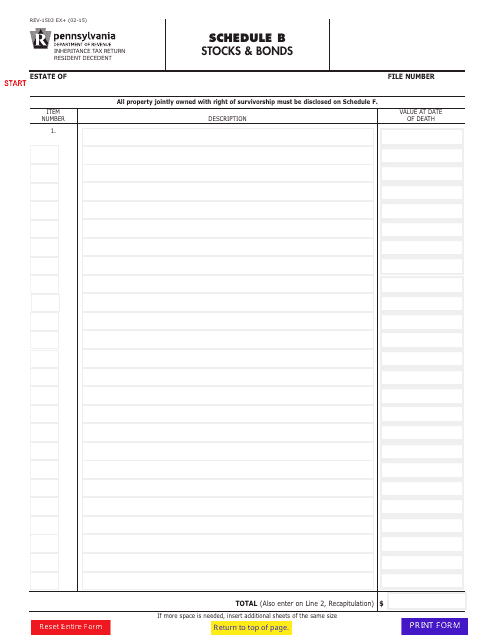

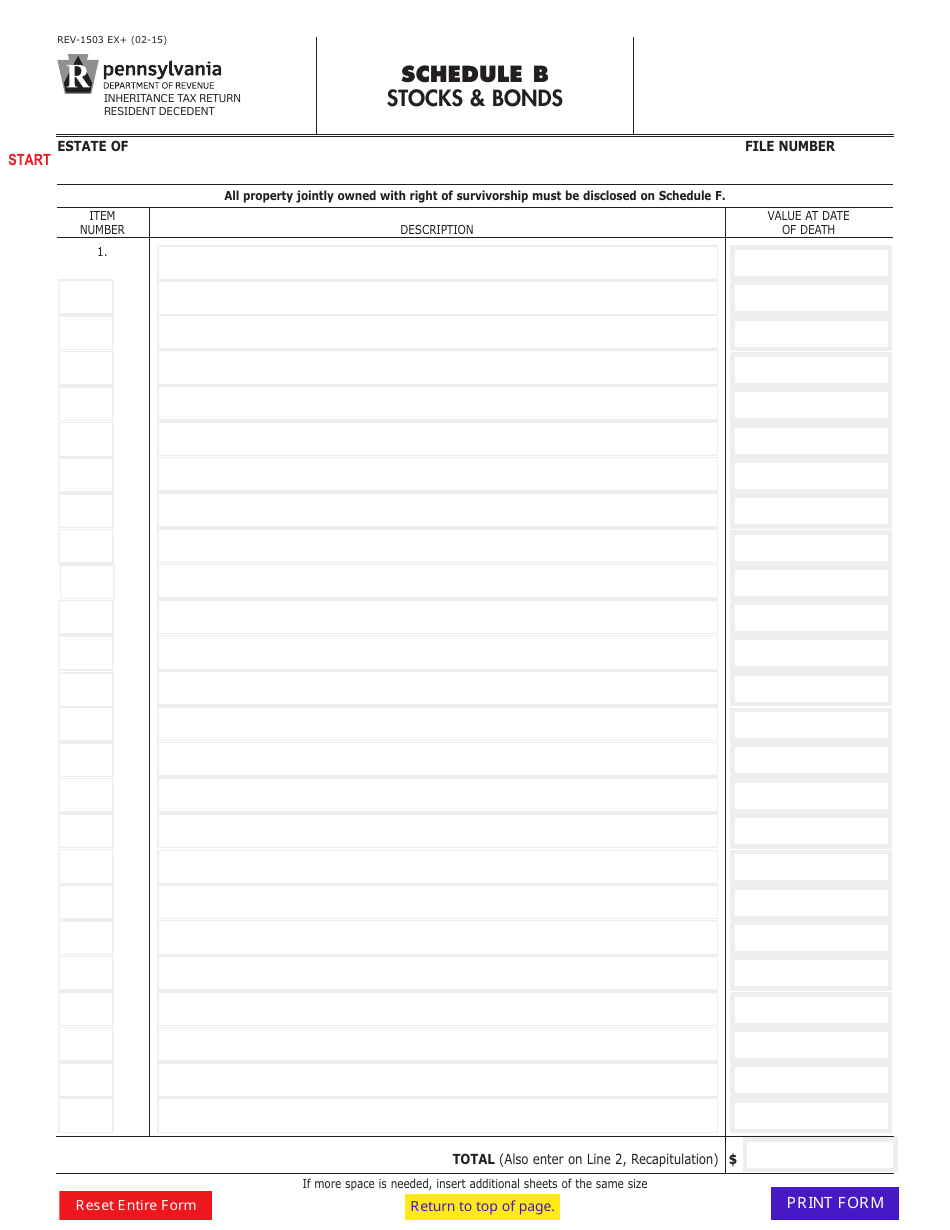

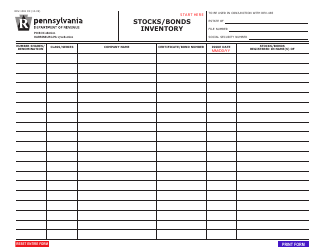

Form REV-1503 Schedule B Stocks & Bonds - Pennsylvania

What Is Form REV-1503 Schedule B?

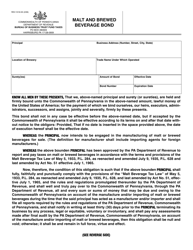

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form REV-1503 Schedule B?

A: Form REV-1503 Schedule B is a tax form used in Pennsylvania to report stocks and bonds.

Q: Who needs to file Form REV-1503 Schedule B?

A: Pennsylvania residents who have stocks and bonds to report on their state taxes need to file Form REV-1503 Schedule B.

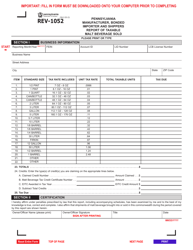

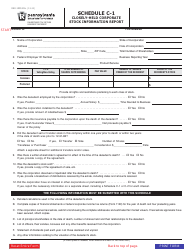

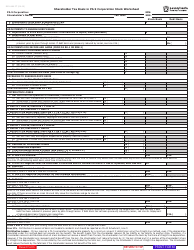

Q: What information is required on Form REV-1503 Schedule B?

A: Form REV-1503 Schedule B requires you to provide details of all the stocks and bonds you own, including their values and any income received.

Q: When is the deadline to file Form REV-1503 Schedule B?

A: The deadline to file Form REV-1503 Schedule B is the same as the deadline for your Pennsylvania state tax return, which is typically April 15th.

Q: Do I need to include Form REV-1503 Schedule B with my federal tax return?

A: No, Form REV-1503 Schedule B is specific to Pennsylvania state taxes and should be filed separately.

Q: What should I do if I have questions about filling out Form REV-1503 Schedule B?

A: If you have any questions or need assistance with Form REV-1503 Schedule B, you should contact the Pennsylvania Department of Revenue or consult a tax professional.

Form Details:

- Released on February 1, 2015;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1503 Schedule B by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.