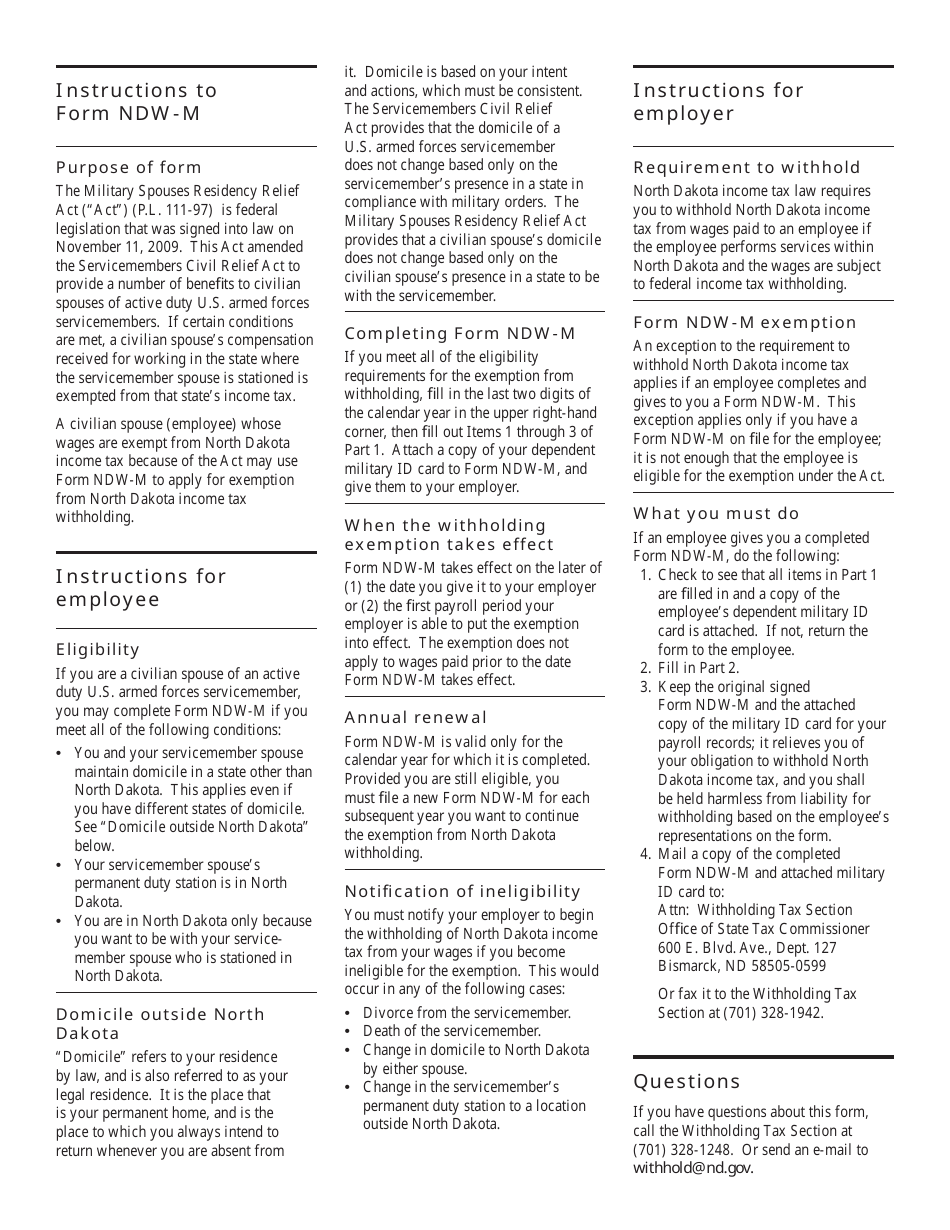

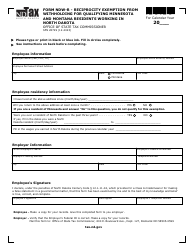

Form NDW-M Exemption From Withholding for a Qualifying Spouse of a U.S. Armed Forces Servicemember - North Dakota

What Is Form NDW-M?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NDW-M?

A: Form NDW-M is an exemption form for withholding for a qualifying spouse of a U.S. Armed Forces servicemember in North Dakota.

Q: Who is eligible to use Form NDW-M?

A: Only qualifying spouses of U.S. Armed Forces servicemembers are eligible to use Form NDW-M.

Q: What does Form NDW-M exempt?

A: Form NDW-M exempts the qualifying spouse from withholding North Dakota income tax.

Q: What is the purpose of Form NDW-M?

A: The purpose of Form NDW-M is to provide an exemption from withholding for qualifying spouses of U.S. Armed Forces servicemembers.

Form Details:

- Released on June 1, 2014;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NDW-M by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.