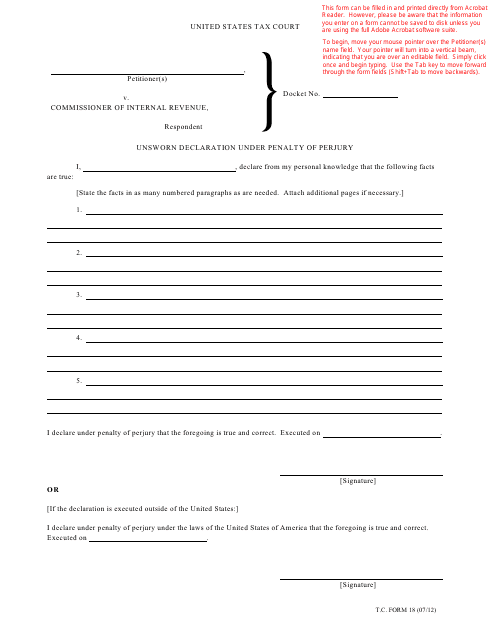

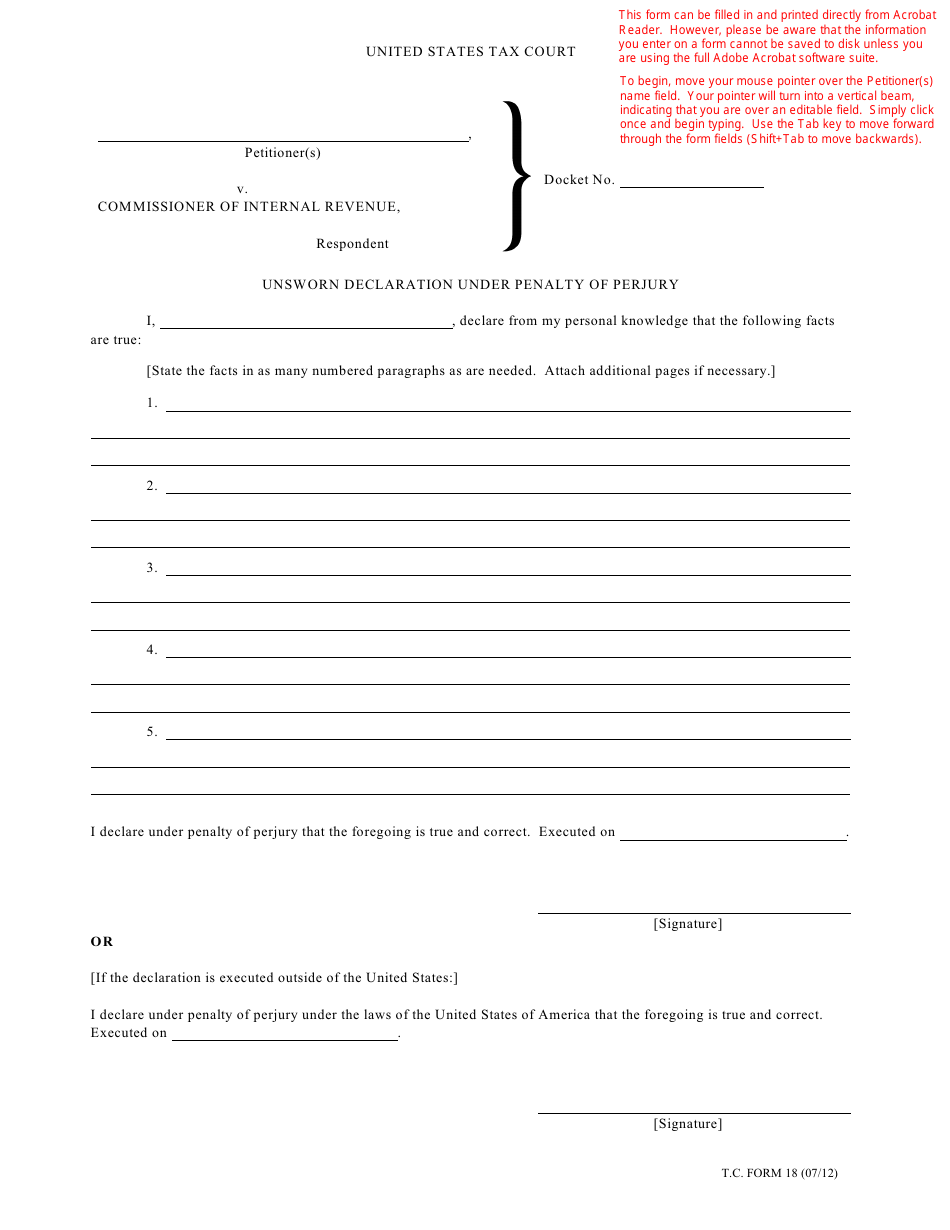

T.C. Form 18 Unsworn Declaration Under Penalty of Perjury

What Is T.C. Form 18?

This is a legal form that was released by the United States Tax Court on July 1, 2012 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is T.C. Form 18?

A: T.C. Form 18 is an Unsworn Declaration Under Penalty of Perjury.

Q: What is the purpose of T.C. Form 18?

A: The purpose of T.C. Form 18 is to provide a declaration that is made under penalty of perjury, but without being notarized.

Q: Who uses T.C. Form 18?

A: T.C. Form 18 is typically used by individuals who need to make a legally binding declaration without going through the process of notarization.

Q: When should I use T.C. Form 18?

A: You should use T.C. Form 18 when you need to make a statement or declaration that is legally binding, but it does not require notarization.

Q: Is T.C. Form 18 accepted nationwide?

A: T.C. Form 18 is generally accepted nationwide, but it is always a good idea to check with the specific agency or organization where you are submitting the declaration to confirm their acceptance.

Form Details:

- Released on July 1, 2012;

- The latest available edition released by the United States Tax Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of T.C. Form 18 by clicking the link below or browse more documents and templates provided by the United States Tax Court.