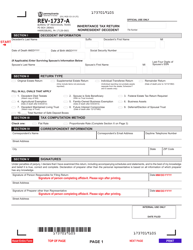

This version of the form is not currently in use and is provided for reference only. Download this version of

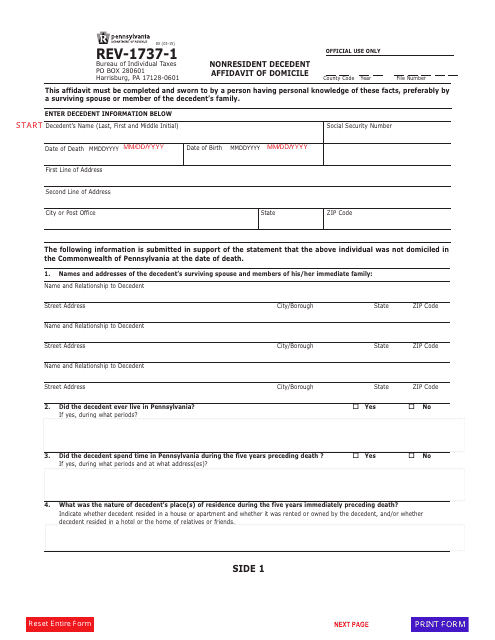

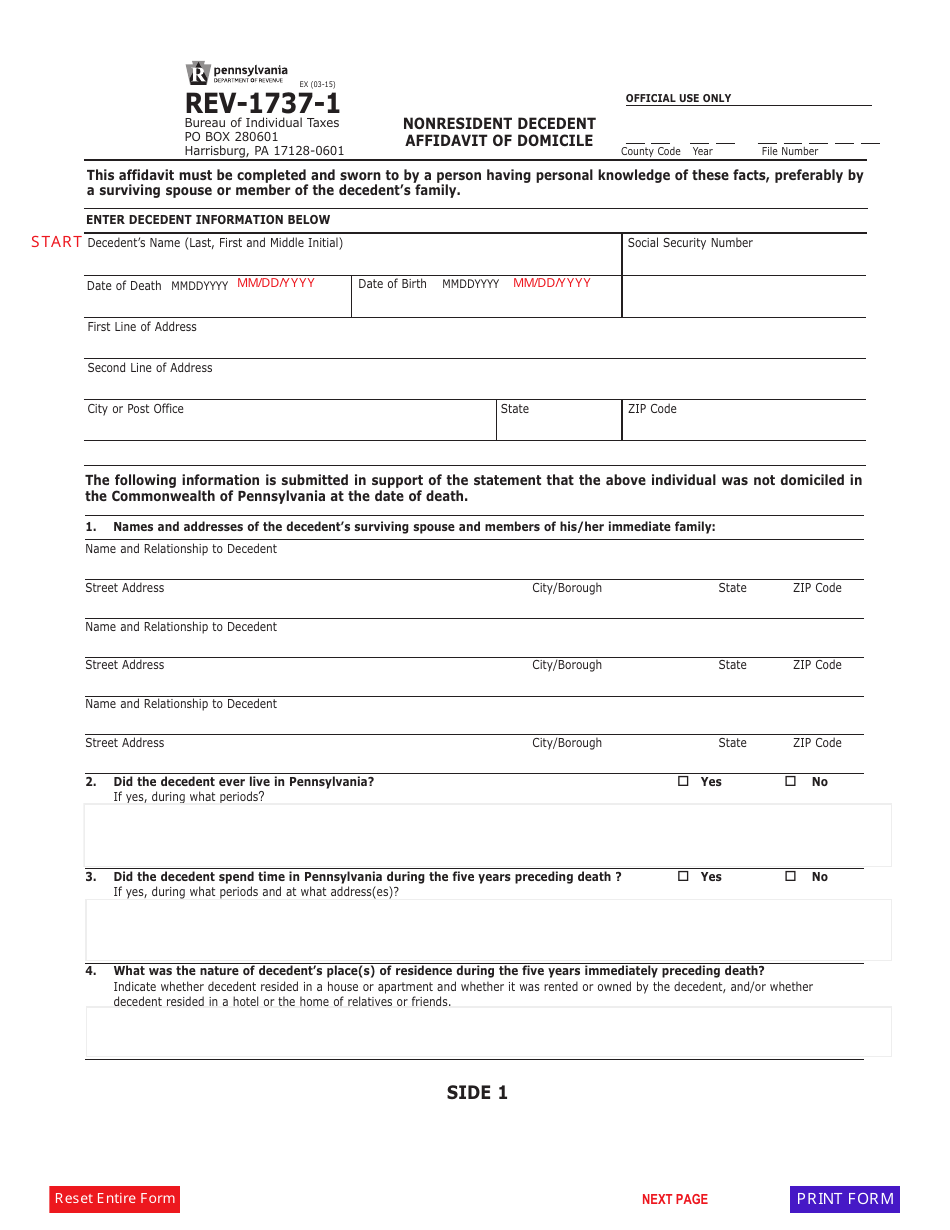

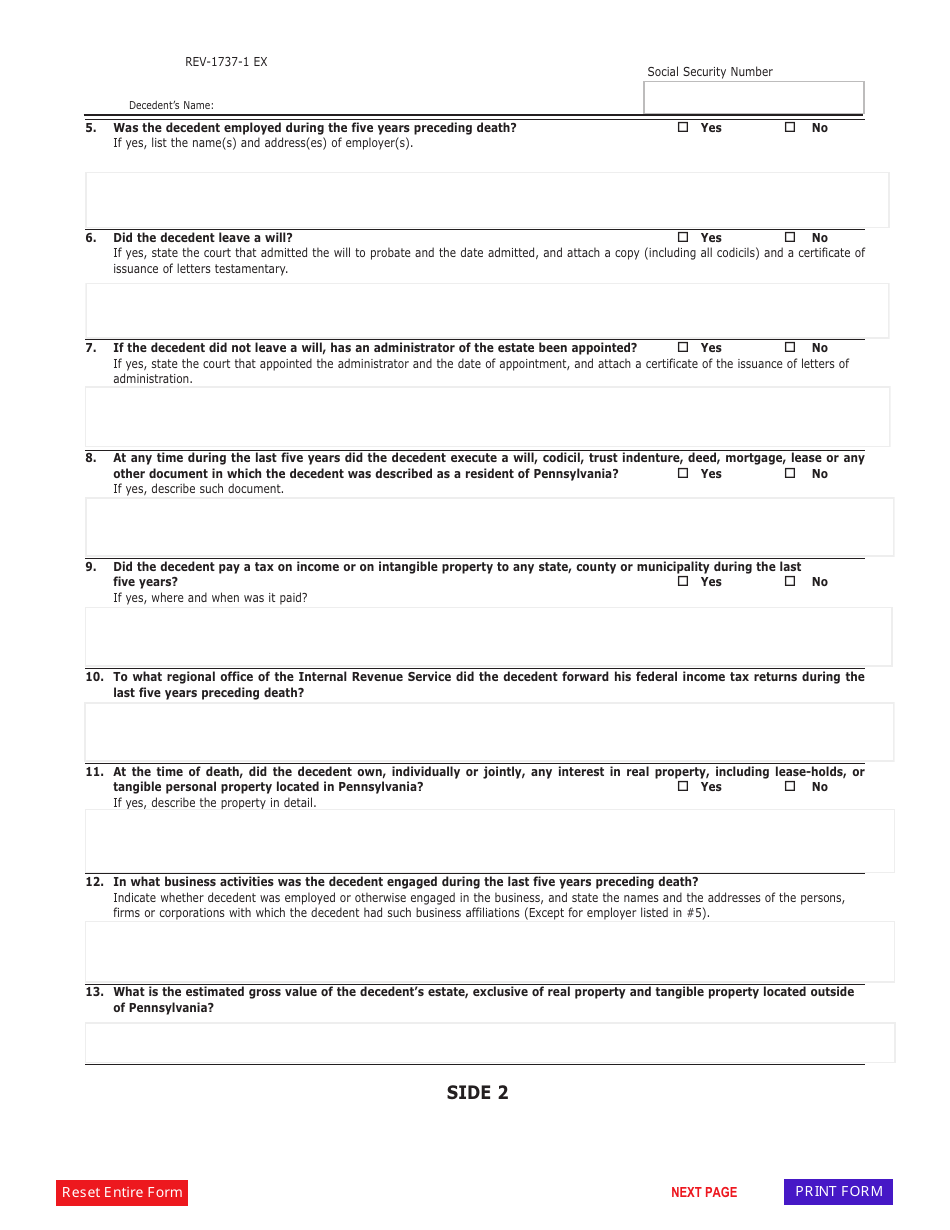

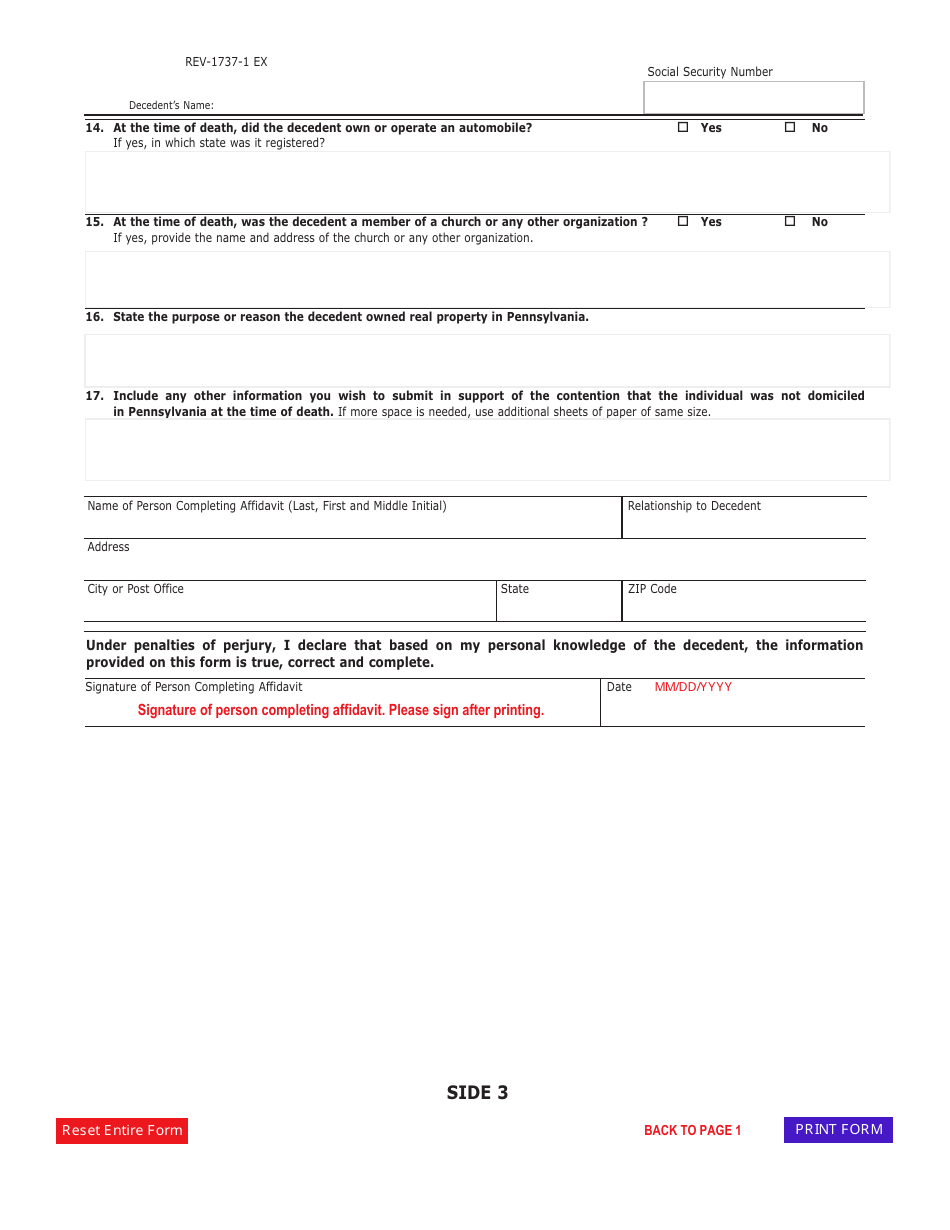

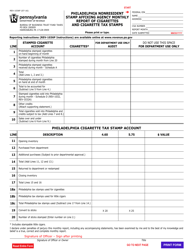

Form REV-1737-1

for the current year.

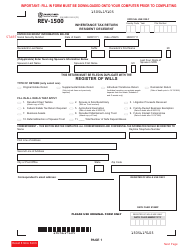

Form REV-1737-1 Nonresident Decedent Affidavit of Domicile - Pennsylvania

What Is Form REV-1737-1?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1737-1?

A: Form REV-1737-1 is the Nonresident Decedent Affidavit of Domicile used in Pennsylvania.

