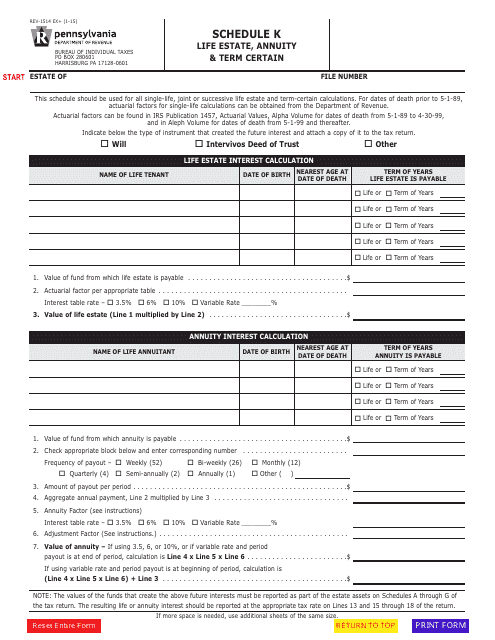

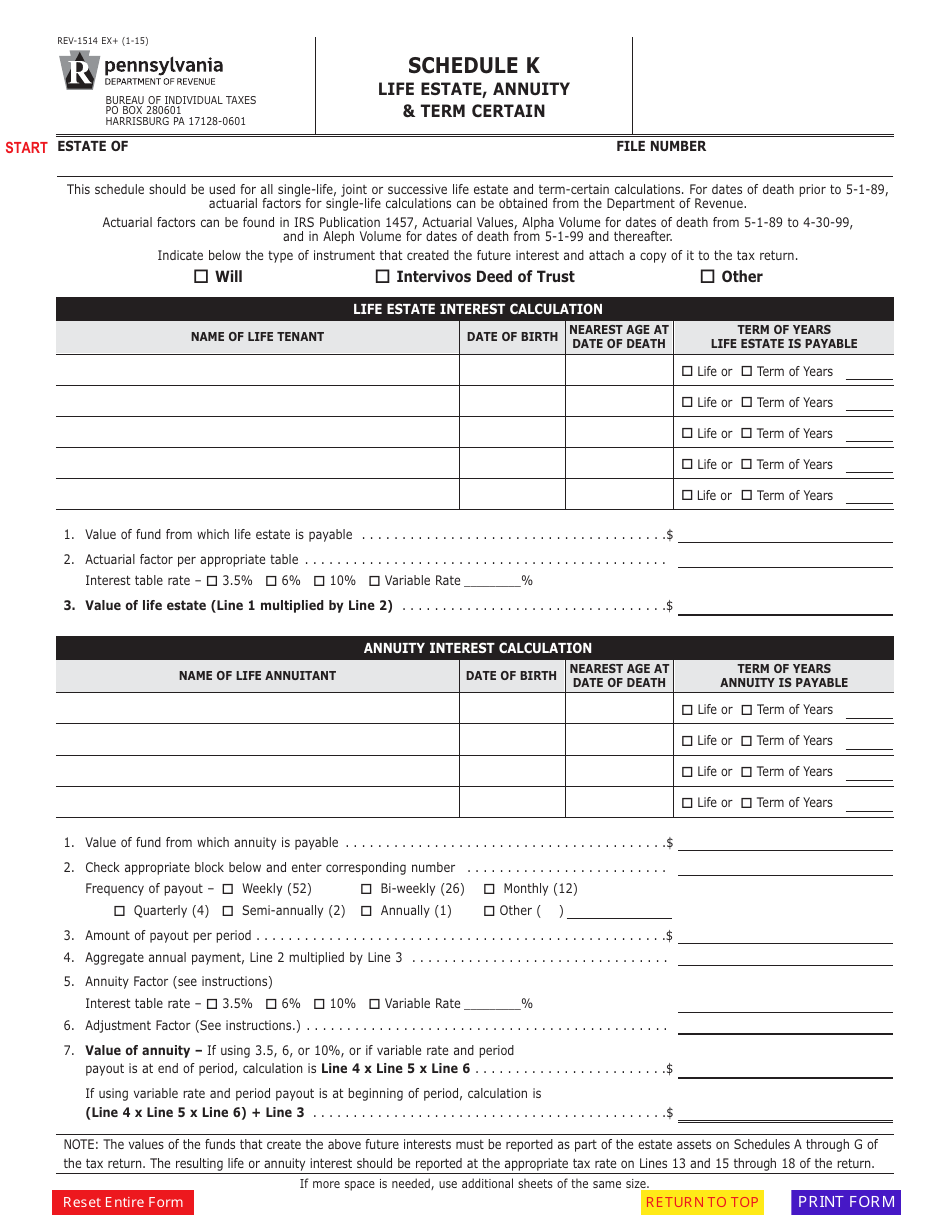

Form REV-1514 Schedule K Life Estate, Annuity & Term Certain - Pennsylvania

What Is Form REV-1514 Schedule K?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form REV-1514 Schedule K?

A: Form REV-1514 Schedule K is a schedule used in Pennsylvania to report income from a life estate, annuity, or term certain.

Q: What types of income are reported on form REV-1514 Schedule K?

A: Form REV-1514 Schedule K is used to report income from a life estate, annuity, or term certain in Pennsylvania.

Q: Who needs to file form REV-1514 Schedule K?

A: Anyone who receives income from a life estate, annuity, or term certain in Pennsylvania needs to file form REV-1514 Schedule K.

Q: What information do I need to complete form REV-1514 Schedule K?

A: To complete form REV-1514 Schedule K, you will need information about the income you received from a life estate, annuity, or term certain.

Q: When is form REV-1514 Schedule K due?

A: Form REV-1514 Schedule K is due on April 15th of each year, or the next business day if April 15th falls on a weekend or holiday.

Q: Are there any penalties for late filing of form REV-1514 Schedule K?

A: Yes, if you fail to file form REV-1514 Schedule K by the due date, you may be subject to penalties and interest.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1514 Schedule K by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.