This version of the form is not currently in use and is provided for reference only. Download this version of

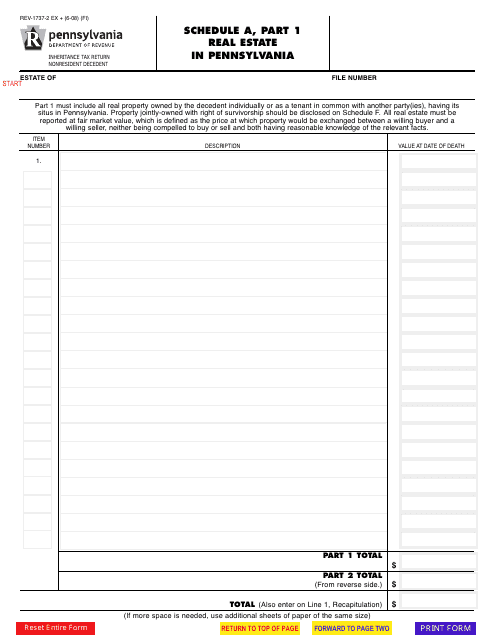

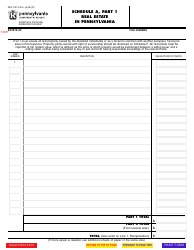

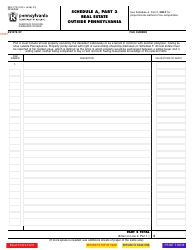

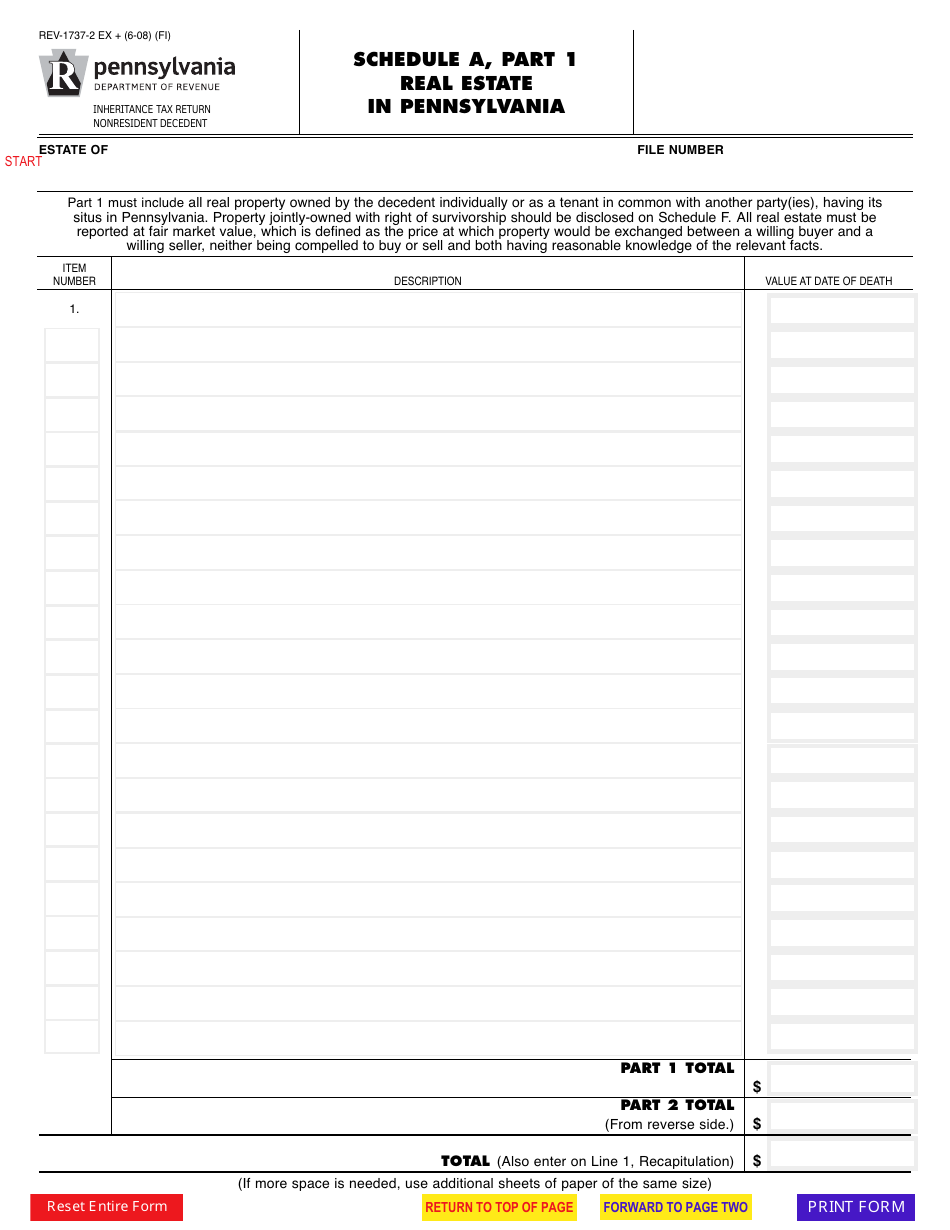

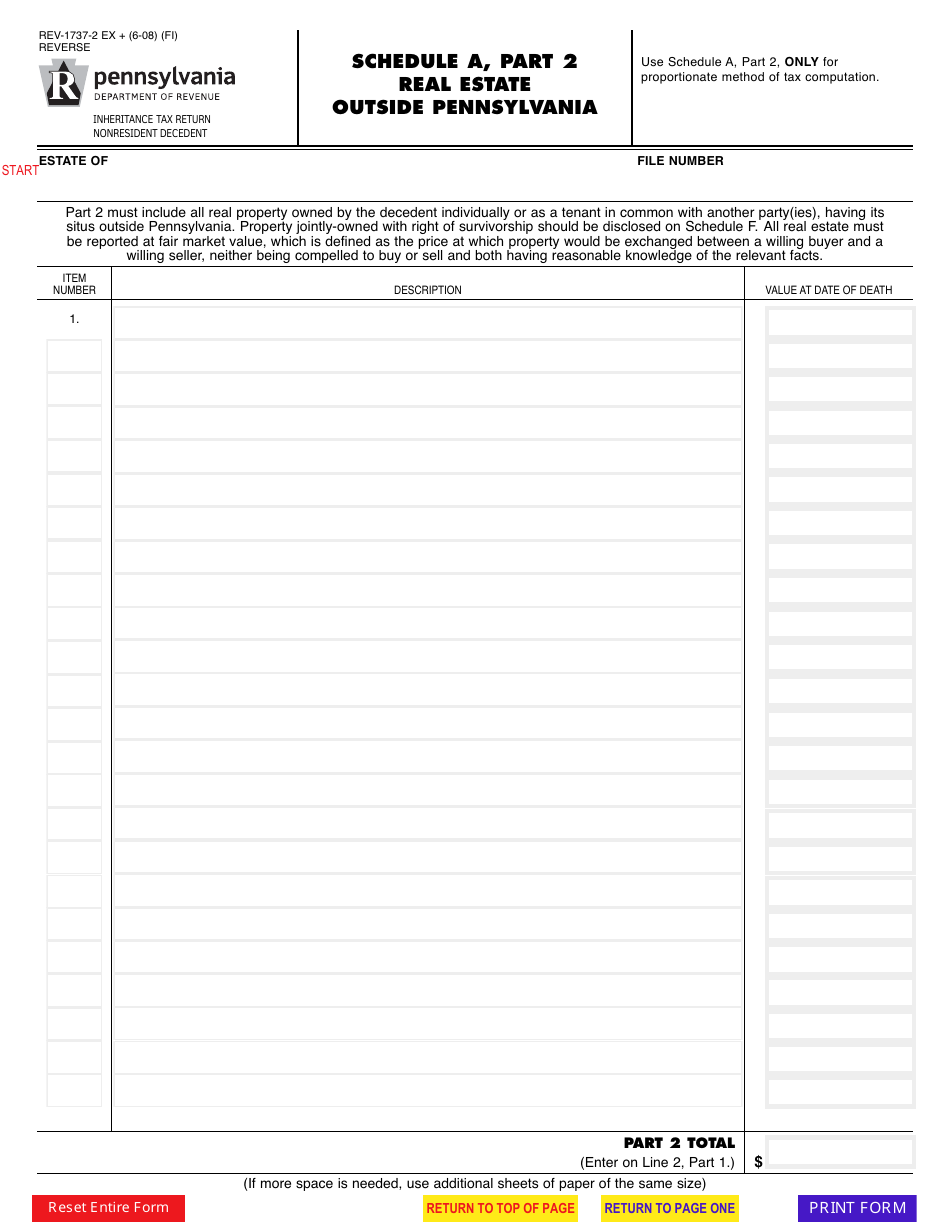

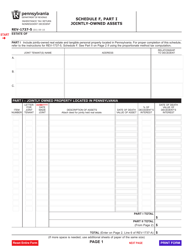

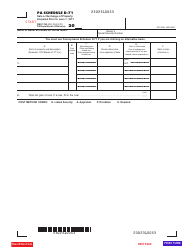

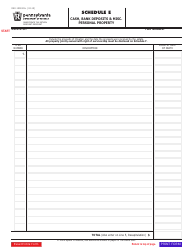

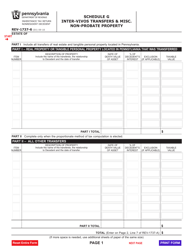

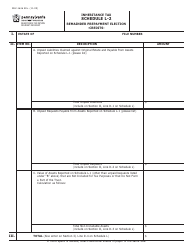

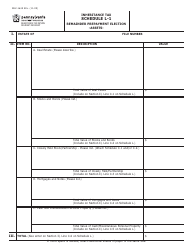

Form REV-1737-2 Schedule A

for the current year.

Form REV-1737-2 Schedule A Real Estate in Pennsylvania - Pennsylvania

What Is Form REV-1737-2 Schedule A?

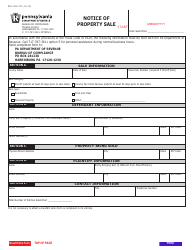

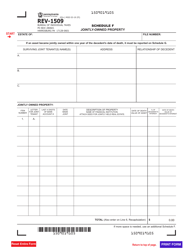

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1737-2?

