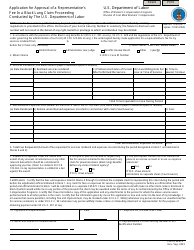

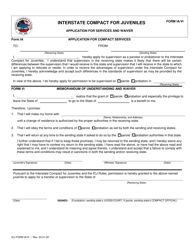

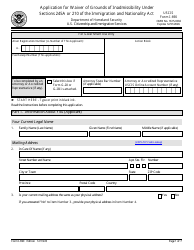

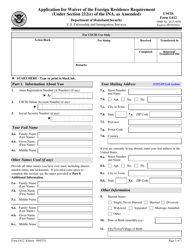

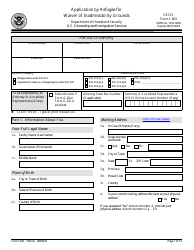

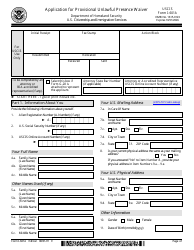

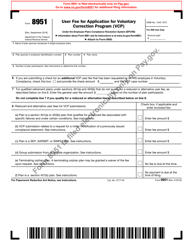

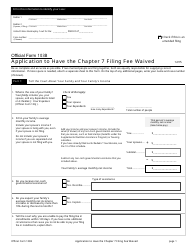

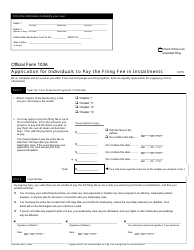

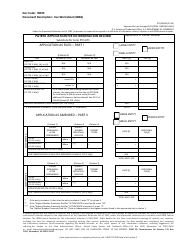

Application for Waiver of Filing Fee

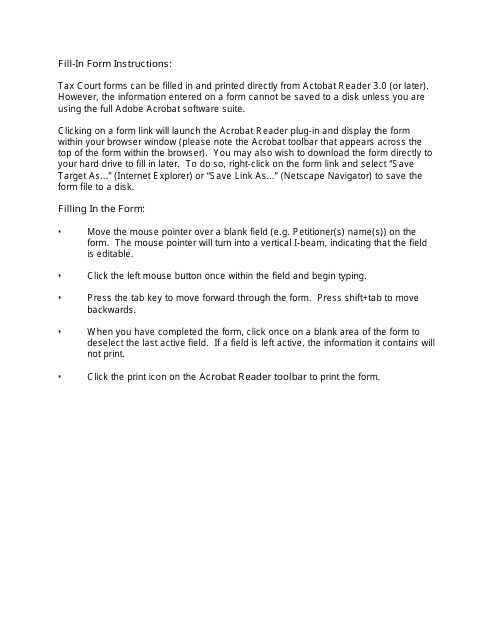

Application for Waiver of Filing Fee is a 3-page legal document that was released by the United States Tax Court on August 1, 2013 and used nation-wide.

