This version of the form is not currently in use and is provided for reference only. Download this version of

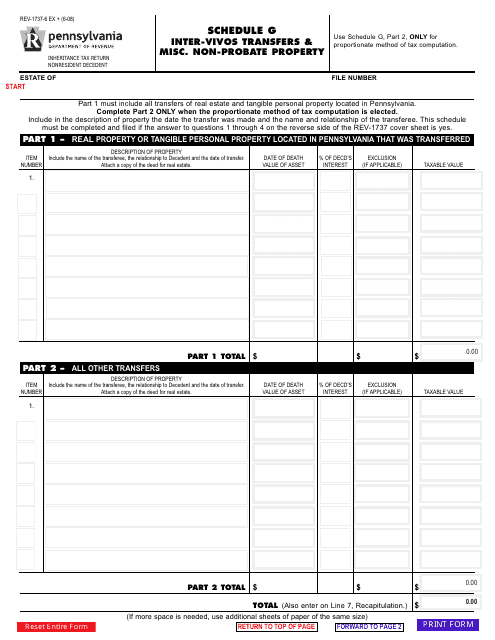

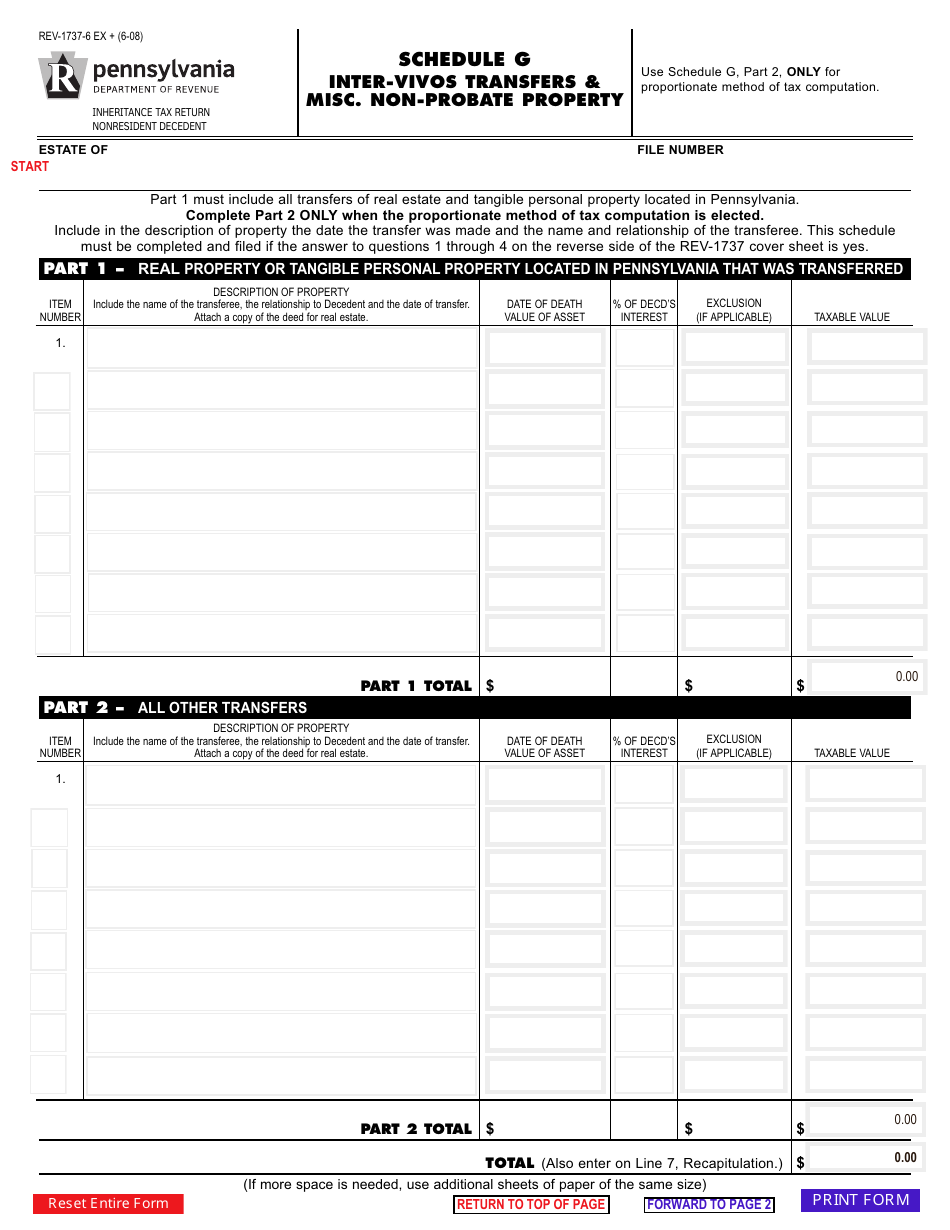

Form REV-1737-6 Schedule G

for the current year.