Q: Who should use Form REV-1737-1?

A: This form should be used by individuals who are not residents of Pennsylvania but have a deceased family member who was a resident of Pennsylvania.

Q: What is the purpose of Form REV-1737-1?

A: The purpose of this form is to declare the decedent's state of domicile at the time of their death, which is important for tax and estate purposes.

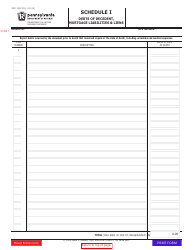

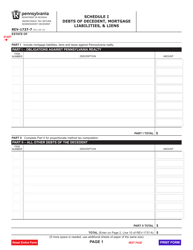

Q: What information is required on Form REV-1737-1?

A: The form requires information about the decedent, such as their name, date of birth, date of death, and details about their domicile.

Q: Are there any fees associated with filing Form REV-1737-1?

A: There are no fees associated with filing this form.

Q: Is Form REV-1737-1 specific to Pennsylvania?

A: Yes, this form is specific to Pennsylvania and is not applicable to other states.

Q: What are the consequences of not filing Form REV-1737-1?

A: Failing to file this form may result in complications with the decedent's estate and tax obligations.

Q: Can I amend the information on Form REV-1737-1 after I submit it?

A: If you need to correct or update the information, you should contact the Pennsylvania Department of Revenue for guidance on how to proceed.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1737-1 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.