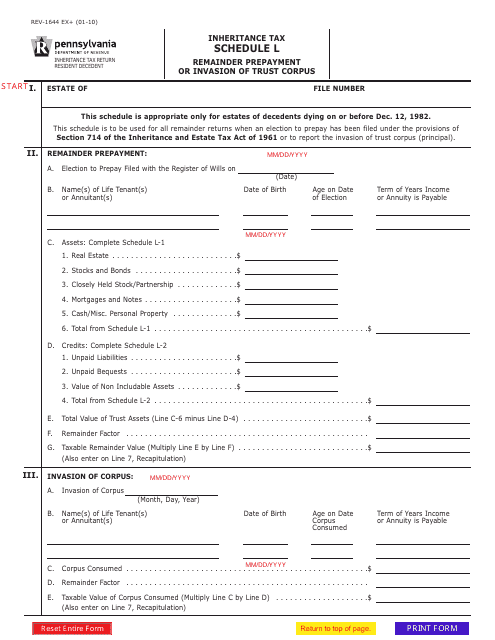

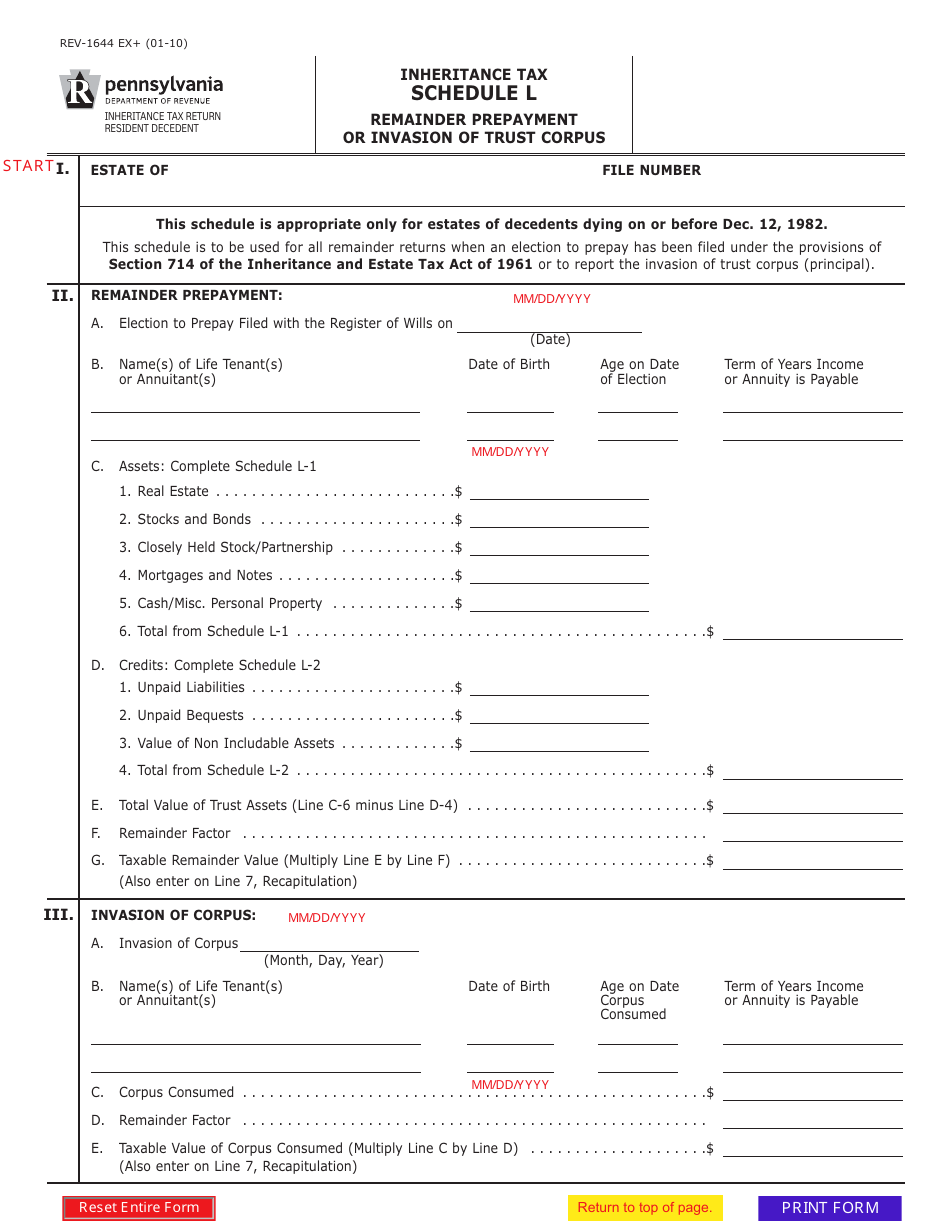

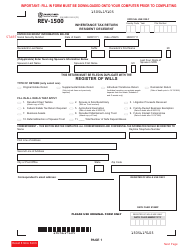

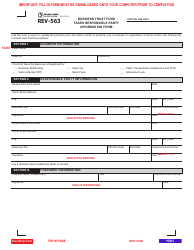

Form REV-1644 Schedule L Remainder Prepayment or Invasion of Trust Corpus - Inheritance Tax - Pennsylvania

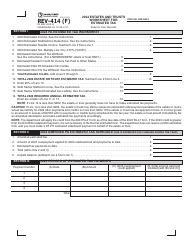

What Is Form REV-1644 Schedule L?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1644 Schedule L?

A: Form REV-1644 Schedule L is a tax form used for reporting the remainder prepayment or invasion of trust corpus for inheritance tax in Pennsylvania.

Q: What is inheritance tax?

A: Inheritance tax is a tax imposed on the transfer of assets from a deceased person to their beneficiaries in Pennsylvania.

Q: Who needs to file Form REV-1644 Schedule L?

A: Individuals who are making a remainder prepayment or invasion of trust corpus for inheritance tax in Pennsylvania need to file this form.

Q: What is a remainder prepayment?

A: A remainder prepayment refers to a payment made during the donor's lifetime to the extent of the value of the remainder interest in real property.

Q: What is invasion of trust corpus?

A: Invasion of trust corpus occurs when the assets of a trust are used or distributed for purposes other than what the trust was initially intended for.

Form Details:

- Released on January 1, 2010;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1644 Schedule L by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.