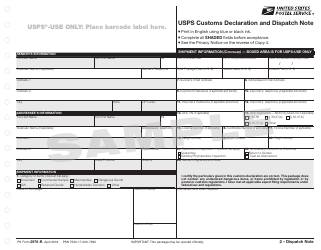

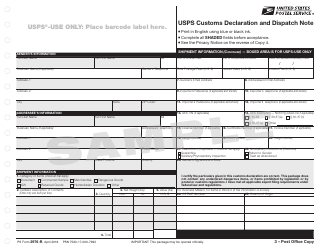

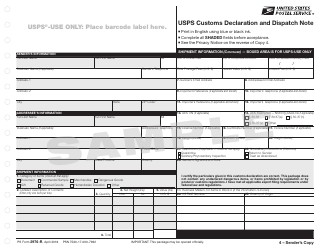

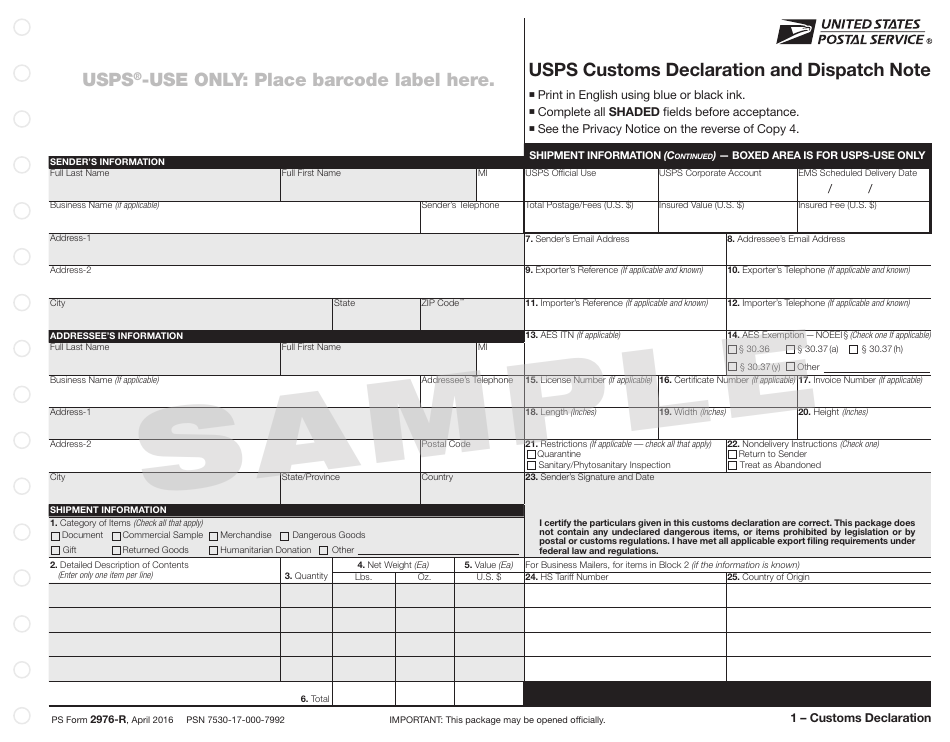

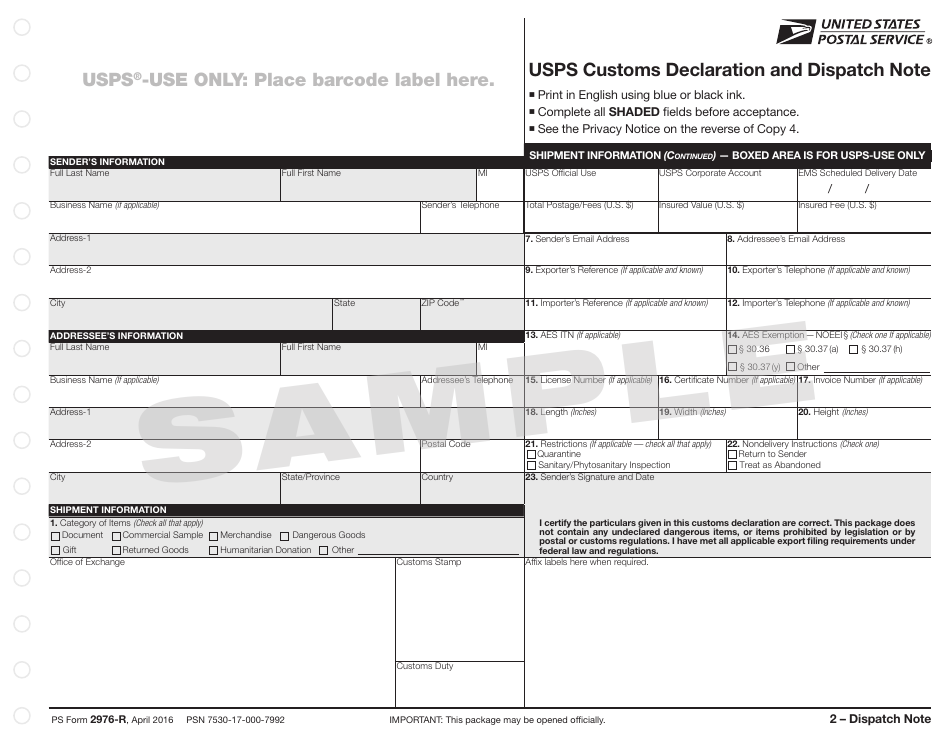

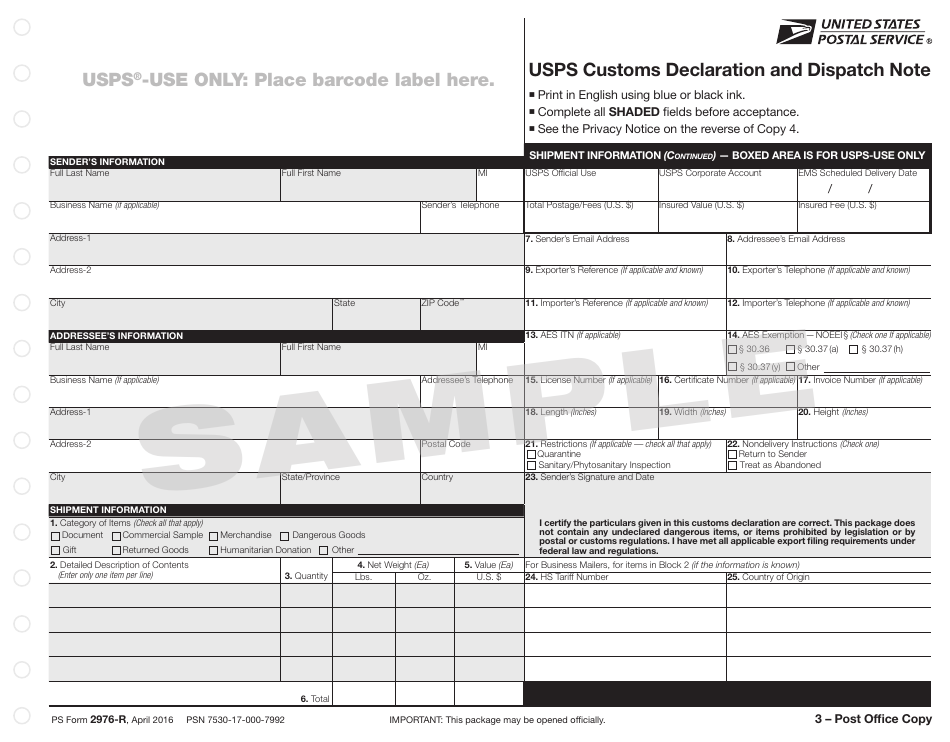

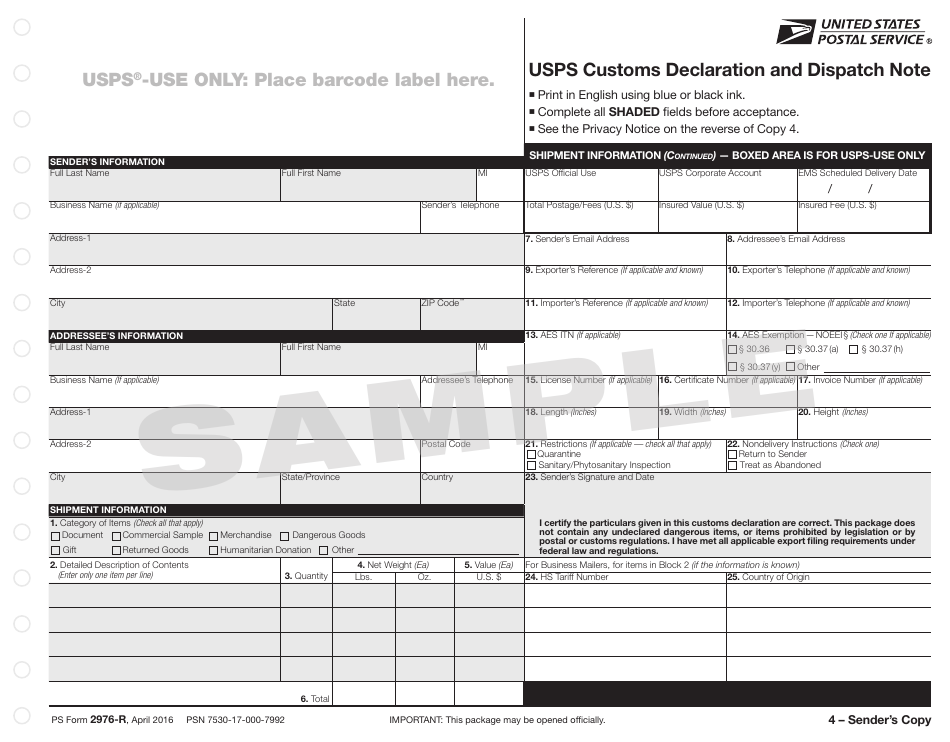

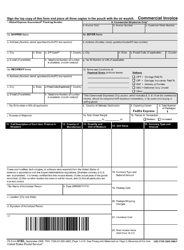

PS Form 2976-R USPS Customs Declaration and Dispatch Note

What Is PS Form 2976-R?

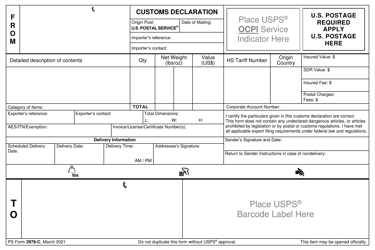

