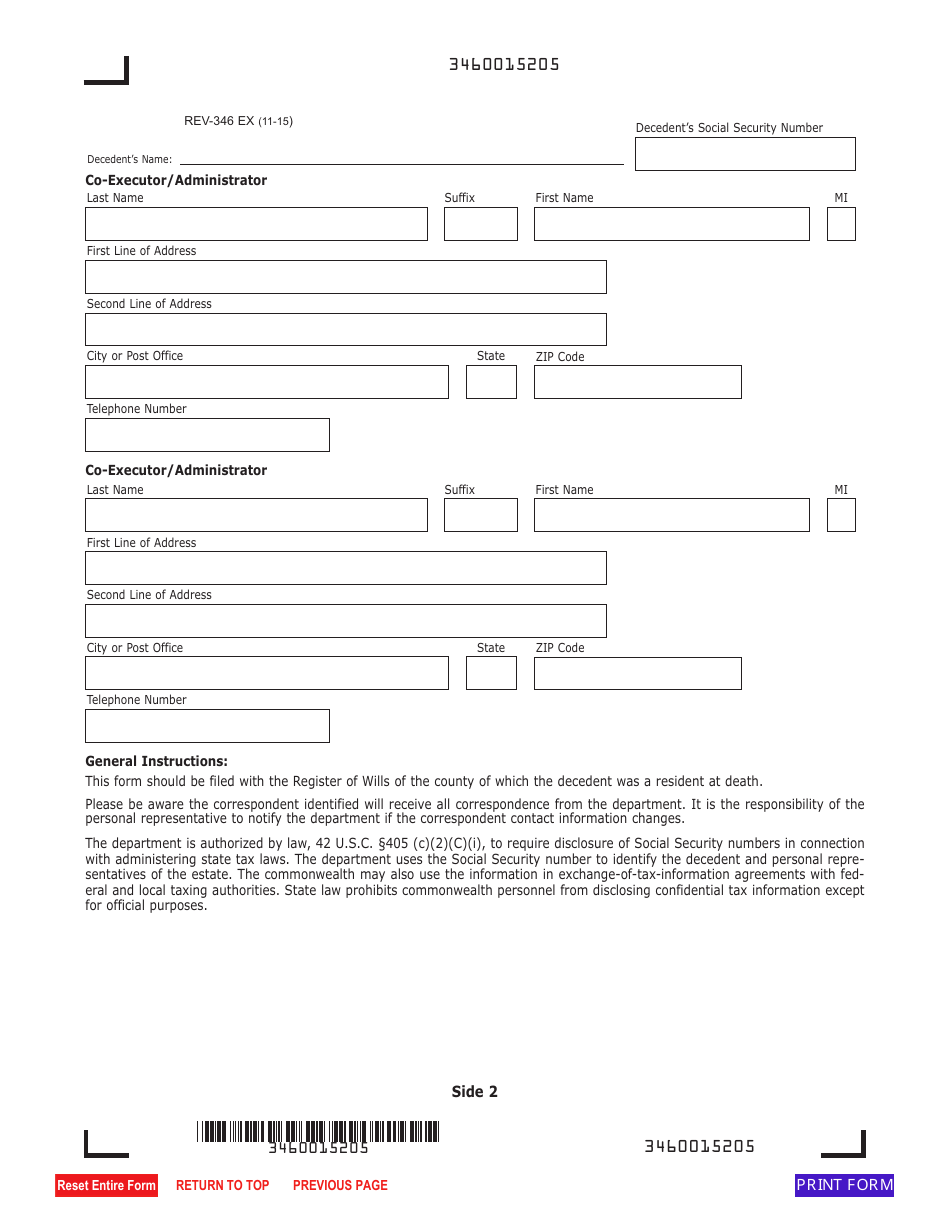

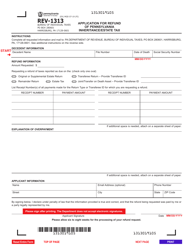

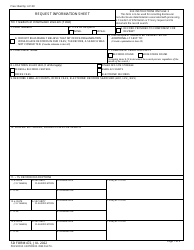

This version of the form is not currently in use and is provided for reference only. Download this version of

