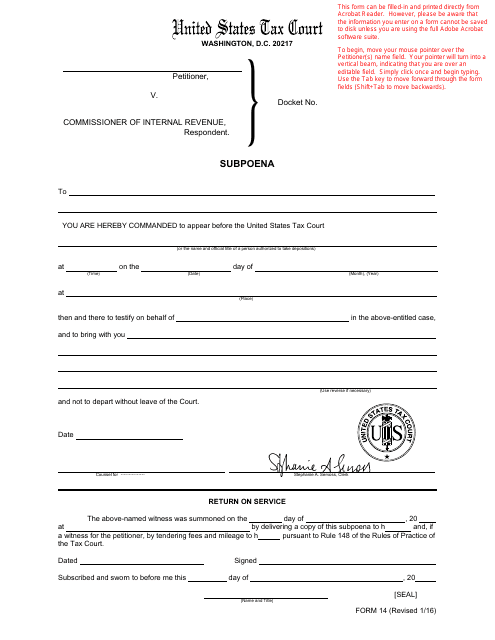

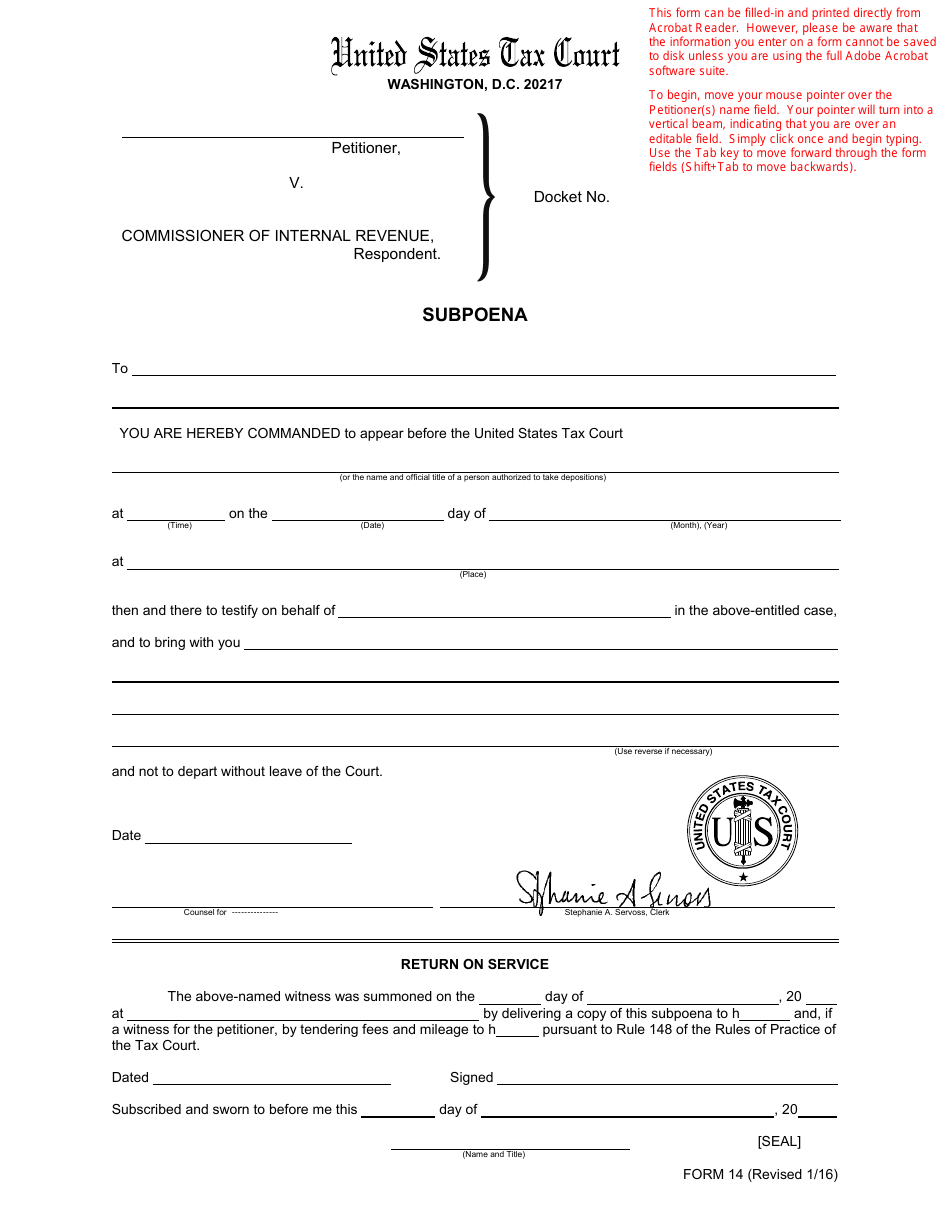

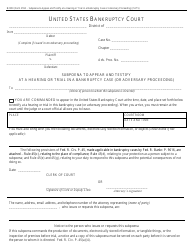

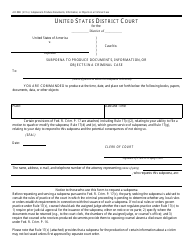

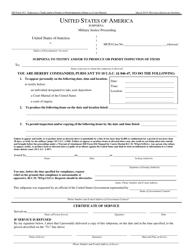

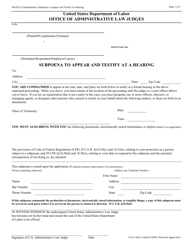

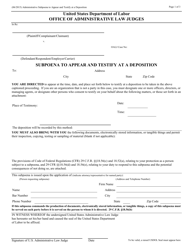

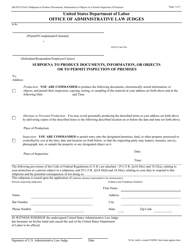

T.C. Form 14 Subpoena

What Is T.C. Form 14?

This is a legal form that was released by the United States Tax Court on January 1, 2016 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is T.C. Form 14 Subpoena?

A: T.C. Form 14 Subpoena is a type of subpoena issued by the Tax Court of the United States.

Q: Who issues T.C. Form 14 Subpoena?

A: T.C. Form 14 Subpoena is issued by the Tax Court of the United States.

Q: What is the purpose of T.C. Form 14 Subpoena?

A: The purpose of T.C. Form 14 Subpoena is to compel the production of documents or testimony in a tax court case.

Q: Do I have to comply with T.C. Form 14 Subpoena?

A: Yes, if you receive a T.C. Form 14 Subpoena, you are legally required to comply with it.

Q: What happens if I fail to comply with T.C. Form 14 Subpoena?

A: If you fail to comply with a T.C. Form 14 Subpoena, you may be subject to penalties or other legal consequences.

Q: Can I object to T.C. Form 14 Subpoena?

A: Yes, you have the right to object to a T.C. Form 14 Subpoena if you believe it is unreasonable or unduly burdensome.

Q: How do I file an objection to T.C. Form 14 Subpoena?

A: To file an objection to a T.C. Form 14 Subpoena, you should follow the instructions provided on the subpoena or consult with an attorney.

Form Details:

- Released on January 1, 2016;

- The latest available edition released by the United States Tax Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of T.C. Form 14 by clicking the link below or browse more documents and templates provided by the United States Tax Court.