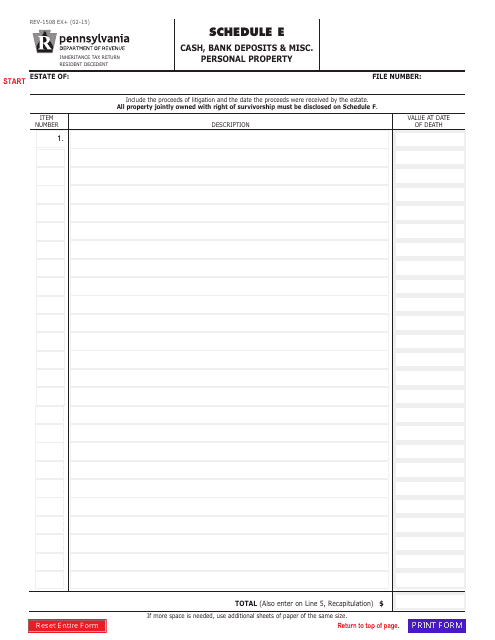

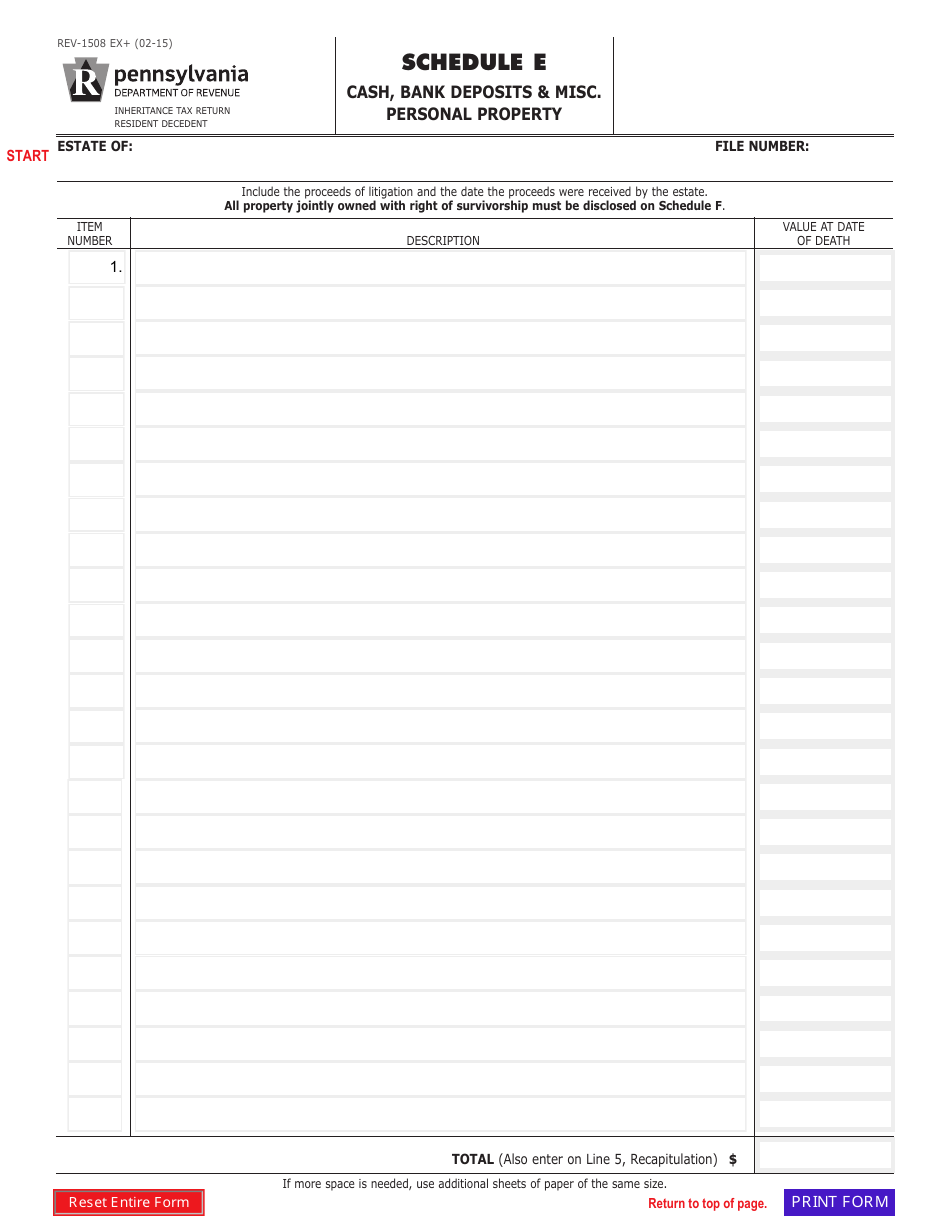

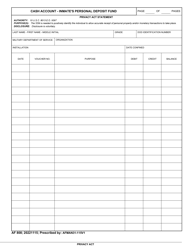

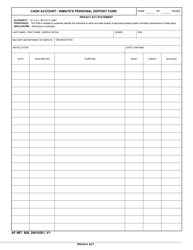

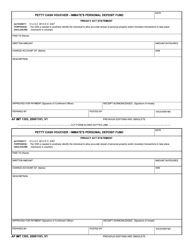

Form REV-1508 Schedule E Cash, Bank Deposits & Misc. Personal Property - Pennsylvania

What Is Form REV-1508 Schedule E?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form REV-1508 Schedule E?

A: Form REV-1508 Schedule E is a form used in Pennsylvania to report cash, bank deposits, and miscellaneous personal property.

Q: Who needs to file Form REV-1508 Schedule E?

A: Individuals and businesses in Pennsylvania who have cash, bank deposits, or miscellaneous personal property need to file Form REV-1508 Schedule E.

Q: What information is required on Form REV-1508 Schedule E?

A: Form REV-1508 Schedule E requires information such as the type of property, description, fair market value, and location.

Q: When is the deadline to file Form REV-1508 Schedule E?

A: The deadline to file Form REV-1508 Schedule E in Pennsylvania is April 15th of each year.

Form Details:

- Released on February 1, 2015;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1508 Schedule E by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.