PS Form 2976-R, USPS Customs Declaration and Dispatch Note - also known as the USPS Form 2976-R - is a customs form released by the United States Postal Service (USPS) that is necessary for border control inspection and contains a description of the items in a package.

The latest version of the form was released on April 1, 2016 , and the current version is the only one. An up-to-date PS Form 2976-R is available for reference through the link below.

The PS Form 2976-R is used as a worksheet, which is presented with the parcel at a USPS retail service counter. The information from the form will be entered into the retail system or Customs Forms online and then the appropriate form is generated and affixed to the parcel. This form is not used as a stand-alone customs form.

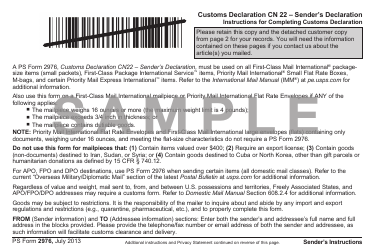

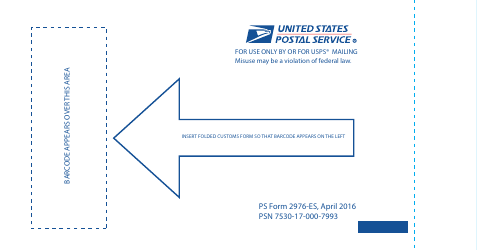

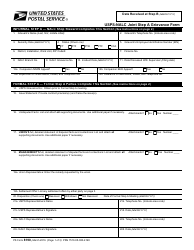

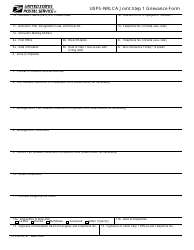

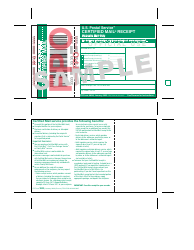

Related forms include the PS Form 2976, PS Form 2976-A, PS Form 2976-B, PS Form 2976-E, and PS Form 2976-ES.