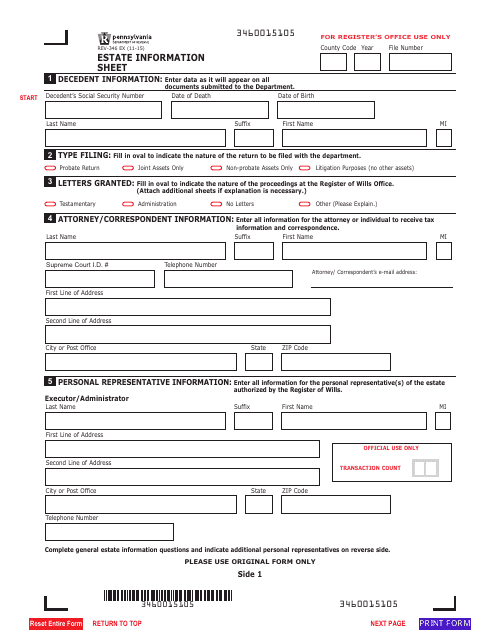

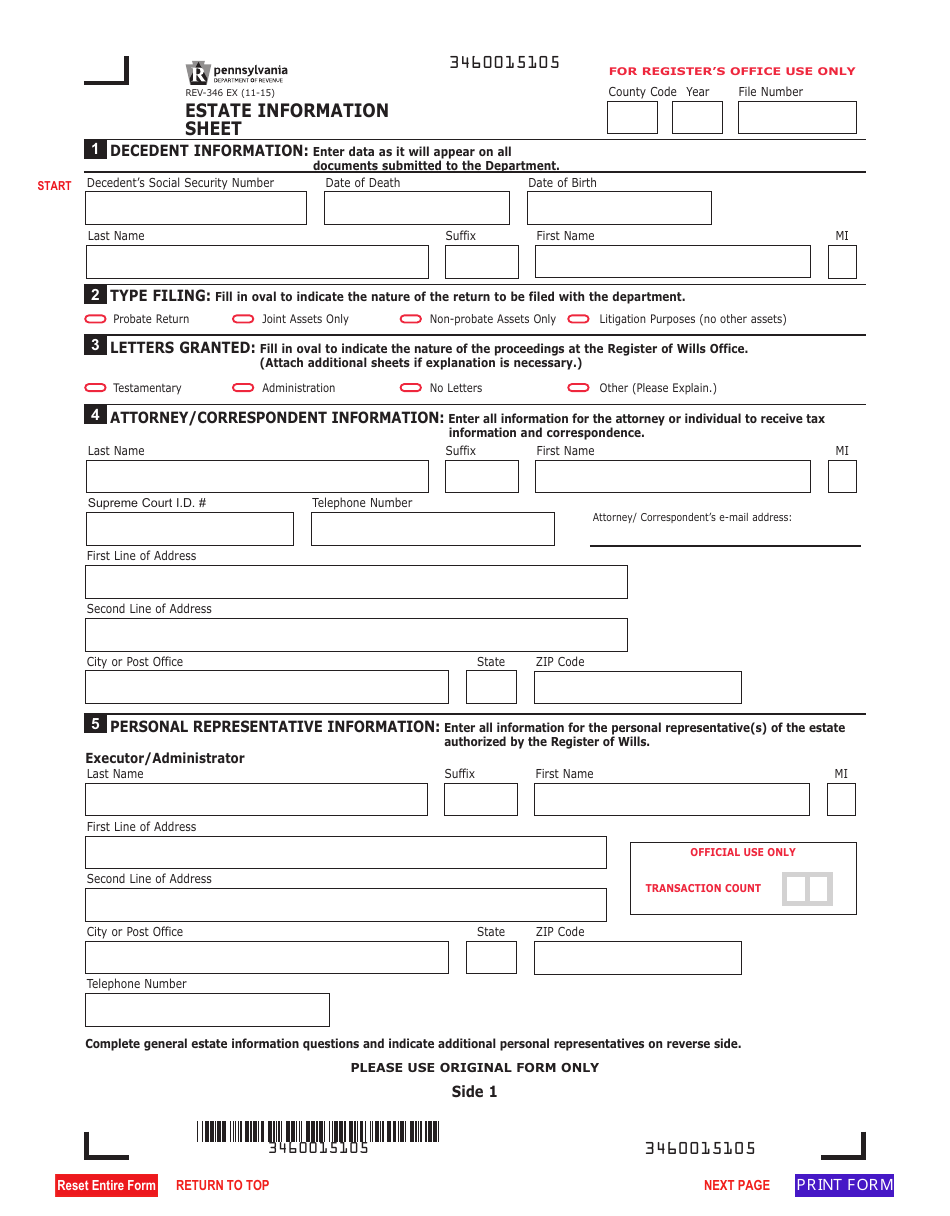

Form REV-346

for the current year.

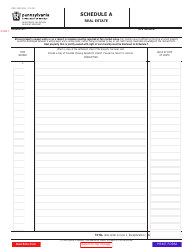

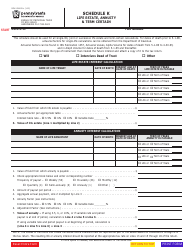

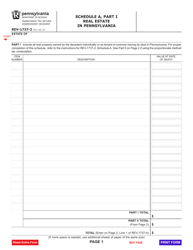

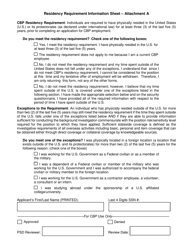

Form REV-346 Estate Information Sheet - Pennsylvania

What Is Form REV-346?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

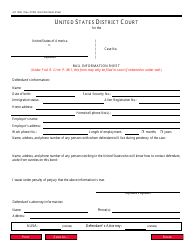

Q: What is Form REV-346?

A: Form REV-346 is the Estate Information Sheet used in Pennsylvania.

Q: What is the purpose of Form REV-346?

A: The purpose of Form REV-346 is to provide information about an estate in Pennsylvania.

Q: Who needs to file Form REV-346?

A: The executor or administrator of an estate in Pennsylvania needs to file Form REV-346.

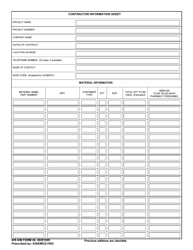

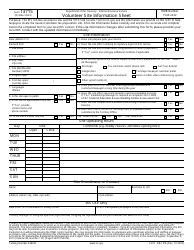

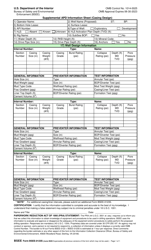

Q: What information is required on Form REV-346?