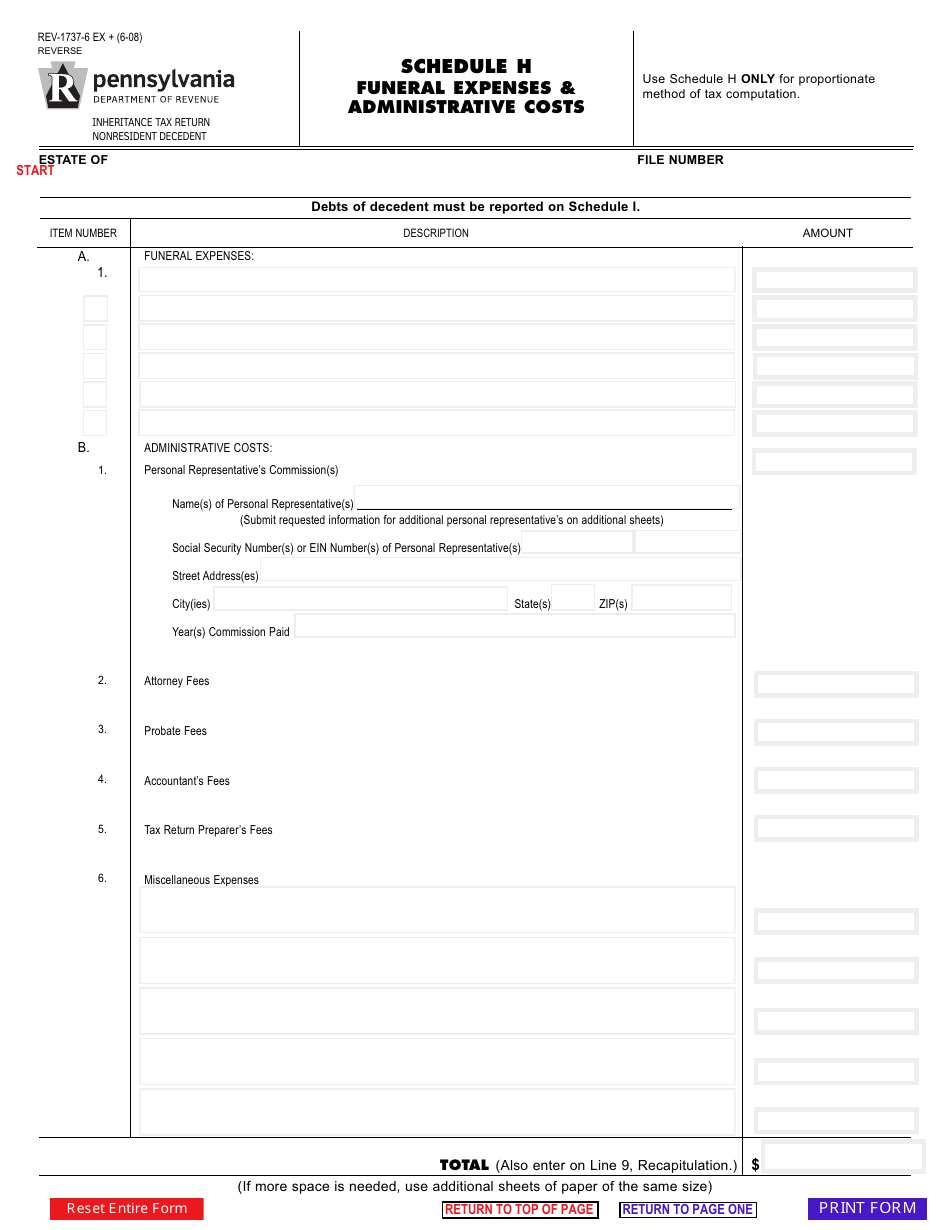

Form REV-1737-6 Schedule G Inter-Vivos Transfers & Misc. Non-probate Property - Pennsylvania

What Is Form REV-1737-6 Schedule G?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1737-6?

A: Form REV-1737-6 is Schedule G for reporting Inter-Vivos Transfers & Misc. Non-probate Property in Pennsylvania.

Q: What is Inter-Vivos transfer?

A: Inter-Vivos transfer refers to the transfer of property between living individuals.

Q: What is Non-probate property?

A: Non-probate property refers to assets that don't go through the probate process after the owner passes away.

Q: Why do I need to complete Schedule G?

A: You need to complete Schedule G to report any inter-vivos transfers and non-probate property in Pennsylvania for tax purposes.

Q: What information should be provided in Schedule G?

A: Schedule G requires you to provide details about the transferor, transferee, property description, and fair market value of the transferred property.

Form Details:

- Released on June 1, 2008;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1737-6 Schedule G by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.