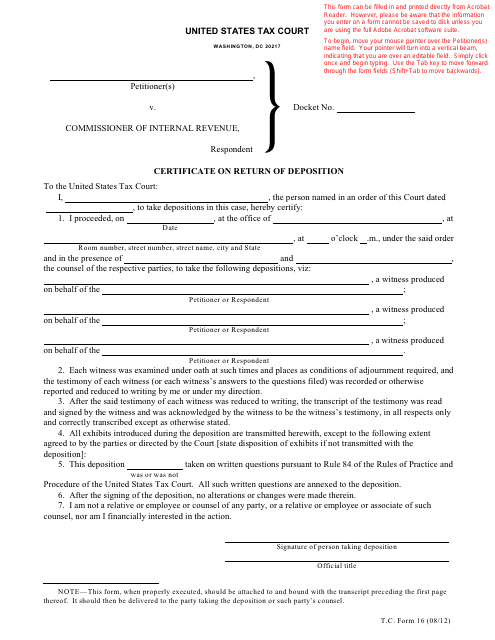

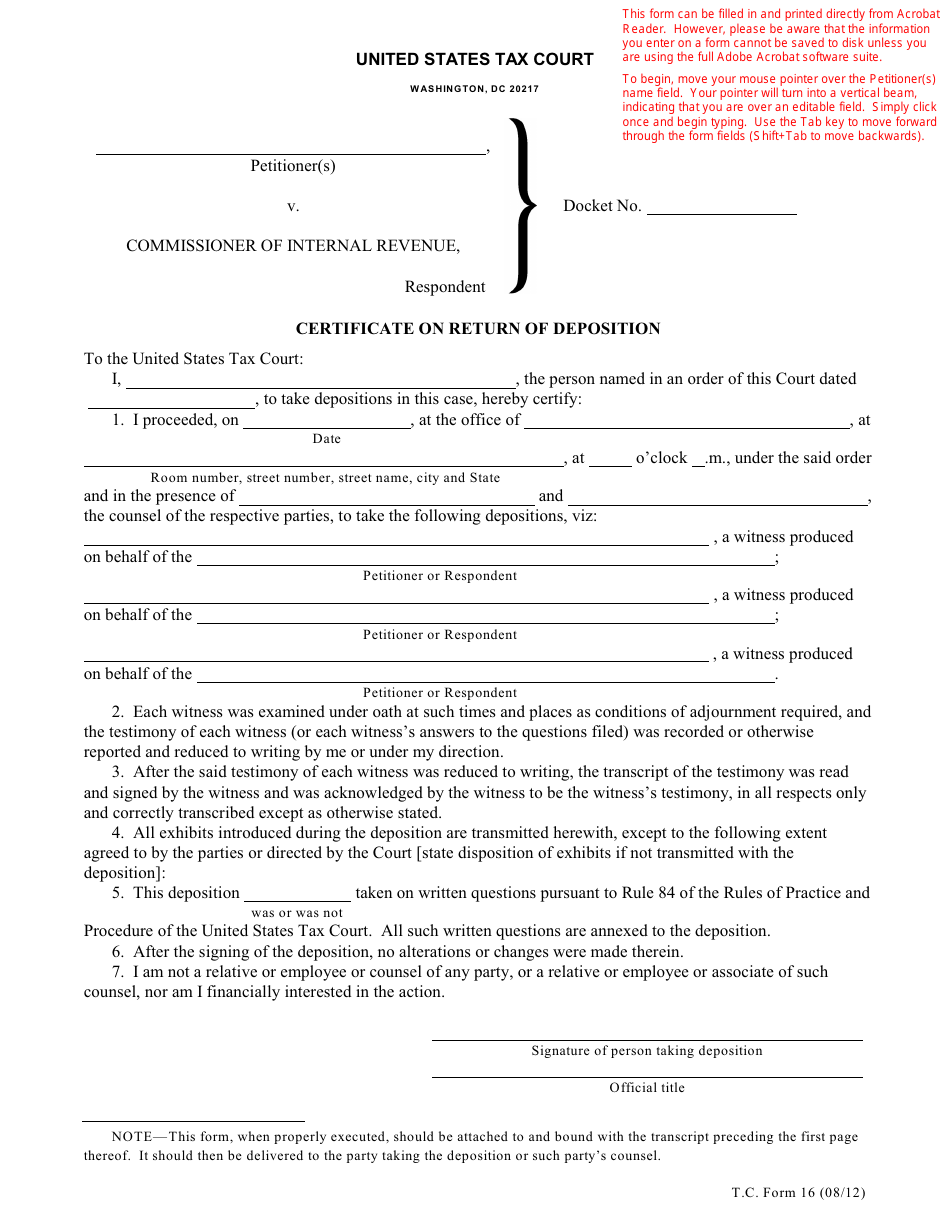

T.C. Form 16 Certificate on Return of Deposition

What Is T.C. Form 16?

This is a legal form that was released by the United States Tax Court on August 1, 2012 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is T.C. Form 16?

A: T.C. Form 16 is a certificate on return of deposition.

Q: What does T.C. stand for in T.C. Form 16?

A: T.C. stands for Tax Certificate.

Q: What is the purpose of T.C. Form 16?

A: The purpose of T.C. Form 16 is to certify the return of deposition.

Q: Who issues T.C. Form 16?

A: T.C. Form 16 is issued by the relevant tax authority or department.

Q: What information is included in T.C. Form 16?

A: T.C. Form 16 includes details such as the date of deposition, the amount of tax, and the name of the taxpayer.

Q: Is T.C. Form 16 required for all taxpayers?

A: T.C. Form 16 may be required for certain taxpayers, especially those who have made depositions of tax amounts.

Q: Can T.C. Form 16 be used as proof of tax payment?

A: Yes, T.C. Form 16 can be used as proof of tax payment.

Q: Is T.C. Form 16 specific to any country?

A: T.C. Form 16 is specific to India and is issued by the Indian tax authorities.

Q: Can T.C. Form 16 be used for filing tax returns?

A: No, T.C. Form 16 is not used for filing tax returns. It is used to certify the return of deposition.

Form Details:

- Released on August 1, 2012;

- The latest available edition released by the United States Tax Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of T.C. Form 16 by clicking the link below or browse more documents and templates provided by the United States Tax Court.