FAQ

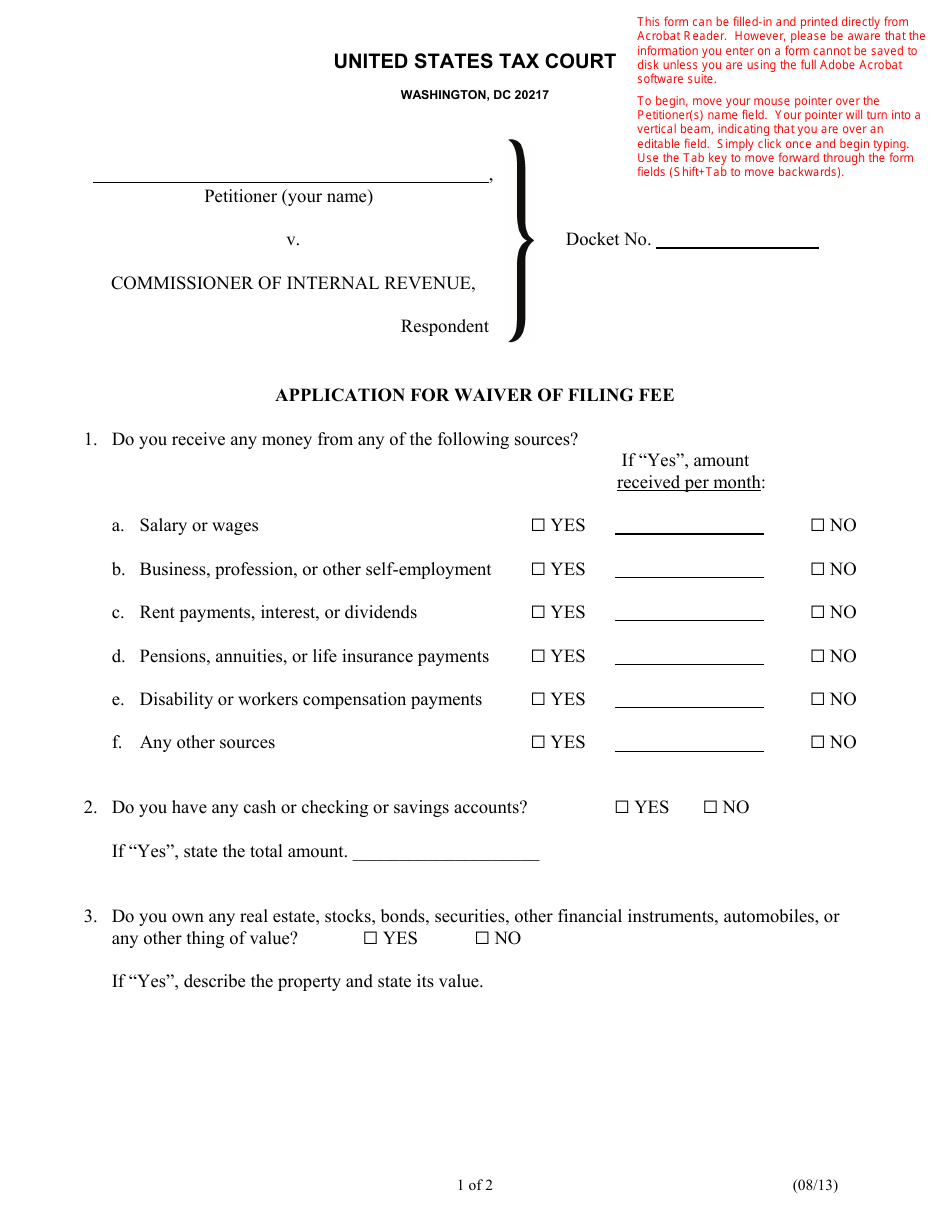

Q: What is the Application for Waiver of Filing Fee?

A: The Application for Waiver of Filing Fee is a form that allows individuals who cannot afford to pay certain court fees to request a waiver or reduction of those fees.

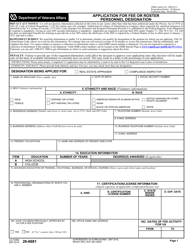

Q: Who is eligible to apply for a waiver of filing fee?

A: Individuals who meet certain income and asset requirements may be eligible to apply for a waiver of the filing fee.

