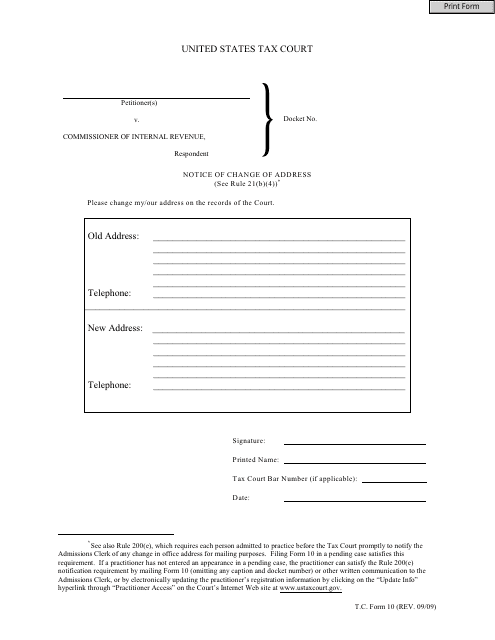

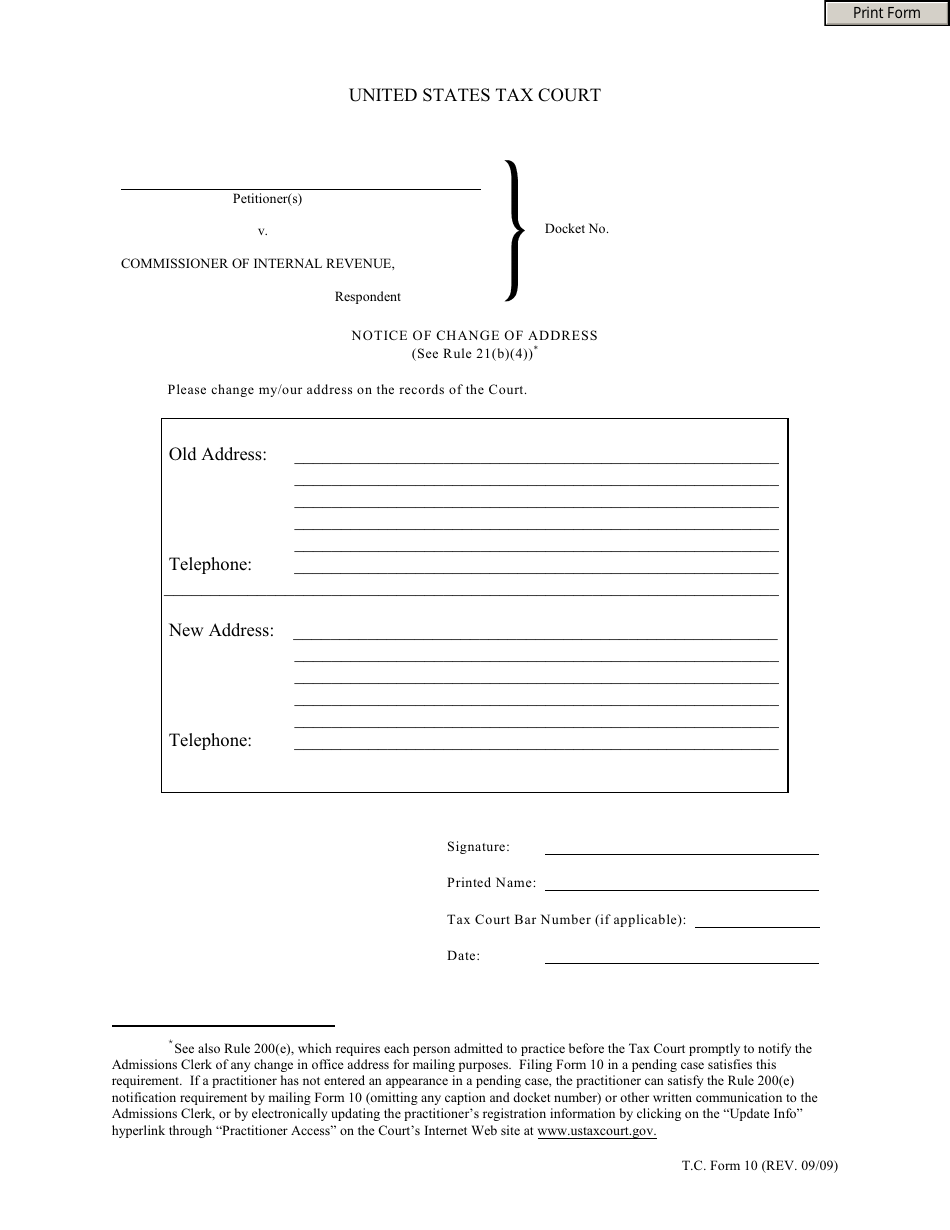

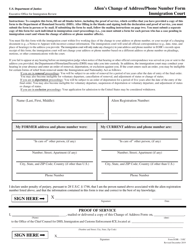

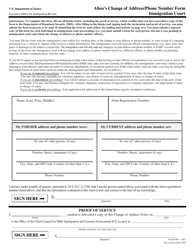

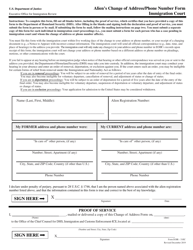

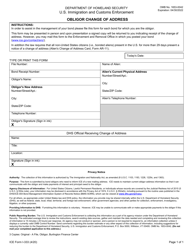

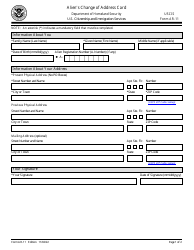

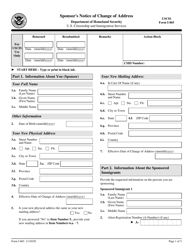

T.C. Form 10 Notice of Change of Address

What Is T.C. Form 10?

This is a legal form that was released by the United States Tax Court on September 1, 2009 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is T.C. Form 10?

A: T.C. Form 10 is a Notice of Change of Address form.

Q: What is the purpose of T.C. Form 10?

A: The purpose of T.C. Form 10 is to inform the relevant authorities about a change in address.

Q: Who needs to fill out T.C. Form 10?

A: Anyone who wants to update their address with the relevant authorities needs to fill out T.C. Form 10.

Q: Do I have to pay a fee to submit T.C. Form 10?

A: The fee for submitting T.C. Form 10 may vary depending on the jurisdiction. It is best to check with the relevant authorities.

Q: What happens after I submit T.C. Form 10?

A: Once you submit T.C. Form 10, your new address will be updated in the records of the relevant authorities.

Q: Is T.C. Form 10 applicable in both the USA and Canada?

A: No, T.C. Form 10 is specific to either the USA or Canada. The form may have a different name and format in each country.

Form Details:

- Released on September 1, 2009;

- The latest available edition released by the United States Tax Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of T.C. Form 10 by clicking the link below or browse more documents and templates provided by the United States Tax Court.