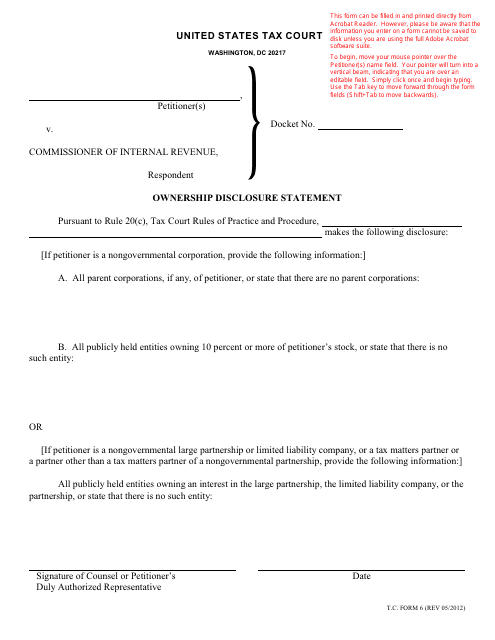

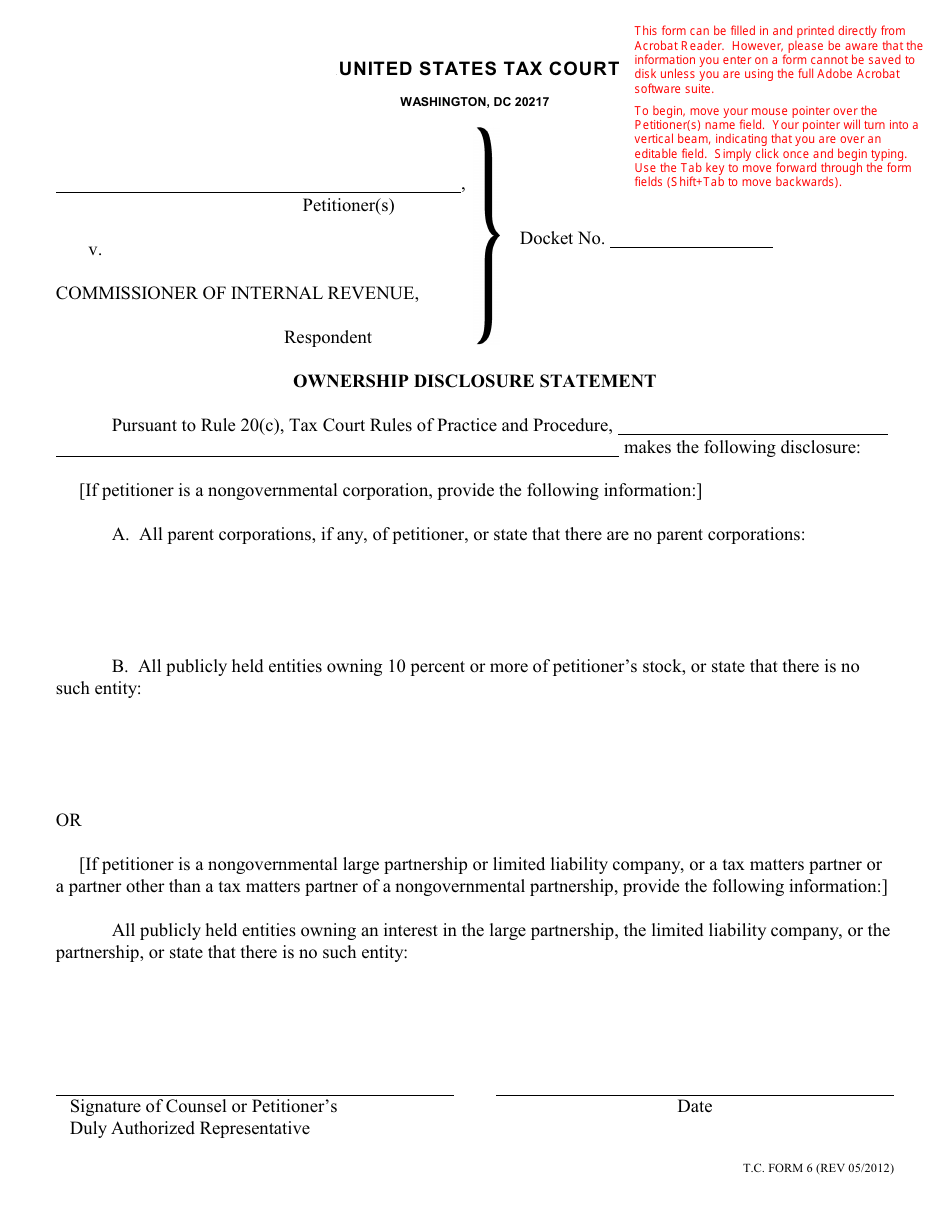

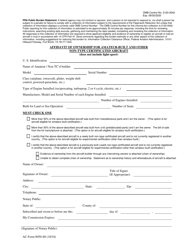

T.C. Form 6 Ownership Disclosure Statement

What Is T.C. Form 6?

This is a legal form that was released by the United States Tax Court on May 1, 2012 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is T.C. Form 6?

A: T.C. Form 6 is the Ownership Disclosure Statement.

Q: What is the purpose of T.C. Form 6?

A: The purpose of T.C. Form 6 is to disclose ownership information.

Q: Who is required to submit T.C. Form 6?

A: Certain individuals or organizations are required to submit T.C. Form 6.

Q: What information is included in T.C. Form 6?

A: T.C. Form 6 includes information about ownership interests.

Q: How do I obtain T.C. Form 6?

A: You can obtain T.C. Form 6 from the relevant authority or agency.

Q: Are there any fees associated with T.C. Form 6?

A: There may be fees associated with submitting T.C. Form 6, depending on the jurisdiction.

Q: What happens if I don't submit T.C. Form 6?

A: Failure to submit T.C. Form 6 as required may result in penalties or other consequences.

Q: Is T.C. Form 6 different for USA and Canada?

A: The specifics of T.C. Form 6 may vary between the USA and Canada. It's important to follow the guidelines for the relevant jurisdiction.

Form Details:

- Released on May 1, 2012;

- The latest available edition released by the United States Tax Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of T.C. Form 6 by clicking the link below or browse more documents and templates provided by the United States Tax Court.