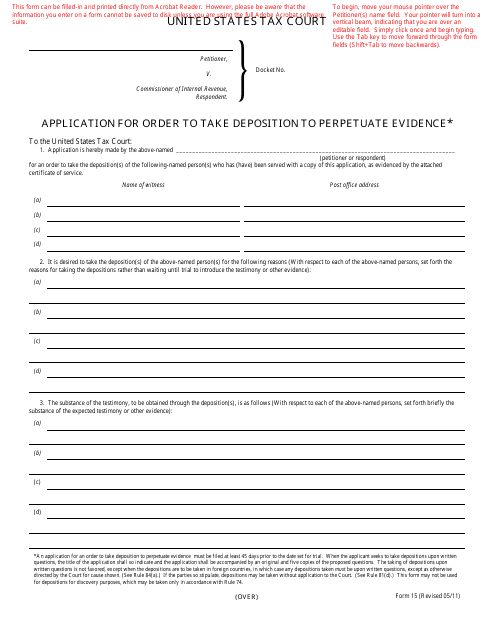

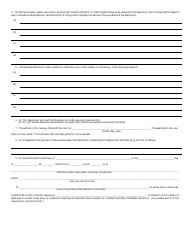

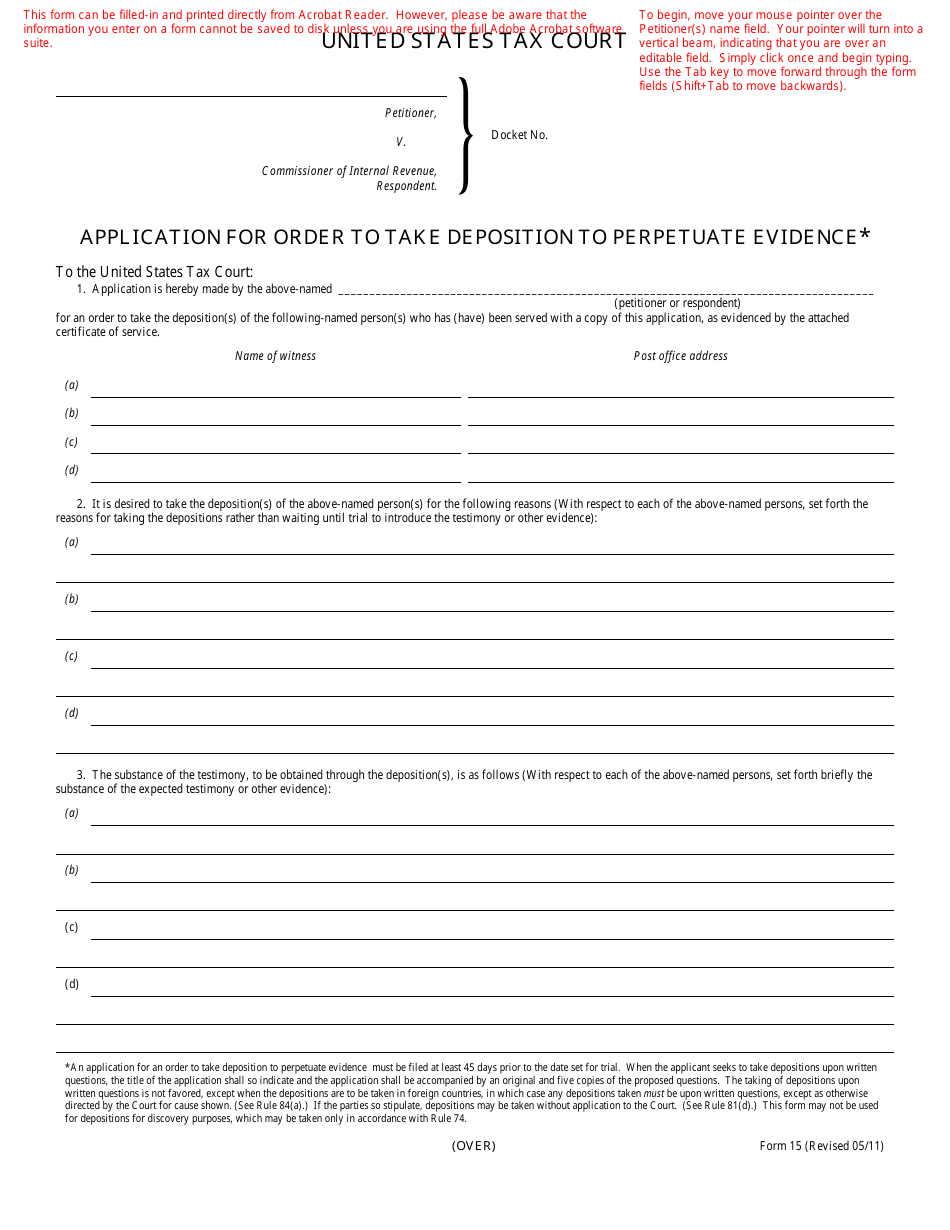

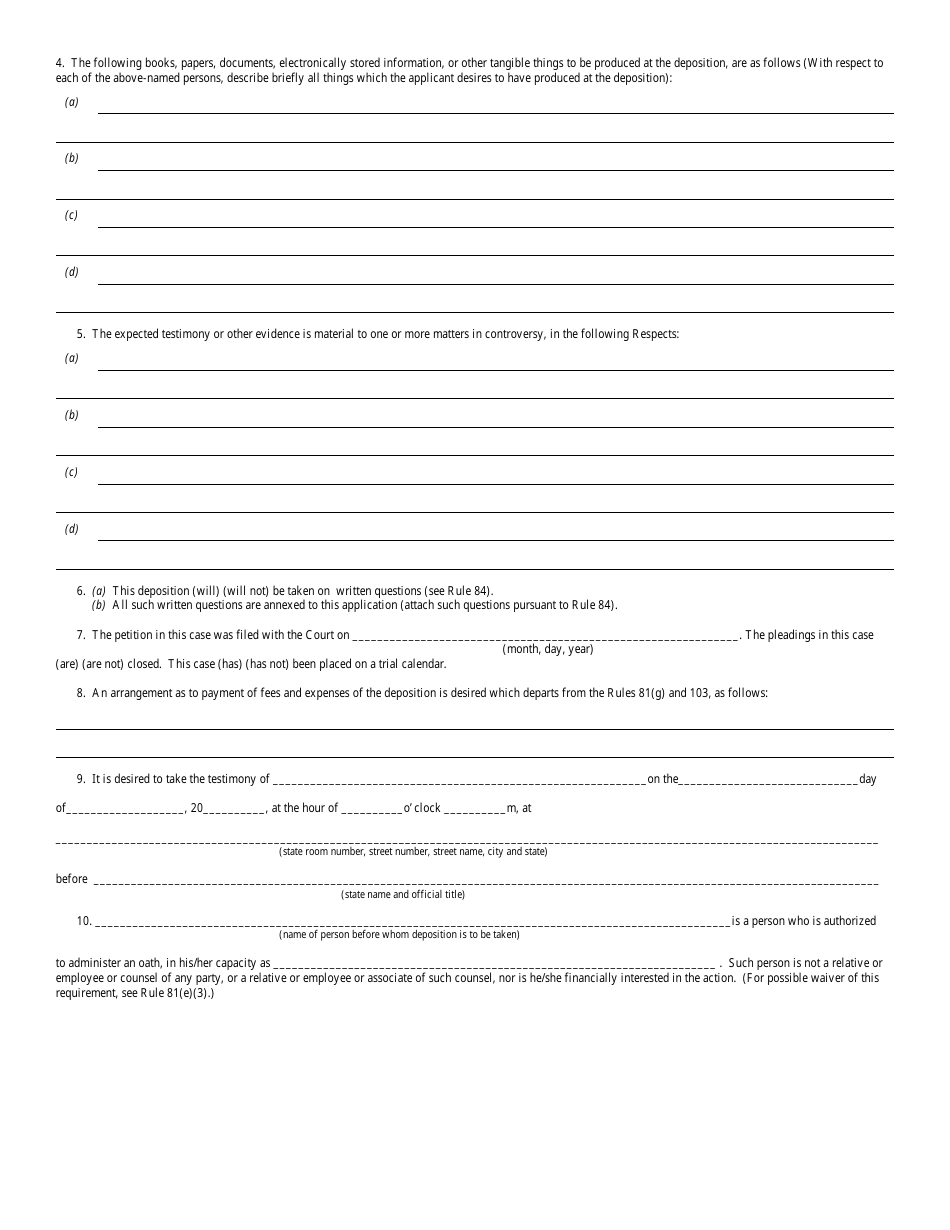

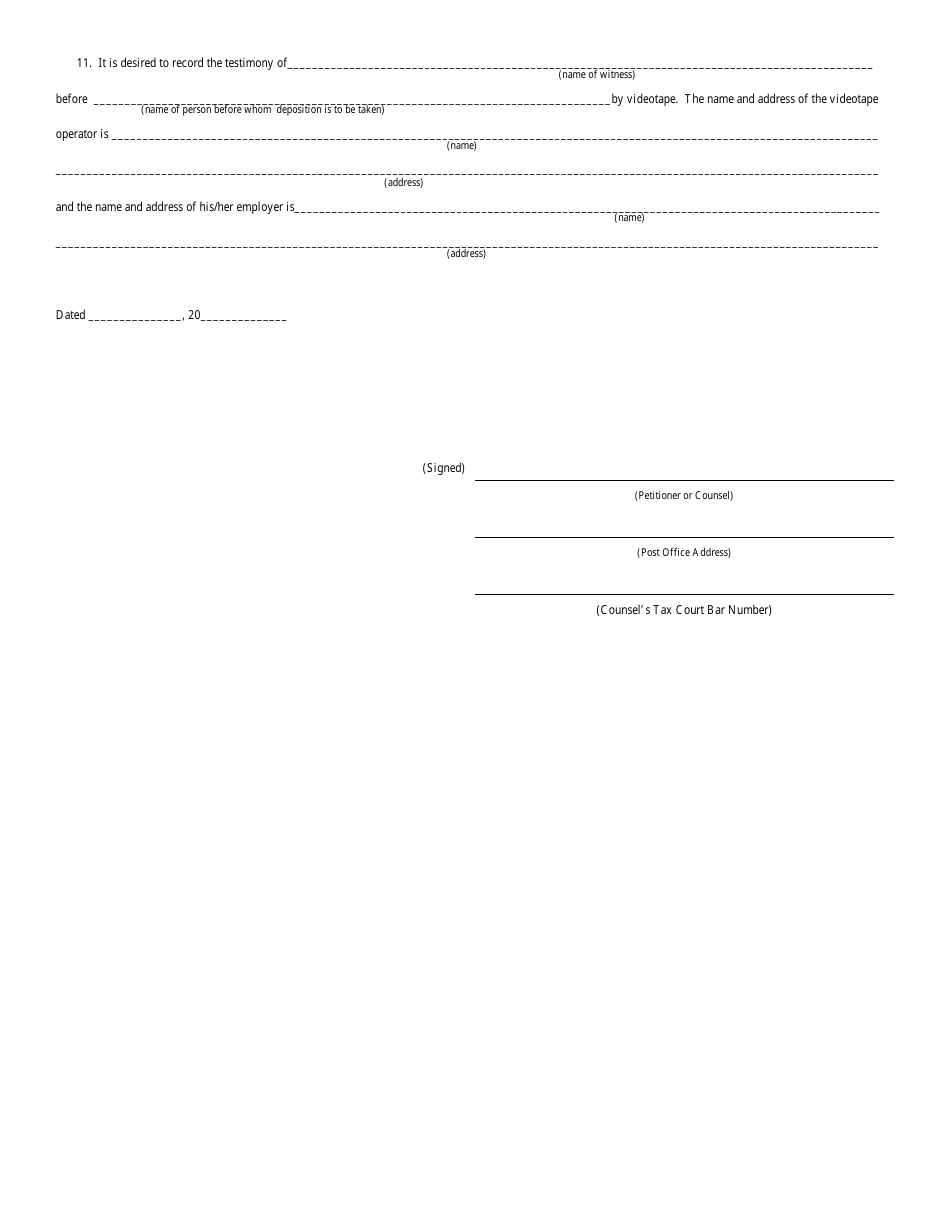

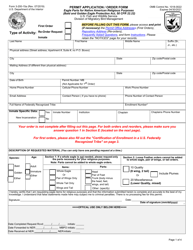

T.C. Form 15 Application for Order to Take Deposition to Perpetuate Evidence

What Is T.C. Form 15?

This is a legal form that was released by the United States Tax Court on May 1, 2011 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is T.C. Form 15?

A: T.C. Form 15 is an application for an order to take a deposition to perpetuate evidence.

Q: What is the purpose of T.C. Form 15?

A: The purpose of T.C. Form 15 is to allow parties to preserve evidence by taking a deposition before a lawsuit or trial begins.

Q: Who can use T.C. Form 15?

A: Any party who believes that important testimony or evidence may be lost or unavailable in the future can use T.C. Form 15.

Q: How does T.C. Form 15 work?

A: T.C. Form 15 is submitted to the court, requesting an order to take a deposition to preserve evidence. If approved, the deposition can be scheduled and conducted.

Q: What is a deposition?

A: A deposition is a sworn statement taken out of court, usually in the presence of both parties' attorneys, which can be used as evidence in a future lawsuit or trial.

Form Details:

- Released on May 1, 2011;

- The latest available edition released by the United States Tax Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of T.C. Form 15 by clicking the link below or browse more documents and templates provided by the United States Tax Court.