A: Form REV-1737-2 is a schedule used in Pennsylvania for reporting real estate transactions.

Q: What is Schedule A?

A: Schedule A is a section of Form REV-1737-2 that is specifically used for reporting real estate transactions.

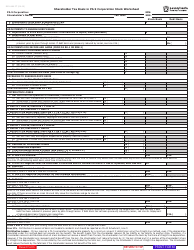

Q: What is considered real estate in Pennsylvania?

A: Real estate in Pennsylvania typically includes land, buildings, and any improvements made to the property.

Q: When should Form REV-1737-2 Schedule A be filed?

A: Form REV-1737-2 Schedule A should be filed within 30 days of the transfer of real estate in Pennsylvania.

Q: Who is required to file Form REV-1737-2 Schedule A?

A: The buyer or transferee of real estate in Pennsylvania is typically responsible for filing Form REV-1737-2 Schedule A.

Q: What information is required on Schedule A?

A: Schedule A requires information such as the property address, sale price, buyer and seller details, and any exemptions or exclusions that may apply.

Q: Are there any fees associated with filing Form REV-1737-2 Schedule A?

A: There are no fees associated with filing Form REV-1737-2 Schedule A in Pennsylvania.

Q: Are there any penalties for late filing of Schedule A?

A: Yes, there may be penalties for late filing of Form REV-1737-2 Schedule A in Pennsylvania. It is important to file the form within the specified timeframe.

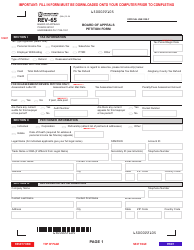

Q: Can Form REV-1737-2 Schedule A be electronically filed?

A: Yes, Form REV-1737-2 Schedule A can be electronically filed using the Pennsylvania Department of Revenue's e-Signature option.

Form Details:

- Released on June 1, 2008;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1737-2 Schedule A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.