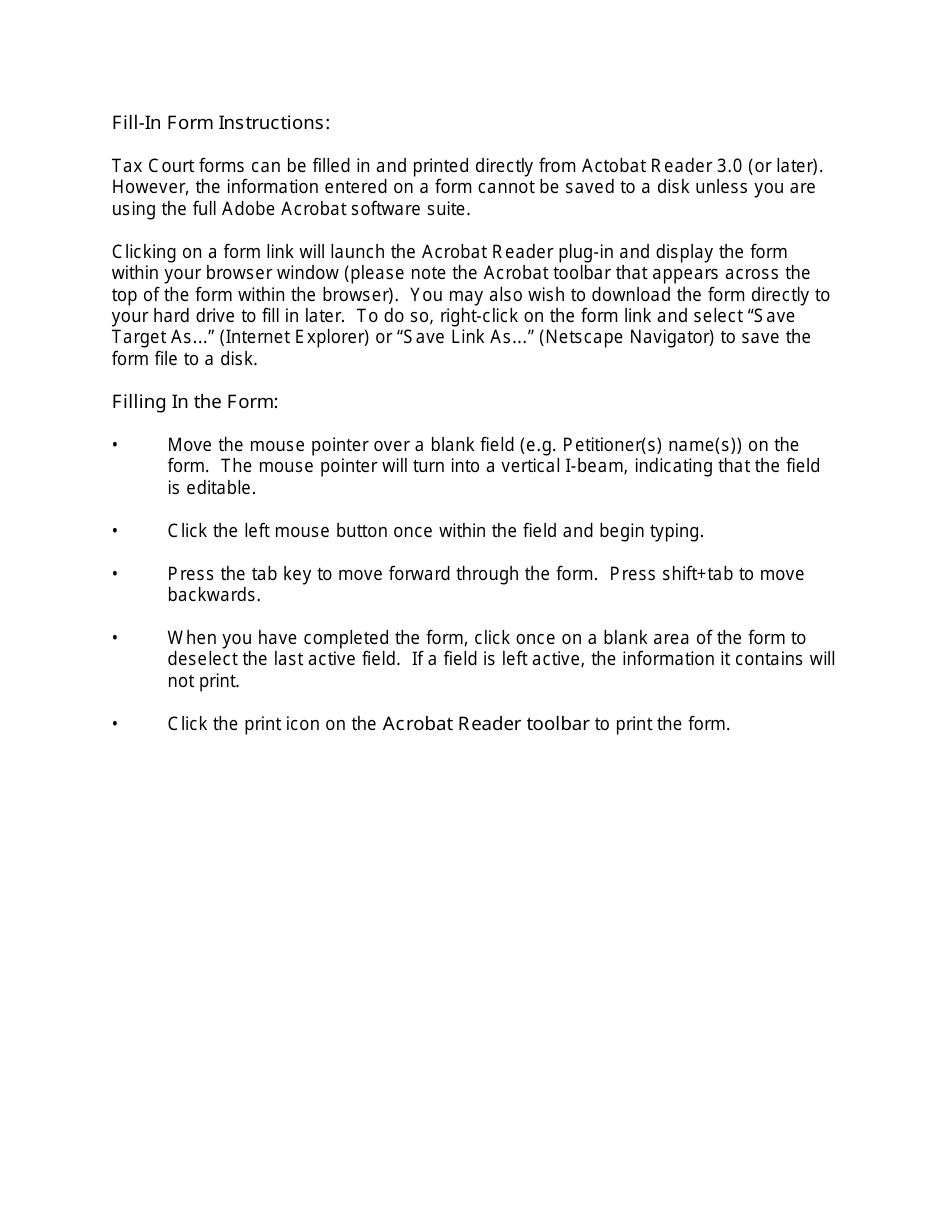

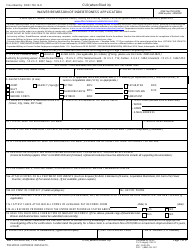

Q: How do I apply for a waiver of filing fee?

A: To apply for a waiver of filing fee, you need to complete the Application for Waiver of Filing Fee form and submit it to the appropriate court along with any required supporting documents.

Q: What documents do I need to submit with the Application for Waiver of Filing Fee?

A: The required documents may vary depending on the court, but typically include proof of income, such as pay stubs or tax returns, and information about your assets and expenses.