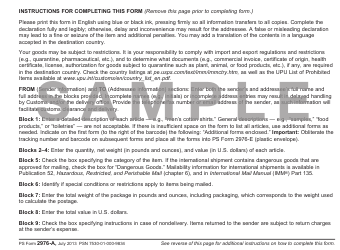

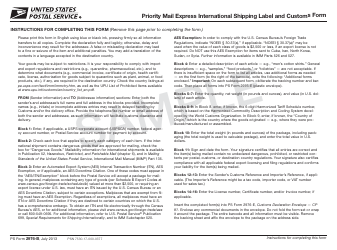

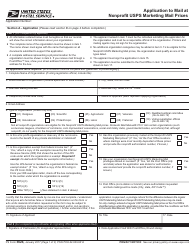

How to Fill Out PS Form 2976-R?

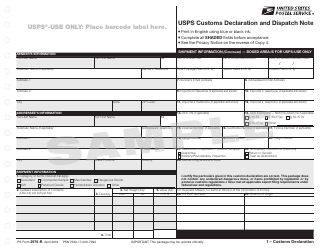

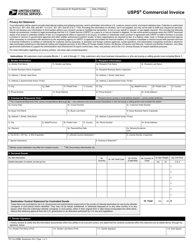

- Sender's Information. Provide your full name and address, as well as the phone or fax number or email address. The contact information is necessary to facilitate customs clearance. If applicable, enter the business name.

- Addressee's information. Enter the full name and address of the addressee. If applicable, enter their business name.

- Block 1. Category of Items. Specify the category of items being mailed.

- Block 2. Detailed Description of Contents. Enter the accurate name of each item type in the parcel.

- Block 3. Quantity. Enter the quantity of items.

- Block 4. Net Weight. Enter the weight of items in pounds and ounces.

- Block 5. Value. Enter the value of items in U.S. Dollars.

- Block 6. Total. Enter the total value of all items in the parcel and their net weight.

- Block 7. Sender's Email Address. Enter your email address.

- Block 8. Addressee's Email Address. Enter the addressee's email address.

- Block 9. Exporter's Reference. Enter the exporter's reference. This might be a tax code, invoice number, or VAT number used for sales tax.

- Block 10. Exporter's Telephone. Enter the exporter's phone number.

- Block 11. Importer's Reference. Enter the importer's reference.

- Block 12. Importer's Telephone. Provide the phone number of the importer.

- Block 13. AES ITN. Enter the Automated Export System (AES) Internal Transaction Number (ITN).

- Block 14. AES Exemption. Choose an Automated Export System Exemption option.

- Block 15. License No. Provide the license number.

- Block 16. Certificate No. Enter the certificate number.

- Block 17. Invoice No. Enter the invoice number.

- Block 18. Length. Enter the length of the parcel in inches.

- Block 19. Width. Provide the width of the parcel in inches.

- Block 20. Height. Enter the height of the parcel in inches.

- Block 21. Restrictions. Check the applicable boxes.

- Block 22. Non-Delivery Instructions. Check the applicable boxes.

- Block 23. Sender's Signature and Date. Sign and date the form.

- Block 24. HS Tariff Number. This block is applicable to business mailers. Provide the 6-digit Harmonized Tariff Schedule.

- Block 25. Country of Origin. This block should be completed my business mailers. Provide the country of origin of your items in a parcel.

How to Order PS Form 2976-R?

The PS Form 2976-R is available only as a hard copy. The sender can obtain it at a post office without charge. It is possible to request multiple forms for mail preparation. You cannot order the PS Form 2976-R through the USPS Online Postal Store.