A: Form REV-346 requires information about the decedent, the estate assets, and the estate liabilities.

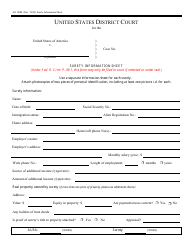

Q: Is there a deadline for filing Form REV-346?

A: Yes, Form REV-346 must be filed within nine months from the date of the decedent's death.

Q: Are there any penalties for late filing of Form REV-346?

A: Yes, there are penalties for late filing of Form REV-346, including interest charges and potential legal consequences.

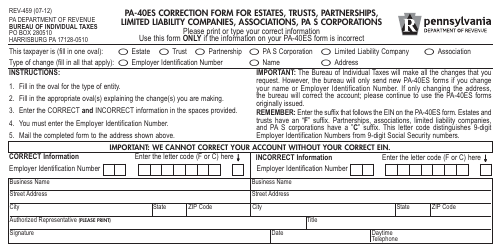

Q: Can I amend Form REV-346 if I made a mistake?

A: Yes, you can amend Form REV-346 if you made a mistake. You should file an amended form as soon as possible.

Q: Do I need to include supporting documents with Form REV-346?

A: Yes, you may need to include supporting documents, such as copies of the decedent's will and the estate's financial statements, with Form REV-346.

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-346 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.