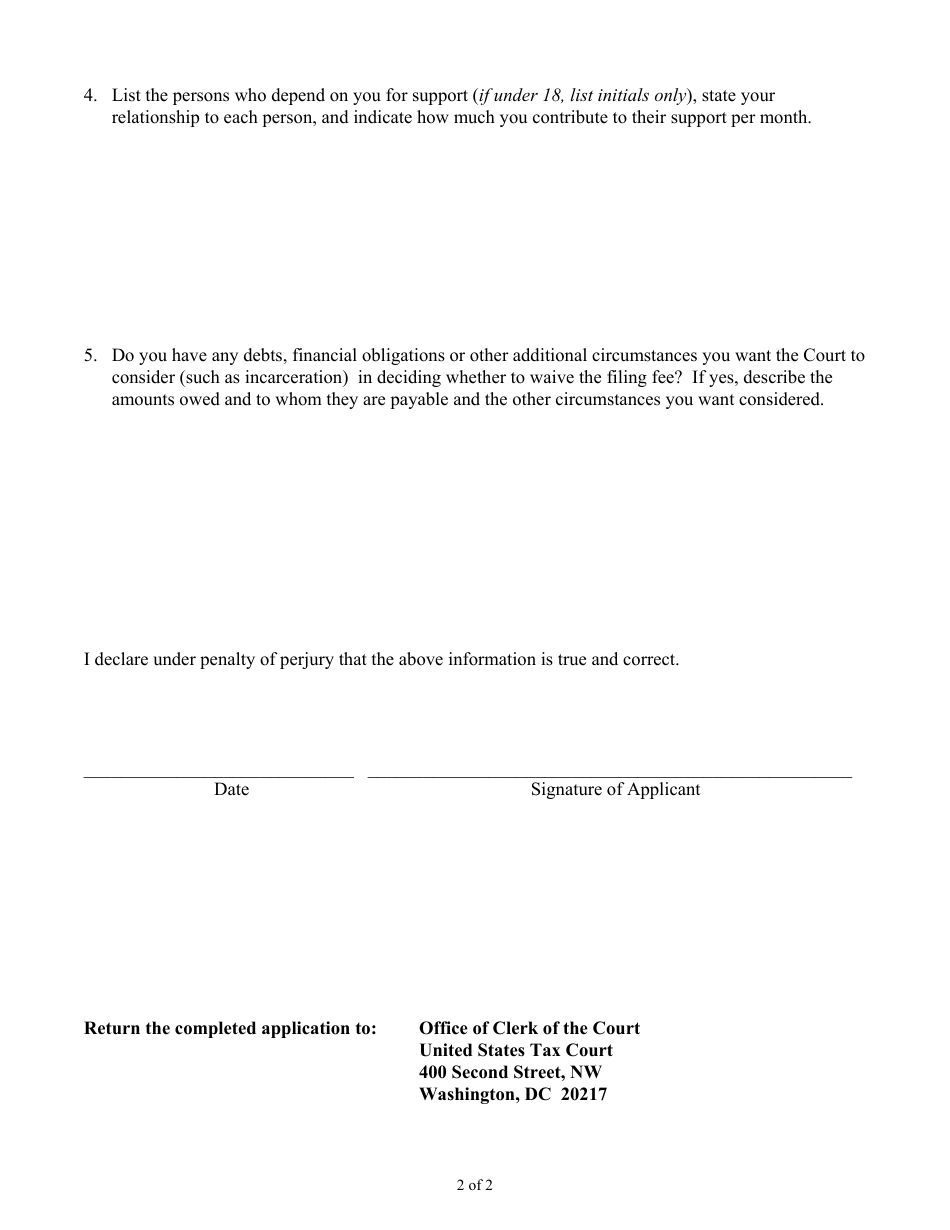

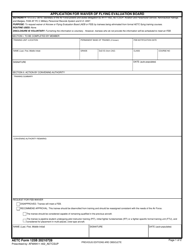

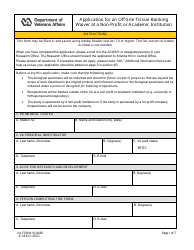

Q: What happens after I submit the Application for Waiver of Filing Fee?

A: The court will review your application and determine whether you qualify for a waiver of the filing fee. You will be notified of the court's decision.

Q: Can I still file my case if my application for waiver of filing fee is denied?

A: Yes, you can still file your case even if your application for a waiver of filing fee is denied. However, you will be responsible for paying the required fees.

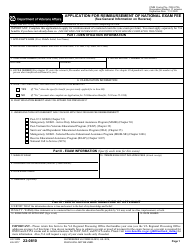

Form Details:

- The latest edition currently provided by the United States Tax Court;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.